The week that went by proved to be a momentous one, marked by remarkable events on both the markets and Indian space fronts. While domestic markets surged to unprecedented heights, reaching a fresh all-time high, another significant milestone was achieved with the resounding success of the Chandrayaan 3 mission.

While the Chandrayan 3 is moving towards the moon another industry is set to achieve new highs within Indian markets and that is the Drone industry.

Drones have been around us for quite some time now and it was the year 2006 when things actually changed as the US approved commercial drones. This could mean that Amazon could deliver products through drones or it could be used for mining or for surveying etc. However, the Indian government gave this approval for commercial use in 2018. But if we rewind a bit in 2014 India had banned import of drones and this meant that every single industry like mining, agriculture, public safety and even delivery was not allowed. But is allowed now!

There are some technologies that are very high tech and cutting edge and are expensive and requires a lot of research and drones is one of those industries. So generally, it is the government’s defence of different countries which adopts that technology first, spend a lot of research power in it, make it a part of usable technology and once this cutting edge technology is tested and approved it becomes more commercialised.

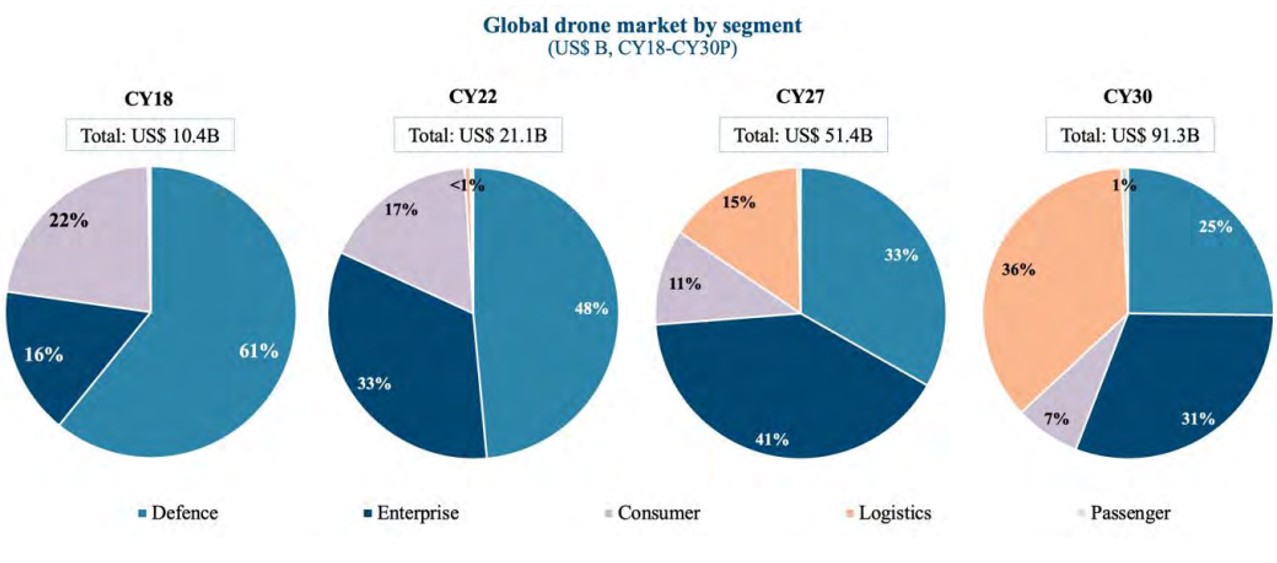

The same trend can be noticed in the chart below:

In 2018 most of market of global drone industry was just focused on defence. Because there are various unknowns associated with the business aspect, businessmen tend to be hesitant to adopt to the new technology. But as the development progresses, we can see that in CY2022 the commercial drone market increased to 52 percent. And as the forecast suggests the contribution by defence gets fragmented and the commercial demand is set to dominate this industry.

What does this mean? This basically means that this is a sunrise industry which means more and more people and business are set to adopt this trend as long as there are new entrants coming in. Also, the global drone industry is set to grow from $21billion in CY21 to all the way to $90 billion in CY30 multiplying at a CAGR of 20 percent in the next 7 years.

