Daily Snippets

Date: 15th September 2023 |

|

|

Technical Overview – Nifty 50 |

|

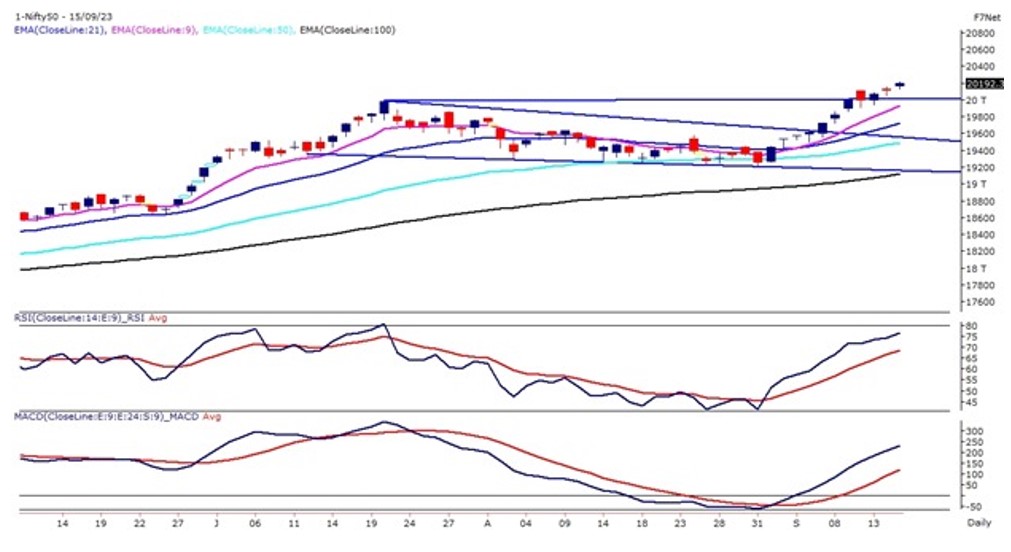

The positive takeaway from today’s trading session was that Nifty closed well above the dotted lines and most importantly, scaled new all-time-high at 20222.45. The Index on the daily chart continues to trade above its horizontal trend line which is placed at 20,000 levels.

On the weekly time frame index has closed in green for the consecutive third week and the prices have completed their throwback of the triangle pattern breakout. The volatility gauge indicator the India VIX closed one percent higher at 10.90 levels.

The Index on the broader time frame indicates a fresh start of an uptrend and the momentum oscillator RSI (14) has witnessed a cup and handle pattern breakout above 65 levels with a bullish crossover on the cards. The MACD indicator suggests positive momentum ahead as reading above its line of polarity.

The view continues to remain bullish with BUY on dips as a strategy to be used. Technically 20,000 – 19,9000 will act as immediate support for the index and the upper band is capped near 20,275 – 20,325 Levels for the time being.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty shut the shop in green for the fourth straight week and gained more than 2 percent on the weekly time frame. On the daily chart, the Banking Index has witnessed a rectangle pattern breakout and posts that prices are trading above the consolidation band of the pattern.

On the broader time frame, the index is trading within a rising wedge pattern and presently has taken support near the lower band of the pattern and moved higher post that. The momentum oscillator RSI (14) has formed a bullish cup and handle formation and the breakout is expected above 70 levels.

Looking ahead, Bank Nifty seems positive above 45,700 with resistance at 47,000 and 47,500. Support is at 45,500 and 45,300 for potential pullbacks, offering trading opportunities.

|

Indian markets:

- Frontline indices saw marginal gains on Thursday amid volatility as the Nifty 50 closed above 20,100 after an afternoon dip.

- Trading was volatile due to index options expiry. Profit-taking restricted gains, but sectors like metal and realty performed well. Broader market showed signs of recovery with rotational buying across sectors.

- However, cautious investor sentiment persisted due to high valuations and concerns over rising crude oil prices boosting inflation and potential rate hikes.

|

Global Markets

- Dow Jones futures signal a positive start for US stocks with a 105-point increase.

- European and Asian markets advanced today, anticipating that the recent rise in US inflation wont prompt more interest rate hikes by the Federal Reserve.

- US stocks closed mixed on Wednesday due to analysis of the August inflation report. In US, Augusts Consumer Price Index rose 0.6% as expected, while the core CPI, excluding volatile food and energy costs, reached 4.3%, in line with estimates and down from Julys 4.7%.

- Markets are now waiting on key economic indicators before the Fed issues its next rate move on September 20. The Bureau of Labor Statistics is slated to release the August Producer Price Index before the opening bell on Thursday.

|

Stocks in Spotlight

- Bajaj Auto shares surged by nearly 6% as BofA Securities upgraded its rating to ‘Buy’ from ‘Neutral,’ raising the target price to Rs 5,550, indicating a 15% upside from September 14’s closing price. Analysts at the firm believe it’s the right time for Bajaj Auto to excel, citing several growth catalysts for the two-wheeler giant.

- Oil India shares rose 2.5% after the Chairman and Managing Director, Ranjit Rath, announced plans to invest Rs 25,000 crore in renewable energy to achieve a net-zero emissions goal by 2040. This includes Rs 8,000 crore for a 2G ethanol plant and transitioning to gas-powered engines.

- Asian Paints shares fell 1.4% as Brent Crude reached $90 per barrel. Rising oil prices are hurting the paint industry as petroleum-based raw materials are crucial. Higher input costs may squeeze paint companies’ margins.

|

News from the IPO world🌐

- RR Kabel issue booked 3.26x on last day

- SAMHI, Zaggle continue to struggle on Day 2

- Yatra Online IPO sees tepid response, subscribed only 11% on first day of bidding process

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | BAJAJ-AUTO | ▲ 6.30% | | HEROMOTOCO | ▲ 2.30% | | M&M | ▲ 2.20% | | GRASIM | ▲ 2.00% | | HCLTECH | ▲ 1.60% |

| Nifty 50 Top Losers | Stock | Change (%) | | BPCL | ▼ -1.60% | | HINDUNILVR | ▼ -1.30% | | ASIANPAINT | ▼ -1.20% | | BRITANNIA | ▼ -1.00% | | TATACONSUM | ▼ -0.90% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY AUTO | 1.58% | | NIFTY IT | 0.94% | | NIFTY PRIVATE BANK | 0.64% | | NIFTY PHARMA | 0.61% | | NIFTY FINANCIAL SERVICES | 0.60% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1869 | | Declines | 1778 | | Unchanged | 139 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,907 | 1.0 % | 5.3 % | | 10 Year Gsec India | 7.2 | 0.90% | 4.90% | | WTI Crude (USD/bbl) | 90 | 1.9 % | 17.2 % | | Gold (INR/10g) | 58,835 | 0.40% | 8.40% | | USD/INR | 82.94 | 0.1 % | 0.3 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|