Daily Snippets

Date: 31st August 2023 |

|

|

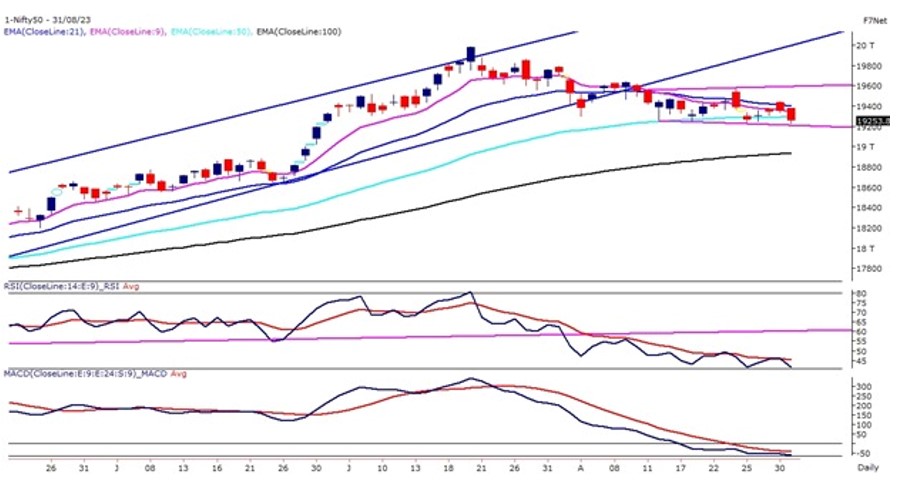

Technical Overview – Nifty 50 |

|

It was a super volatile monthly expiry day where traders were always fishy for the trend, bets were on both sides, and traders kept guessing the direction. The prices recorded an intraday high at 19,388.20 levels and post that couldn’t hold on to its gains and drifted lower by more than 120 points towards the close.

Nifty50 on the monthly chart has lost more than 2.53% and has almost engulfed its previous month’s candle. Nifty has continued to trade in a narrow-range rectangle pattern for the past more than 2 weeks, indicating a sideways market trading range.

The momentum oscillator RSI (14) has been hovering below 50 levels for the past couple of weeks suggesting weak momentum on the cards. The immediate support for the index is placed near the lower band of the rectangle pattern at 19180 levels. A sustained move below the said levels will witness a breakdown in the index and prices may drift lower to 19,000 levels. The hurdle for the index is placed near its short-term EMA at 19,450 levels

|

Technical Overview – Bank Nifty |

|

The sentiments remained depressed on the monthly expiry day drifted 0.55% and closed marginally below 44,000 levels. On the monthly chart the banking index has formed a bearish engulfing candle stick pattern and the tall red candle has engulfed its previous two months’ candles.

The index on the daily chart is trading within the rectangle pattern and got tangled between 50 & 21 EMA. The momentum oscillator RSI (14) has been hovering below 50 levels for the past couple of weeks suggesting weak momentum on the cards.

The immediate support for the Banking index is placed near the lower band of the rectangle pattern at 43700 levels. A sustained move below the said levels will witness a breakdown in the Banking index. The hurdle for the index is placed near the upper band of the rectangle pattern at 44,600 levels.

|

Indian markets:

- Domestic equity indices closed lower on Thursday, ending a three-day winning streak.

- The day marked volatility due to the monthly F&O expiry.

- Nifty ended around 19,250 points, having reached a high of 19,388.20 in the morning.

- Concerns arose due to a 9% monsoon deficit and insufficient rainfall in several districts.

- Despite mixed global cues, there was optimism in the broader market and selective sector-wise buying.

- Consumer durables, realty, and IT shares performed well.

- However, PSU banks, energy, and FMCG shares faced downward pressure.

|

Global Markets

- The US Dow Jones index futures were up 113 points, indicating a positive opening in the US stocks today.

- European markets were mixed as euro zone inflation for August remained unchanged at 5.3%, higher than expected. Inflation in Germany and Spain showed signs of slowing at a sluggish pace. In France, consumer prices rose 1.0% in August, with an annual gain of 4.8%, surpassing expectations.

- Most Asian stocks ended lower as Chinas factory activity contracted for the fifth consecutive month in August, albeit at a slower rate than in July.

- US stocks, on the other hand, advanced in the last session after the latest GDP data indicated a potential pause in interest rate hikes. The US second-quarter GDP growth was revised downward to 2.1% annualized, mainly due to lower estimates for corporate expenditure, partially offset by an upward revision for state and local government spending.

|

Stocks in Spotlight

- Sula Vineyards saw a nearly 4 percent decrease in its stock price following a block deal on August 31, where 13.1 percent of its equity changed hands. Approximately 1.1 crore shares were traded at an average of Rs 490 each, marking a 3.8 percent reduction from the previous day’s closing price of Rs 508.70. The total transaction value amounted to Rs 540 crore. The specific buyers and sellers involved were not immediately identified, but it was earlier reported that Verlinvest Asia Pte, a significant institutional investor in India’s sole listed winemaker, was planning to reduce its stake of 12.56 percent.

- Shares of the most out of all Adani companies declined a day after the non-profit Organized Crime and Corruption Reporting Project (OCCRP) alleged that the Adani Family partners invested millions to buy own group shares through opaque investment funds based in Mauritius. The company has denied the charges.

- BHEL hit a new 52-week high of Rs 121.15 on August 31 after the engineering PSU won a Rs 15,530-crore order from state-run NTPC for a thermal power plant. The order comes days after BHEL bagged a Rs 2,242-crore work from NHPC and a Rs 4,000-crore order from an Adani Power subsidiary.

|

News from the IPO world🌐

- Mono Pharmacare IPO fully booked on bidding debut

- Cryogenic tank maker Inox India files draft papers with Sebi for IPO

- Chennai based Basilic Fly Studio to launch IPO on September 1

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | JIOFIN | ▲ 3.80% | | MARUTI | ▲ 2.10% | | HDFCLIFE | ▲ 1.40% | | CIPLA | ▲ 1.40% | | TATASTEEL | ▲ 1.20% |

| Nifty 50 Top Losers | Stock | Change (%) | | ADANIENT | ▼ -3.50% | | BPCL | ▼ -3.30% | | ADANIPORTS | ▼ -3.20% | | BRITANNIA | ▼ -2.00% | | EICHERMOT | ▼ -1.90% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY CONSUMER DURABLES | 0.83% | | NIFTY REALTY | 0.65% | | NIFTY IT | 0.20% | | NIFTY AUTO | -0.05% | | NIFTY PHARMA | -0.20% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1813 | | Declines | 1819 | | Unchanged | 136 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,890 | 0.1 % | 5.3 % | | 10 Year Gsec India | 7.2 | -0.30% | 4.70% | | WTI Crude (USD/bbl) | 82 | 1.9 % | 6.1 % | | Gold (INR/10g) | 59,117 | 0.50% | 7.80% | | USD/INR | 82.65 | 0.0 % | (0.0) % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|