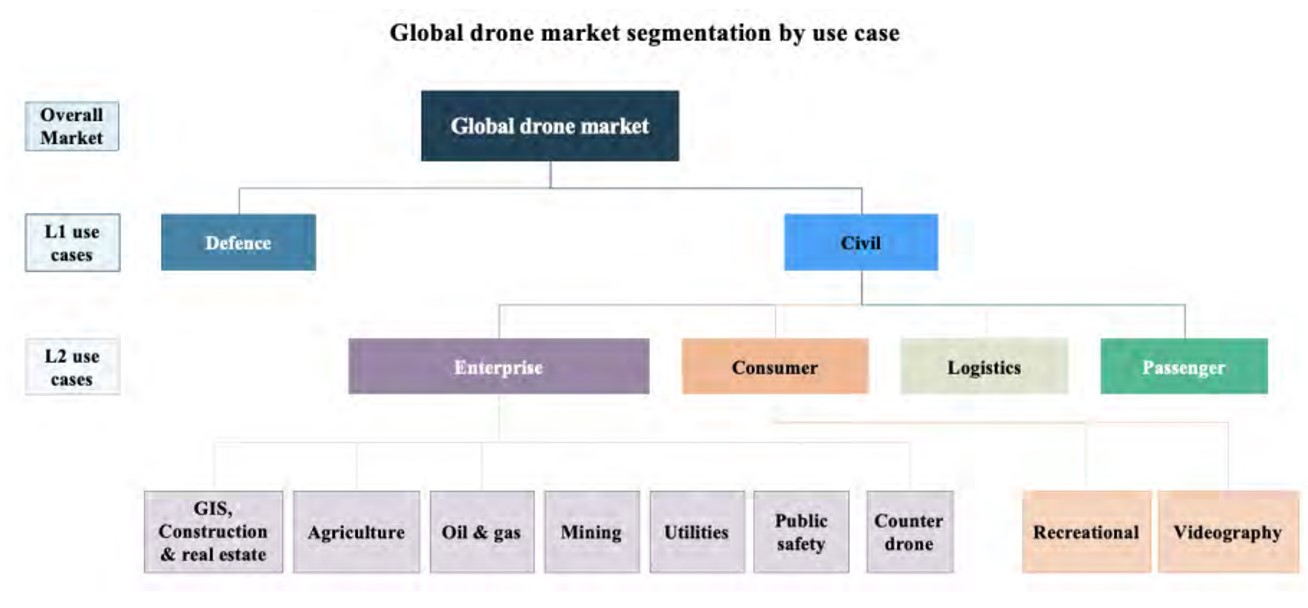

The use cases for the drone industry can be divided into two Defence & Civil, within Civil we have use cases like Enterprise, Consumer, Logistics, Passenger.

Indian Drone Industry:

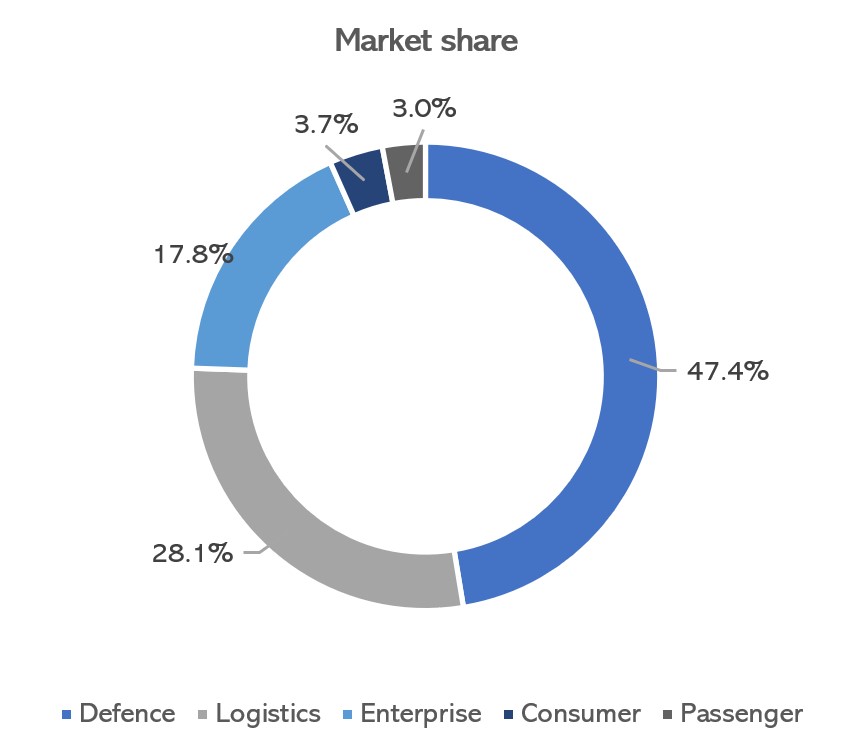

The Indian drone industry is currently in its early stages, and as a result, the requirements and potential of this burgeoning sector are continuously evolving. In the year 2022, the potential market size for the Indian drone industry was estimated to be approximately US$ 2.71 billion. Drones have showcased immense potential in various sectors, such as healthcare, agriculture, energy utilities, construction, mining, passenger transportation, public safety, and logistics, serving as modern-day use cases.

