Timing the market has long been a subject of fascination and debate among investors. Yet, it’s important to remember that the general trend of the market is upwards over the long run. Every peak we see today is but a trough when viewed from a distant future. Markets continuously reach new highs, and trying to perfectly time entry and exit points is a feat achieved by only a select few.

Idle money, when invested wisely, has the potential to yield returns at any point in time. Capital markets can only move in two directions at any given moment: up or down. This fundamental truth remains unchanged, even when the market is at an all-time high.

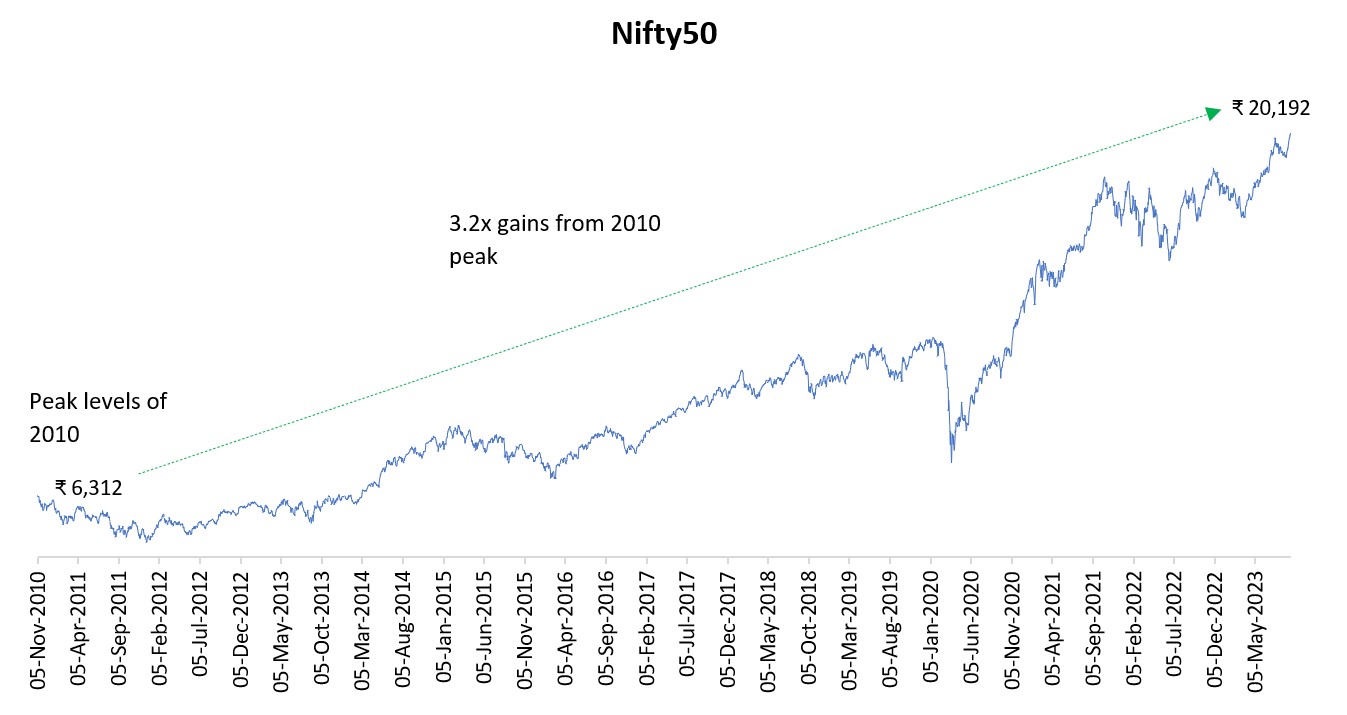

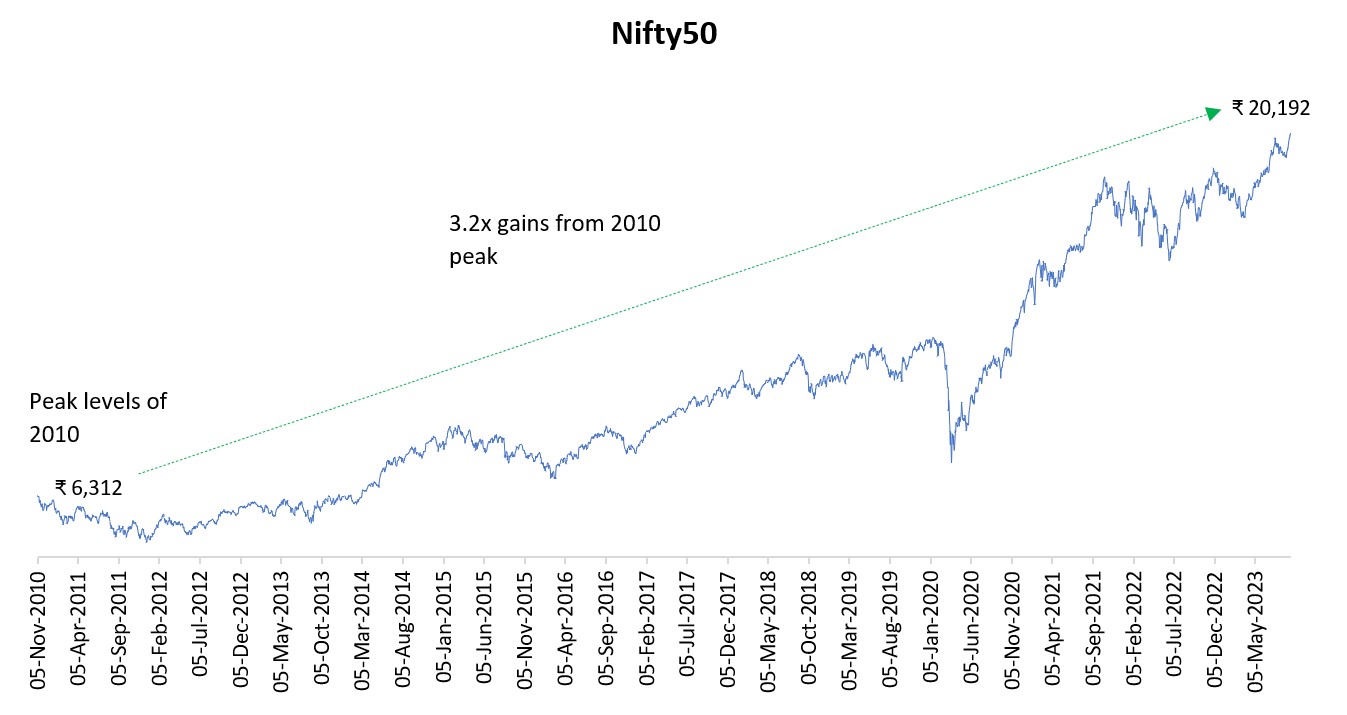

This week the NIFTY 50 reached all-time high and crossed the historical mark of 20,000. While this is the new high made in 2023 the benchmark indices have repeatedly reached all-time highs almost every financial year. Some might argue that these separate data points should have served as exit signals from the market. However, it’s essential to recognize that a peak is just another indicator of market growth, and it is relative. What was an all-time high in 2021, is merely another historical data point today.

Market peaks are recurring events, not signals to exit. Although investing at a peak may be intimidating due to the potential for subsequent corrections, it is far from a wasted effort.

|

Source: NSE India, Fisdom Research |

|

Here are few perspectives on how one should look a market highs:

When to Be Cautious

While market peaks should not be a cause for alarm, there are situations where investors should exercise caution:

Market-wide Expensive Valuations: If a market rally is driven by all stocks, resulting in expensive valuations across the board, it may be prudent to be cautious.

Economic and Earnings Peaks: When the economy is in the final stages of an economic cycle and earnings are at their zenith, investors should watch for potential downturns.

IPO Frenzy and Excessive Borrowing: A surge in initial public offerings (IPOs), a borrowing frenzy to finance investments, and other factors contributing to market euphoria may signal a need for caution.

As of today, the market appears expensive, but it is primarily driven by a variety of stocks and a few are yet to achieve their milestones. Along with this;

- Corporate India finds itself in the early stages of both economic and earning cycles, positioning it favorably for growth.

