Daily Snippets

Date: 23rd August 2023 |

|

|

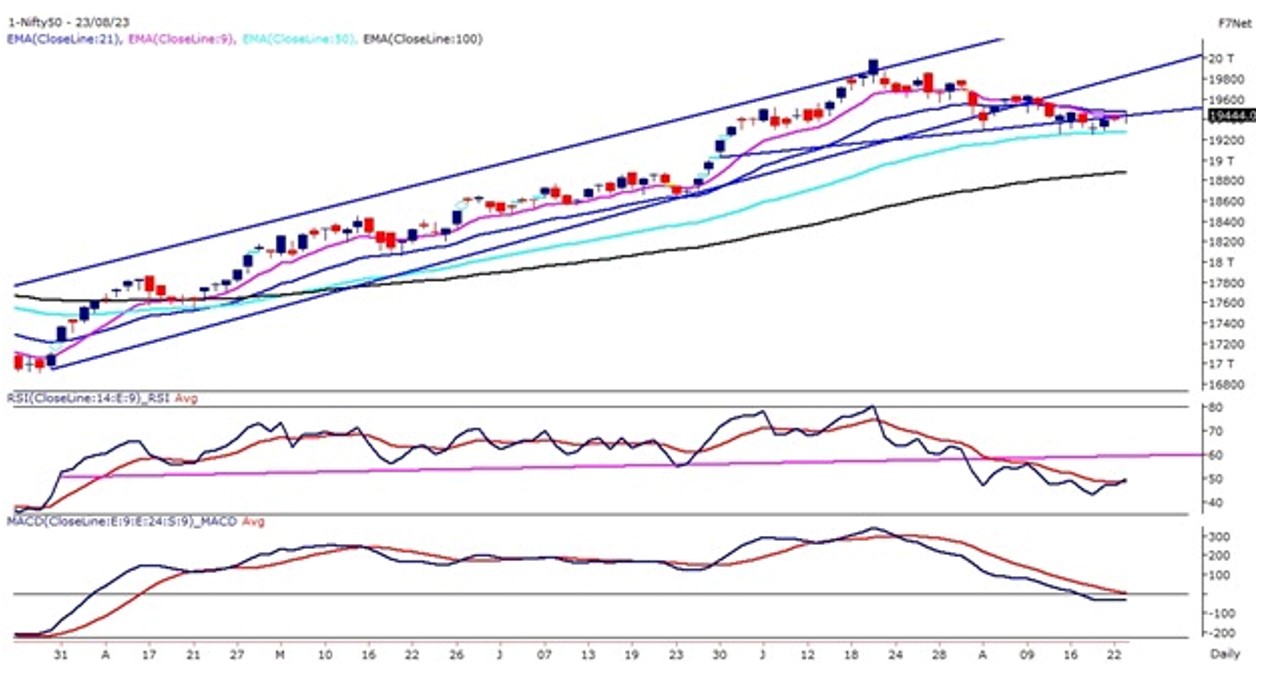

Technical Overview – Nifty 50 |

|

Nifty50 on 23 Aug witnessed a sharp reversal from the lower levels after recording an intraday low at 19,366.60 levels. The Benchmark index on the daily chart inched closer to its resistance zone and was not able to break above its consolidation band.

Nifty has constructed a small body candle and is trading within the 200 points range from the past seven trading sessions hence does not give any clear picture of the trading prescriptive. The lower high lower low formation is still intact post registering record high levels.

In Index options, Both FII and PRO continue to remain net short. Options chain – OI concentration in Nifty is in 19500 CE and 19400 PE.

On the downside, the 50 EMA at 19281 levels may perform as crucial support. Below this, a gap between 19200-19234, on a weekly and monthly chart could act as a strong demand zone. A breakout above 19,500 – 19,525 levels will create demand towards 19,650 levels.

|

Technical Overview – Bank Nifty |

|

It was Banking stocks that really controlled the market and formed a solid green candle on the daily chart. The Bank Nifty has entered above its neckline of a bearish head and shoulder pattern and hinted a failure of a bearish pattern if prices are sustained above the same.

After wobbling in the morning session, Bank Nifty turns north – joining the conga line of climbing global stock markets. The Banking index was holding above its 100-day exponential moving average from the last few trading sessions and finally rebounded from the lower levels. The momentum oscillator RSI (14) has been reversed from the lower levels and presently moved above 45 levels with a bullish crossover.

