Daily Snippets

Date: 24th July 2023 |

|

|

Technical Overview – Nifty 50 |

|

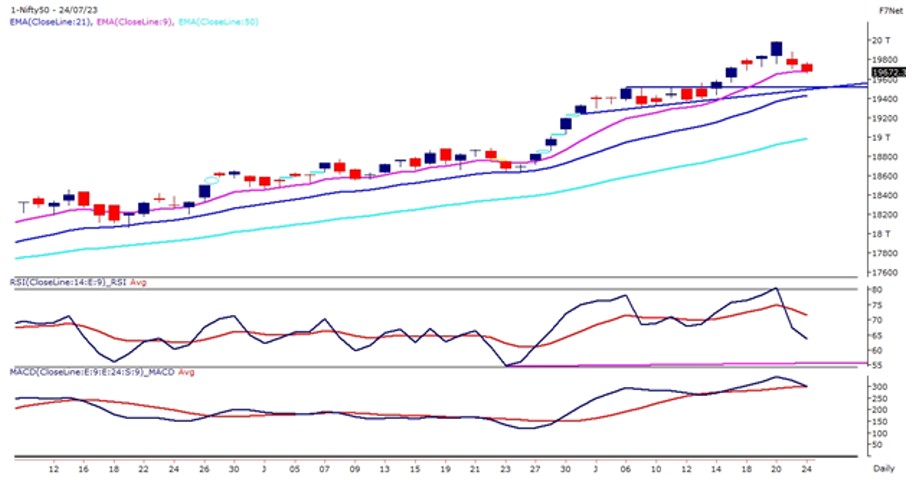

The Benchmark index on 24th July witnessed a flat opening and gained some momentum in the first hour of the trade and recorded a day’s high at 19,782 levels. The Nifty couldn’t hold on to its gains and drifted lower with volatility and closed below the 19,700 mark with a loss of 73 points.

The Nifty50 has closed just near the border of 9 EMA which was acting as an immediate support for the index. On the weekly chart, the index formed a shooting star formation and on Monday session index closed with a negative return suggesting the possibility of retracement in the index.

The Nifty gave a profit booking scenario which was pulled down further with weakness IT sector. A crucial support level for the Nifty lies at 19,600, marked by a Put writing. A breach below this level may lead to a substantial market correction near 19500 levels. On the flip side, the immediate resistance stands at 19,900 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty started its week with a negative note but traded above 45,850 levels for the majority of the time. The Banking index on the intraday chart has formed a falling wedge pattern and presently prices are trading within the 200 points range.

The negative baton from Friday’s session eventually found its way in the second half of today’s session as investors preferred to remain on the sidelines ahead of the Fed policy outcome slated to release this Wednesday, July 26th.

The highest call side open interest is at 46,000 & 46,500 and the highest put side open interest is at 46,000 & 45,000 levels and the bank nifty PCR ratio stands at 0.94 levels which indicates a sideways outlook for the 27th July expiry.

Volatility and choppiness have found their way to Dalal Street again. The breakout of a wedge pattern on the intraday chart stands above 46,080 levels and on the lower side intraday supports stand at 45,800 levels.

|

Indian markets:

- Indian market ended lower on July 24 amid selling pressure and high volatility.

- Weak global cues and the ongoing earnings season contributed to the decline in equity benchmarks.

- FMCG sector, particularly ITC, suffered losses due to the announcement of its hotels business demerger.

- Metals and oil & gas sectors also experienced selling pressure. Pharma and healthcare indices bucked the trend and saw some buying activity.

- The PSE Index garnered interest as several constituents rose, possibly due to likely inclusion in the MSCI and new clean-energy orders.

- There is no widespread pessimism in the market, but a normal correction was anticipated.

- Investors might be adjusting their positions ahead of the key US FOMC policy outcome to be announced on Wednesday.

|

Global Markets

- European shares declined while Asian stocks ended mixed on Monday ahead of key economic data and a busy week of earnings and central bank meetings.