Within the Indian drone market, the defense industry exhibited the highest potential with a value of US$ 1.28 billion in 2022. Following closely behind, the logistics sector held a potential market size of US$ 0.76 billion, while the enterprise sector accounted for US$ 0.48 billion. The passenger transportation segment, though relatively smaller, presented a market potential of US$ 0.08 billion.

Let us also try and understand the growth factors of drone industry:

PLI Scheme: The government offers PLI where anyone producing drones could get a benefit of Rs. 120 crore throughout the industry and as per a recent updated. The Ministry of Civil Aviation has disbursed an amount of Rs. 30 crores to the beneficiaries during FY2022-2023. Although this is small amount but still there is some incentive for the industry.

Startup boom: Indian drone startups have grown by leaps and bounds. The number of startups in this space has increased from 157 in Aug’21 to 211 in Mar’22. And Indian stands at 4th place after US China and UK in terms of drone startups.

Existing businesses are showing interest in using drones. For example Swiggy’s Instamart had commenced a pilot project in Bengaluru and Delhi for grocery deliveries using drones. TATA Steel has singed a MOU with Australia for boundary and safety zone surveillance. Rajasthan government on the other hand deployed drones to prevent illegal mining. And during Covid-19, vaccines were deployed using drones. Hence more and more use cases are emerging other than defence.

Geopolitical edge: The concerns raised by the USA regarding spying and national security threats associated with Chinese-owned apps and companies have cast a shadow over the reputation of Chinese drone manufacturers, such as SZ DJI Technology Co. Ltd. This has created an opportunity for the Indian drone industry to step in as a viable alternative in the global market. Chinese-based manufacturing companies have been able to offer drones at a lower cost, attracting countries with limited resources. However, the rapid increase in production has led to issues of unreliability and performance, as highlighted by nations like Saudi Arabia and Jordan. The data confidentiality concerns and the growing anti-China sentiments globally have opened doors for the Indian drone industry to showcase its capabilities. With the Indian government’s industry-friendly policies, significant investments, and the rising demand for drones worldwide, the Indian drone sector is well-positioned to emerge as a global competitor, providing both civil and military drones for export. Through strategic public and private investments, India aims to establish itself as a reliable and innovative player in the international drone market.

Here’s an update on the key players in the drone industry:

IdeaForge, India’s leading drone maker, witnessed a highly successful IPO with its shares listing at a significant premium on both the BSE and NSE. The stock debuted at Rs 1,300 on the NSE, representing a remarkable increase of 93.45% over its IPO issue price of Rs 672. The IPO garnered tremendous investor interest, with the subscription being oversubscribed by 106 times. Retail individual investors subscribed 85.1 times, qualified institutional buyers subscribed 125.81 times, and non-institutional investors subscribed 80.5 times. IdeaForge’s strong market leadership in the Indian unmanned aircraft systems (UAS) drone market, coupled with its unique position as the only listed company in the space, attracted investors despite its relatively higher valuation. With a 50% market share in the UAS market and a focus on manufacturing UAVs for mapping, security, and surveillance.

Hindustan Aeronautics Limited (HAL), a state-owned aerospace and defense company, is actively engaged in the development of advanced drones for strategic missions in high-altitude areas, particularly along the border with China. HAL is working on an artificial intelligence (AI)-driven drone project and plans to conduct a maiden test flight by the middle of next year. In the initial phase, the company aims to produce 60 of these advanced drones. Additionally, HAL is collaborating with the Defense Research and Development Organization (DRDO) on two separate drone projects. The company’s management has also mentioned their development of a rotary drone in the 200 kg class. HAL’s focus on the drone segment is evident, even as it continues to prioritize other high-margin profit segments. With its strong performance and highest-ever revenue of over Rs 240 billion in the previous fiscal year. The company’s strategic position in the aerospace and defense sector is further strengthened by its leading role in various projects and a substantial order book worth Rs 1 lakh crore. Given HAL’s current trajectory and involvement in critical drone initiatives, it is expected to perform well in the medium term.

Zen Technologies, a leading provider of defense training solutions and a drone technology company, has established itself as a key player in the industry. Headquartered in Hyderabad with offices in India and the USA, Zen Technologies has applied for over 90 patents and has successfully shipped more than 1,000 training systems worldwide. Drones have become a significant focus for the company, often leading to a surge in its share prices upon securing major orders. In September 2022, Zen Technologies received a significant Rs 1.6 billion order from the Indian Air Force for the supply of counter unmanned aircraft systems (CUAS), marking its entry into the anti-drone space. The company’s shares more than doubled in just a month’s time. Continuing its success, Zen Technologies recently bagged orders worth Rs 1.3 billion from the armed forces in March 2023. These achievements have translated into impressive financial performance, with the company reporting a profit after tax (PAT) of Rs 119.4 million for the December 2022 quarter, compared to a loss of Rs 2.2 million in the previous year. Revenues also tripled, reaching Rs 524.8 million. Looking ahead, Zen Technologies aims to sustain its order wins by actively participating in various defense events. The company’s order book stood at Rs 4 billion as of December 2022.