Looking at the options data, Bank Nifty is likely to trade in a bullish to a sideways range above as the 44000 put holds substantial OI while the 44600 call holds substantial OI. A fresh-up move is expected only above 44600 levels and on the downside, 44000 is expected to act as support.

|

Indian markets:

- Equity benchmark indices extended their gains for a third successive session. Notably, the Nifty managed to close above the 19,400 level, a positive sign of the ongoing uptrend.

- The Nifty started the day with a dip, touching a morning low of 19,366.60 before rebounding. This highlights the intraday volatility that shaped trading.

- The session’s recovery was largely underpinned by the strength in banking stocks. Their positive performance contributed significantly to the overall market rebound.

- Despite the market’s upward movement, investors maintained a cautious approach. This reflects ongoing concerns related to the global macroeconomy and the impact of rising US bond yields.

- Market participants are closely monitoring the central bankers meeting scheduled at Jackson Hole, especially since it falls on Friday. The anticipation is that this event could introduce heightened volatility.

- The primary focus of the Jackson Hole meeting revolves around the potential for a US rate hike and the consequent impact on bond yields. These factors are contributing to the cautious sentiment in global markets.

|

Global Markets

- The markets in Europe and Asia showed gains on Wednesday. However, the latest PMI release by S&P Global indicates a decline in business activity across different regions.

- In the Eurozone, the seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index fell to 47.0 in August 2023, reaching its lowest level since November 2020. This is a decrease from the indexs July 2023 reading of 48.6.

- Similarly, the S&P Global/CIPS flash U.K. composite PMI dropped to a 31-month low of 47.9 in August, down from 50.8 in July.

- Australia also experienced a contraction in business activity, with Juno Bank reporting the fastest pace of contraction in 19 months. The flash composite purchasing managers index for August stood at 47.1.

- On the other hand, Japan witnessed an expansion in its business activity. The flash PMI for August was 54.3, higher than the previous months reading of 53.8.

- In the U.S., stock markets closed with a mixed performance on Tuesday. Investors eagerly await a crucial speech from Federal Reserve Chairman Jerome Powell scheduled later this week.

|

Stocks in Spotlight

- Larsen & Toubro (L&T) rose 1.42% after the EPC major announced that its construction arm has secured new large orders for its power transmission & distribution business in the Middle East. As per L&Ts classification, the value of the Large project is Rs 2,500 crore to Rs 5,000 crore.

- Shares if Linde traded 3.2 percent higher. The stock also hit a record a day after the industrial gas company announced that it had been awarded a letter of acceptance by Indian Oil Corporation Limited (IOCL) for an air separation unit. It has been asked to set up an air separation unit at IOCL’s Panipat refinery for the production and supply of instrument air, plant air and cryogenic nitrogen for the refinery’s expansion project, the company told exchanges on August 22.

- Shares surged 1.3 percent after the debt-ridden company announced its plans to clear about Rs 2,400 crore of dues to the government by September, PTI reported on August 22. “Vodafone Idea will clear dues for the June 2023 quarter and spectrum instalment with applicable interest by September.

|

News from the IPO world🌐

- Heating Equipment firm JNK India files draft IPO papers with SEBI

- Shiva Pharmachem files DRHP with Sebi for Rs 900 crore IPO

- Aeroflex Industries IPO sails through within one hour of opening

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | HINDALCO | ▲ 2.30% | | AXISBANK | ▲ 2.10% | | ICICIBANK | ▲ 1.60% | | DIVISLAB | ▲ 1.60% | | LT | ▲ 1.50% |

| Nifty 50 Top Losers | Stock | Change (%) | | ADANIENT | ▼ -5.90% | | JIOFIN | ▼ -5.00% | | ADANIPORTS | ▼ -2.90% | | SUNPHARMA | ▼ -1.40% | | TECHM | ▼ -1.20% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY PSU BANK | 1.72% | | NIFTY PRIVATE BANK | 1.26% | | NIFTY BANK | 1.10% | | NIFTY FINANCIAL SERVICES | 0.92% | | NIFTY MEDIA | 0.68% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2165 | | Declines | 1616 | | Unchanged | 153 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,289 | (0.5) % | 3.5 % | | 10 Year Gsec India | 7.2 | -0.30% | 4.70% | | WTI Crude (USD/bbl) | 80 | (0.6) % | 3.5 % | | Gold (INR/10g) | 58,221 | 0.10% | 6.20% | | USD/INR | 83.12 | (0.1) % | 0.5 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|