- The market conditions do not indicate a significant increase in IPO activity or an influx of substantial funds into new investment themes.

- Additionally, companies have been reducing their debt burdens and fortifying their balance sheets.

|

The Key to Long-Term Success-

A fundamental rule of successful long-term investing is to prioritize asset allocation, disciplined investing, and a focus on financial goals over attempting to time the market. Still, it’s natural for investors to feel anxious when entering the market at elevated levels.

The recent market rally and all-time highs should not be a cause for alarm. Instead, they provide an opportunity to understand market dynamics and make informed investment decisions. Amid a runup in small cap indices certain pockets might be expensive however there are still enough opportunities in the underinvested and under researched segments. While the recent runup in stocks has been notable investor should deploy money in small cap funds in a staggered manner. STPs and SIPs are the preferred ways to invest in them.

In the ever-changing landscape of financial markets, embracing all-time highs with a strategic, long-term approach remains a sage choice. After all, as Benjamin Graham wisely observed, the true measure of investment success lies in the discipline of your financial plan and your ability to stay the course, regardless of market peaks.

|

Markets this week | | 28th Aug 2023 (Open) | 01st Sep 2023 (Close) | %Change | | Nifty 50 | ₹19,298 | ₹19,435 | 0.70% | | Sensex | ₹64,906 | ₹65,387 | 0.70% |

Source: BSE and NSE

|

- The market extended its winning streak for the third consecutive week, closing on September 15 with record-high levels.

- This bullish trend was supported by positive macroeconomic data and sustained buying from domestic investors.

- Furthermore, the decline in selling by Foreign Institutional Investors (FIIs) was notable, possibly in anticipation of no rate hike by the Federal Reserve in the upcoming policy meeting.

- Foreign institutional investors (FIIs) continued their selling spree for the eighth consecutive week, offloading equities worth Rs 746.62 crore.

- In contrast, domestic institutional investors (DIIs) displayed strong buying activity, acquiring equities worth Rs 3,363.36 crore during the week.

|

Weekly Leader Board

NSE Top Gainers

| Stock |

Change (%) |

| Bajaj Auto |

▲ 7.79% |

| Grasim Ind |

▲ 6.65 % |

| Bharti Airtel |

▲ 5.68 % |

| Axis Bank |

▲ 4.78 % |

| UPL |

▲ 4.59 % |

|

NSE Top Losers

| Stock |

Change % |

| Bharat Petroleum |

▼ 2.68% |

| HDFC Life Insurance |

▼ 1.91% |

| HUL |

▼ 1.75% |

| NTPC |

▼ 1.69% |

| ASIANPAINT |

▼ 1.28% |

|

Source: NSE |

Stocks that made the news this week:

- Asian Paints’ shares have experienced a 2.5 percent decline over the past two days, likely attributed to the recent surge in oil prices. This rise in oil prices has a detrimental effect on the paint manufacturing industry since numerous raw materials utilized in paint production are petroleum-derived. The resulting increase in input costs for these crucial raw materials could potentially exert pressure on the overall manufacturing expenses, subsequently impacting the profit margins of paint companies.

- NTPC’s stock witnessed gains in early trade on September 15 following the announcement of a supplementary joint venture agreement with the Uttar Pradesh state government utility. India’s largest PSU power generation company, NTPC, entered into this supplementary agreement, building upon their initial pact with Uttar Pradesh Rajya Vidyut Utpadan Nigam (UPRVUNL) from February 2008. This agreement pertains to the establishment of Meja Urja Nigam (MUNPL), a joint venture company, and was confirmed through a corporate filing dated September 14.

- On September 15, Oil India shares showed a notable 4 percent increase, driven by reports that the state-owned company’s Chairman and Managing Director, Ranjit Rath, disclosed plans to invest Rs 25,000 crore in renewable energy. This substantial investment aims to align with the company’s ambitious goal of achieving net-zero emissions by 2040. A significant portion of this investment, around Rs 8,000 crore, will be allocated for the establishment of a 2G ethanol plant, in addition to the necessary capital for transitioning from diesel-fired engines to gas-powered ones.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|