Paras Defence, through its subsidiary Paras Aerospace, places significant focus on the development of aerospace technology related to drones. Since its establishment in 2019, Paras Defence has forged partnerships with UAV manufacturers in Israel, Latvia, and Italy, allowing the company to access cutting-edge solutions in the drone industry. Israel, in particular, has a longstanding expertise in drone production, dating back to 1980. In fiscal year 2021, Paras Defence entered a partnership with High Lander, a company specializing in end-to-end solutions for autonomous drone fleet management. This collaboration further strengthens Paras Defence’s capabilities in the drone sector. Additionally, the company sealed an exclusive teaming agreement with ELDIS Pardubice of the Czech Republic in September 2022, aiming to provide comprehensive anti-drone systems for civilian airports in India. Paras Aerospace, a beneficiary of the production-linked incentive (PLI) scheme, has been shortlisted by the Ministry of Civil Aviation (MoCA) as a drone component manufacturer. This recognition allows the company to receive incentives from MoCA under the terms and conditions of the PLI scheme, further boosting its growth prospects. What sets Paras Defence apart as a top contender is its diversified range of products and favorable financial position. The company’s product portfolio spans various sectors, including heavy engineering, defense and space optics, and defense electronics. Notably, one of its subsidiaries recently received a certificate from the Directorate General of Civil Aviation (DGCA) for its Agri Drone called “Paras-Agricopter,” emphasizing its commitment to innovation in the drone field. With an order book worth Rs 2.7 billion and strong revenue visibility in the near term, Paras Defence is well-positioned to thrive in the drone industry.

Conclusion:

What matters the most for a retail investor or any other investor is will the growth numbers about the industry and companies continue to grow over next 5 or 10 years. One should not buy a business because it has a cool tech. You should buy it looking at other important parameters such as strong revenue stream and able to grow this revenue along with profits over long periods of time. That is when your money will grow. Investor should consult their financial advisors before making any financial decisions or else consider their risk profile and specific goals before investing.

Markets this week

| 10th July 2023 (Open) | 14th July 2023 (Close) | %Change | |

| Nifty 50 | ₹ 19,400 | ₹ 19,564 | 0.8% |

| Sensex | ₹ 65,482 | ₹ 66,061 | 0.9% |

- The Indian market’s impressive rally continued for the third consecutive week, with gains driven by improved domestic and global data.

- Consistent buying from foreign institutional investors (FIIs) and positive quarterly earnings contributed to the market’s upward momentum.

- The progress of the monsoon season was healthy, further boosting market sentiment and confidence.

- Foreign institutional investors (FIIs) played a significant role in driving the market higher, purchasing shares worth Rs 5,417.78 crore.

- Domestic institutional investors (DIIs), on the other hand, sold equities worth Rs 1,251.29 crore during the week.

- So far in the month, FIIs have made substantial investments in Indian equities, with purchases amounting to Rs 14,582.63 crore. Conversely, DIIs have sold shares worth Rs 8,129.50 crore during the same period.

- The combination of positive market fundamentals and strong investor interest has contributed to the ongoing record run in the Indian market.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Infosys | ▲ +7.20% | Power Grid Corp | ▼ -6.03% |

| Tech Mahindra | ▲ +6.28% | UPL | ▼ -3.54% |

| Hindalco Industries | ▲ +5.74% | BPCL | ▼ -3.09% |

| TCS | ▲ +5.57% | Titan Company | ▼ -2.81% |

| Eicher Motors | ▲ +5.10% | NTPC | ▼ -2.67% |

Source: NSE

Stocks that made the news this week:

Tata Consultancy Services (TCS) announced a 16.8% year-on-year (YoY) growth in net profit for the quarter ended June 30, 2023. This impressive performance can be attributed to the company’s ability to secure significant total contract value (TCV) deals despite operating in a challenging business environment. The reported figures align with subdued estimates amid a weak demand landscape.

Marksans Pharma witnessed a significant rally of almost 9% on July 12 following the approval granted by the US Food and Drug Administration (FDA) for the company to manufacture a pain relief tablet. This development represents a promising opportunity for the drug maker to expand its product portfolio and enhance its presence in the market.

Delta Corp faced a significant decline of 23% on July 12 following the decision made by the GST Council to impose a 28% tax on online gaming, casinos, and horse racing. This sudden tax imposition comes at a challenging time when the online gaming industry was showing signs of recovery, fueled by the establishment of a Self Regulatory Body (SRB) and the lifting of the ban on Battlegrounds Mobile India.

Please visit www.fisdom.com for a standard disclaimer.