TLDR:

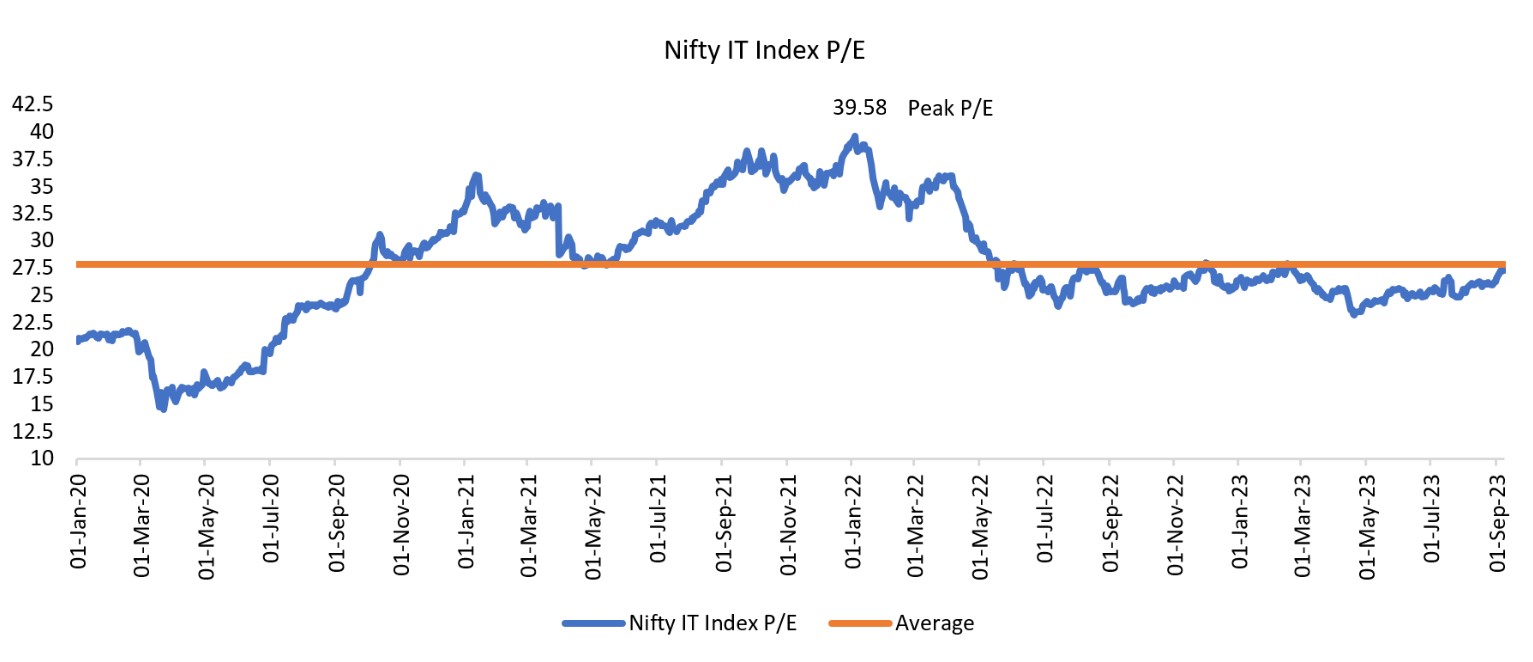

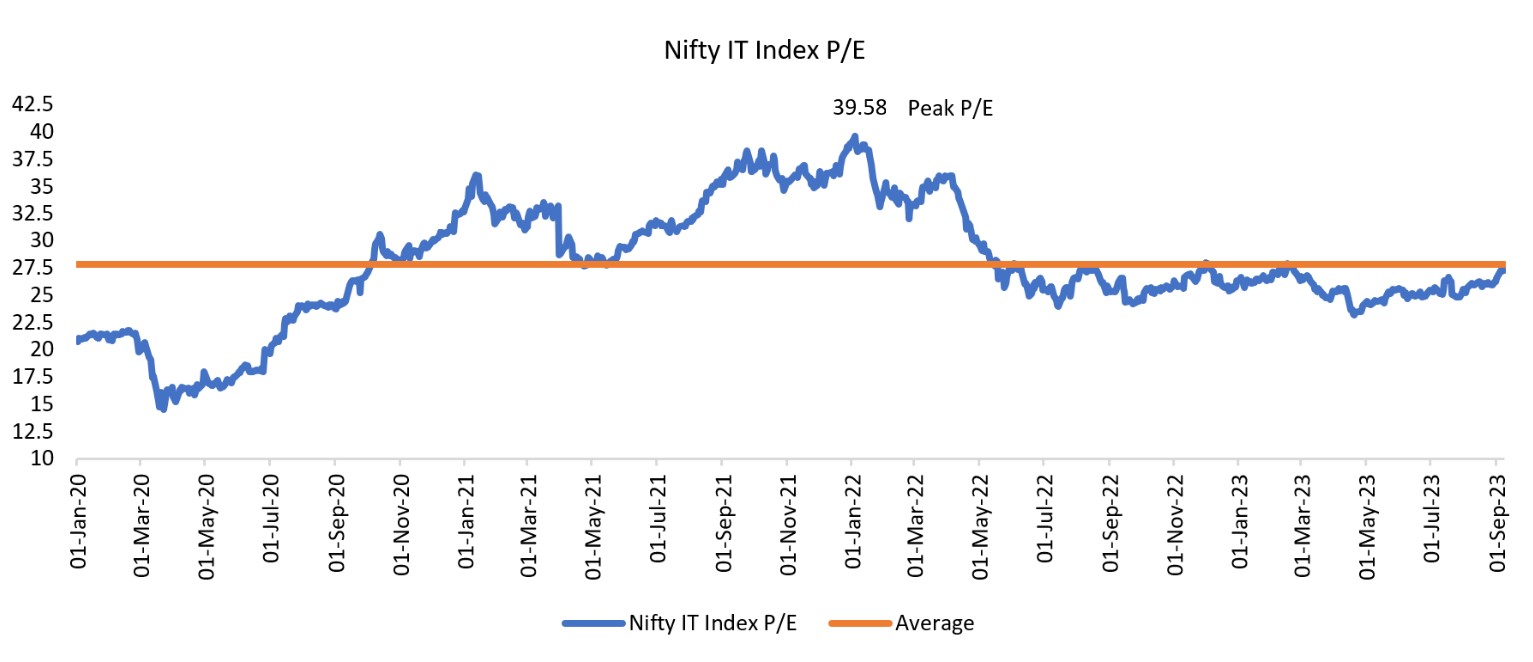

- Nifty IT index’s P/E ratio fell from 40x in late 2021 to 23-24x in April 2023.

- Inflation in the US and Europe decreased, and the US economy stayed resilient.

- IT companies improved margins through layoffs.

- The combination of low valuations and improving global economic stability made Indian IT a promising long-term investment opportunity.

|

|

The Indian IT sector has traversed a rollercoaster journey in recent years, shaped by a series of ups and downs. Following a post-pandemic surge, the sector encountered a slew of challenges, marked by layoffs and sluggish growth. It was only about June 2023 onwards the IT sector began exhibiting early signs of recovery. Since then, the IT sector has not only rebounded but has also outpaced the broader Nifty index significantly. In this article, we revisit the trajectory of the Indian IT sector, shedding light on its past struggles and offering insights into what the future may hold.

In the aftermath of the pandemic, as the world embraced remote work, a seismic shift occurred, with a heightened focus on digitization and related domains like cybersecurity. This digital revolution propelled the Nifty IT index to unprecedented highs. During this period, there was an enthusiastic wave of hiring as companies sought to accommodate what appeared to be an ever-expanding array of new business opportunities.