- The European Central Bank meets on Thursday, when policymakers are likely to announce a 25 basis point rate hike and offer guidance for the final stages of their inflation-fighting efforts.

- Japans manufacturing activity extended declines in July, as the au Jibun Bank flash Japan manufacturing purchasing managers index (PMI) fell to 49.4 in July from 49.8 in June.

- Markets reportedly anticipate a 25 basis points interest rate hike from the US Federal Reserve and European Central Bank later this week and possibly the end of the tightening cycle in both. Meanwhile, the Bank of Japan on Friday will likely keep its super-loose policy intact.

- U.S. stocks ended mixed on Friday, with the Dow Jones Industrial Average rising marginally to notch its 10th straight day of advances, its longest rally in almost six years.

|

Stocks in Spotlight

- ITC Limited’s Board has given in-principle approval for the demerger of its hotels business through a scheme of arrangement, as announced in a regulatory filing on July 24. The proposed restructuring will enable the hotel business to operate as a separate entity in the rapidly growing hospitality industry, with a focus on its growth trajectory and an optimal capital structure. The new entity will be predominantly owned by the company’s shareholders, holding approximately 60 percent stake, while ITC Limited will retain around 40 percent ownership. This strategic move aims to ensure the company’s continued interest in the hospitality sector, providing long-term stability and support for the new entity’s accelerated growth and sustained value creation.

- Canara Bank reported a significant 74.8 percent year-on-year rise in profit after tax, reaching Rs 3,534.84 crore during the first quarter of the current financial year. This surge was attributed to increased net interest income, improved interest margins, and enhanced asset quality. The bank’s net profit in the same period last year was Rs 2,022.03 crore. Notably, Canara Bank’s asset quality showed improvement, with gross non-performing assets (NPAs) ratio at 5.15 percent, down from 5.35 percent in the previous quarter and 6.98 percent in the same quarter last year. Similarly, the net NPA ratio stood at 1.57 percent, showing an improvement from 1.73 percent in the previous quarter and 2.48 percent in the year-ago period.

- Biocon’s shares declined by 5.5 percent as the company received six observations from the US Food and Drug Administration (USFDA). The US FDA conducted two cGMP inspections at Biocon Sdn. Bhd’s insulin manufacturing facility in Malaysia, covering biologics drug substances, drug product units, quality control laboratories, and the delivery devices unit.

|

News from the IPO world🌐

- IPO worth Rs. 50,000 crore in next 6 months; proposal worth Rs. 42000 crore more await SEBI nod

- Ola advances plan for IPO and electric scooters take off in India

- Textile Manufacturer Shri Techtex to roll out IPO

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | INDUSINDBK | ▲ 2.00% | | SBILIFE | ▲ 2.00% | | DRREDDY | ▲ 1.90% | | M&M | ▲ 1.50% | | ULTRACEMCO | ▲ 1.40% |

| Nifty 50 Top Losers | Stock | Change (%) | | ITC | ▼ -4.30% | | KOTAKBANK | ▼ -3.90% | | TECHM | ▼ -3.10% | | RELIANCE | ▼ -2.00% | | BRITANNIA | ▼ -1.50% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY HEALTHCARE INDEX | 0.45% | | NIFTY PHARMA | 0.41% | | NIFTY REALTY | 0.20% | | NIFTY AUTO | 0.17% | | NIFTY PSU BANK | 0.10% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1710 | | Declines | 1995 | | Unchanged | 150 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 35,228 | 0.0 % | 6.3 % | | 10 Year Gsec India | 7.1 | -0.20% | 3.00% | | WTI Crude (USD/bbl) | 77 | 1.9 % | 0.2 % | | Gold (INR/10g) | 59,221 | -0.10% | 7.30% | | USD/INR | 82.08 | 0.0 % | (0.7) % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|