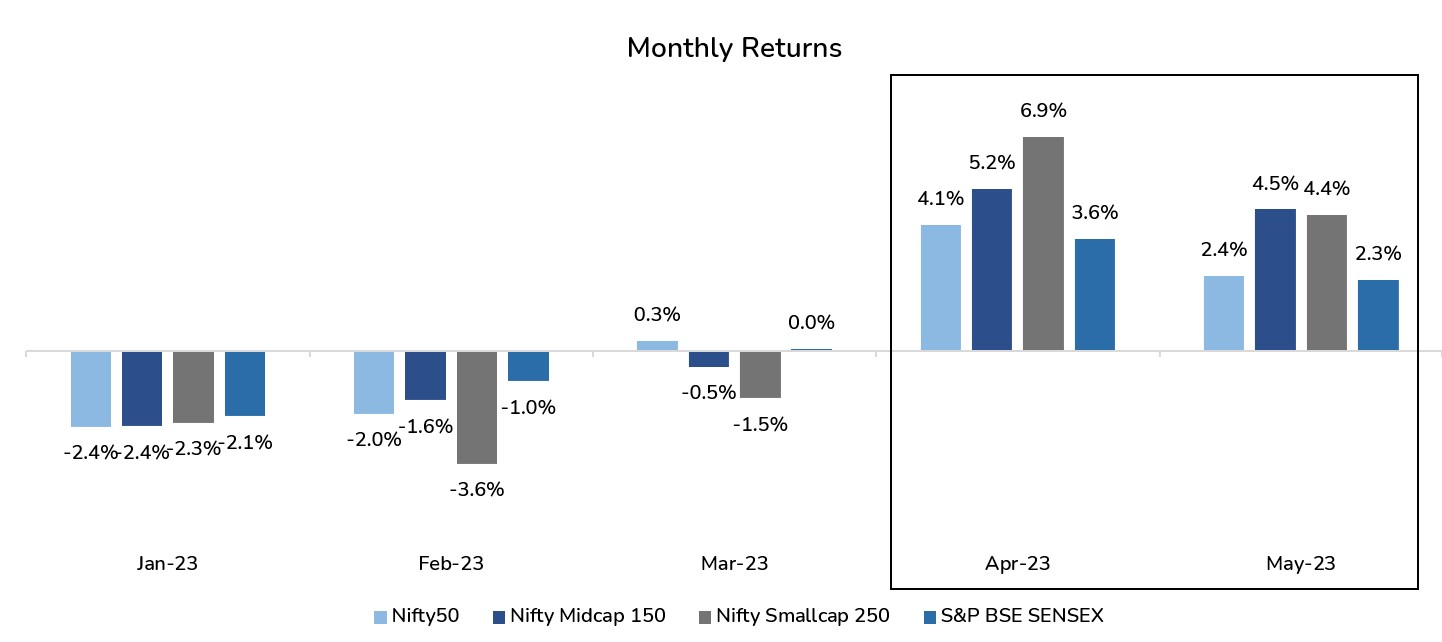

May has witnessed notable gains in both the Sensex and Nifty, with each index rising by 2.3 percent. Additionally, the NSE MidCap and SmallCap indices have experienced impressive growth, each increasing by 4.5 percent.

Source: NSE India, Fisdom Research. Data as on 26th May 2023

Several key factors have contributed to this market rally:

1 . Global Positive Factors:

- The stock prices of chipmakers in the US and Europe surged after they reported better-than-expected results during the week.

- Encouraging news regarding progress in US debt ceiling negotiations also boosted investor sentiment. Reports indicated that Republican and White House negotiators had narrowed their differences and were moving closer to reaching an agreement to raise the debt limit and cap federal spending for two years.

2. Positive Commentary by Jefferies:

Jefferies, a renowned foreign brokerage, has recently published a report expressing confidence in India’s enduring structural narrative and foreseeing the BSE benchmark Sensex crossing the remarkable milestone of 1,00,000. This projection has captured the attention of India’s dynamic financial media landscape.