However, this optimistic scenario took a turn when inflation concerns took center stage, triggering one of the most aggressive phases of monetary tightening in recent memory. The tightening measures were particularly pronounced in the United States and Europe, where the surge in inflation levels was virtually unparalleled. To exacerbate matters, the impact of interest rate hikes on inflation was gradual, resulting in an extended period of exceptionally high interest rates and raising fears of stagflation. This adverse macroeconomic environment had repercussions, especially for FAANG stocks in the US and Indian IT firms that predominantly served clients in these regions.

As companies globally scaled back their technology investments amidst these macroeconomic headwinds, the pipeline of deals dwindled, and the initial hiring fervor gave way to large-scale layoffs. During this phase, the Nifty IT index witnessed a correction exceeding 30 percent from its peak.

Now, we examine how the Indian IT sector has navigated through these challenges and where it stands today.

|

Valuation at reasonable levels:

Even though the Indian IT sector has experienced an upswing in its fortunes lately, its Price-to-Earnings (P/E) ratio remains notably lower than its historical average. Furthermore, despite some recent challenges, the sector’s long-term growth potential remains solid. It continues to hold its position as a compelling option for long-term investors seeking capital appreciation. Nevertheless, it’s essential to acknowledge that short-term fluctuations and corrections are possible, given that risks persist, and valuations have climbed, leaving limited margin for absorbing any unexpected setbacks in the near term.

|

Source: NSE India, Fisdom Research Source: NSE India, Fisdom Research

|

|

Earnings update:

IT companies experienced only a slight increase in revenues during the first quarter, which is typically a strong period for this sector. Infosys, a major player in the IT industry, provided a considerably lower guidance for the financial year 2024 than initially expected. However, the results for the rest of the IT sector were largely in line with street estimates. Because the IT sector had already experienced significant correction, any absence of negative news was seen as a positive development. Consequently, despite the sharp drop in Infosys’s stock price following their results, the overall IT sector outperformed the Nifty index after the earnings announcements.

|

US Economy resilient however challenges still persist from Europe:

Within the US, despite the overall economy demonstrating resilience in the face of interest rate hikes, the banking sector has adopted a cautious approach, affecting lending and IT expenditures. This cautious stance raises questions about the prospects of Indian IT firms like Mphasis, primarily serving the US BFSI (Banking, Financial Services, and Insurance) sector. Additionally, the unpredictability surrounding artificial intelligence and its potential impact on traditional IT services adds another layer of uncertainty.

More and more economists, including those within the Federal Reserve, are becoming optimistic about the United States avoiding a recession. However, concrete confirmation of this positive outlook might not emerge until well into 2024. However, the path to recovery for Europe might be longer and more challenging compared to the US.

|

Conclusion:

Despite sector-specific challenges, particularly with the advent of AI, it’s crucial for investors to emphasize companies in the IT realm that showcase adaptability in the face of rapid change.

While the IT sector’s post-pandemic surge may have been somewhat hasty, the enduring potential of digitization remains bright. Over the long term, the IT sector is expected to regain its momentum. For astute, long-term investors, the recent correction presents an enticing entry point to engage with this evolving sector and potentially benefit from its future resurgence.

|

Markets this week

| | 28th Aug 2023 (Open) | 01st Sep 2023 (Close) | %Change | | Nifty 50 | ₹ 19,525 | ₹ 19,820 | 1.50% | | Sensex | ₹ 65,525 | ₹ 66,599 | 1.60% |

Source: BSE and NSE

|

- Indian market achieved strong gains for the second consecutive week.

- The upward trend was supported by positive domestic macro data, sustained buying from domestic investors, and optimism regarding a potential rate pause by the US Federal Reserve in their upcoming meeting.

- Participants appeared to be unfazed by concerns about inflation stemming from deficit monsoon rains and increasing crude oil prices.

- All sectoral indices closed in positive territory, with notable surges in the BSE realty index (up 5 percent), capital goods (up 5 percent), energy (up 4.7 percent), and the BSE Power index (up 4.7 percent).

- Foreign institutional investors (FIIs) continued their selling streak for the seventh consecutive week, with equity offloads totaling Rs 9,321.41 crore.

- In contrast, domestic institutional investors (DIIs) displayed strong buying activity, acquiring shares worth Rs 4,572.14 crore during the week.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Coal India | ▲ 19.08% | | L&T | ▲ 7.38 % | | HCL Technologies | ▲ 6.43 % | | Bharat Petroleum | ▲ 5.16 % | | LTIMindtree | ▲ 3.30 % |

| NSE Top Losers | Stock | Change % | | M&M | ▼ (1.53) % | | Axis Bank | ▼ (1.09) % | | Eicher Motors | ▼ (0.87) % | | Asian Paints | ▼ (0.66) % | | Nestle India | ▼ (0.15) % |

|

Source: NSE |

Stocks that made the news this week:

- Nazara Technologies experienced a notable rally during the week, reaching a 52-week high of Rs 906 on September 5. The company has announced plans to discuss raising additional funds at its upcoming board meeting, scheduled for September 7. The meeting will explore the possibility of raising funds through the issuance of equity shares or securities on a preferential basis, in line with the Companies Act, 2013.

- RVNL’s stock rose by 12% following the company’s announcement that it secured orders worth Rs 604.19 crore from the Madhya Gujarat Vij Company. These orders involve developing distribution infrastructure for loss reduction in Vadodara and Dahod districts as part of a distribution sector scheme. The Vadodara project is estimated at Rs 322.08 crore, and the Dahod district project at Rs 282.11 crore, with a completion timeline of 31 months.

- Tata Power stock reached a 52-week high, with approximately 0.2 percent of its equity changing hands in a substantial trade valued at Rs 155 crore on September 8th. Bloomberg data revealed that around 52.5 lakh shares of Tata Power were transacted in a block deal at Rs 270 per share on the NSE. In Q1FY24, the company reported a 4.95 percent YoY increase in revenue to Rs 15,213 crore, with net profits rising by 29.07 percent YoY to Rs 1,141 crore. Operating profit margins also expanded significantly, growing by 600 basis points to reach 18 percent.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|