Jefferies’ optimistic forecast is based on the assumption of a 15 percent earnings per share (EPS) growth over a five-year period and the maintenance of a five-year average one-year forward price-to-earnings (PE) multiple of 19.8 times.

- Portfolio Changes by Jefferies:

- In the Asia Pacific ex-Japan relative-return portfolio, Jefferies has made adjustments to their holdings. They have lowered the overweight position in China and Australia, while increasing the weight of India, Korea, and Taiwan. Specifically:

- China’s weight will be reduced by 2 percent.

- Australia’s weight will be reduced by 1 percent.

- India, Korea, and Taiwan will each gain a 1 percent weight increase.

- In the Asia ex-Japan long-only portfolio, Jefferies has made further changes to their investments. They have made the following adjustments:

- Investments in Standard Chartered Plc and HDFC Life Insurance Co. will be replaced by companies like and Zomato Ltd. and SBI Life Insurance Co.

- The investment in Vale Indonesia will be removed.

- The investment in JD.com will be reduced by one percentage point.

- Investments in AIA Group, PT Bank Central Asia Tbk, Bajaj Finance Ltd., Godrej Properties Ltd., and Macrotech Developers Ltd. will each be increased by one percentage point.

- In the India long-only portfolio, Jefferies has introduced an investment in Zomato with a 4 percent weight, while removing the investment in HDFC Life Insurance. Additionally:

- The investment in REC Ltd. to be increased by 2%.

- The investment in Oil & Natural Gas Corp. will be reduced.

In the global long-only equity portfolio, Jefferies plans to make the following changes:

- Zomato will be added by reducing investments in JD.com and Alibaba by 2 percent each.

3. India GDP Data:

India’s Gross Domestic Product (GDP) is anticipated to have grown by 5.1 percent in the final quarter of 2022-23, showing an improvement from the previous quarter’s growth rate of 4.4 percent. This estimate is based on the projections of 15 economists.

- Services Sector as Key Driver: The services sector is expected to have played a significant role in driving growth during January-March. S&P Global’s Purchasing Managers’ Index (PMI) for the services sector averaged 58.1 in the quarter, compared to 56.8 in the October-December period and 53.6 in January-March 2022.

- Strong Net Services Exports: India’s net services exports reached $41 billion in January-March 2023, marking a growth of 6.1 percent compared to the previous quarter and a substantial 45.1 percent increase from January-March 2022.

- Recovery in Private Consumption: On the expenditure side, private final consumption expenditure is expected to recover after a slump in October-December. During that period, it only saw a modest increase of 2.1 percent, compared to a growth rate of 8.8 percent in July-September.

- Implications for Full-Year GDP Estimate: A growth rate of 5.1 percent in January-March would align with the statistics ministry’s second advance estimate of 7 percent for the full year’s GDP. However, there is growing optimism among authorities that the 2022-23 growth number could surpass expectations.

- Upbeat Outlook: Speaking at the Confederation of Indian Industry’s Annual Session, Reserve Bank of India (RBI) Governor Shaktikanta Das expressed his belief that GDP growth could exceed 7 percent in 2022-23. Other experts also share this positive sentiment, suggesting a better outcome than previously forecasted.

- Easing Inflation Concerns: Inflation concerns have eased significantly over the past two months. Recent data revealed a decline in the Consumer Price Index (CPI) inflation to 5.66 percent in March, followed by an 18-month low of 4.66 percent in April.

Below are the estimates of various marque economists:

| Institution | Q4FY23 GDP Estimates |

| State Bank of India | 5.45% |

| Barclays | 5.40% |

| IndusInd Bank | 5.40% |

| QuantEco Research | 5.30% |

| Emkay Global Financial Services | 5.10% |

| IDFC First Bank | 5.10% |

| Standard Chartered Bank | 5.10% |

| YES Bank | 5.10% |

| Deutsche Bank | 5.00% |

| Kotak Mahindra Bank | 4.95% |

| HDFC Bank | 4.90% |

| ICRA | 4.90% |

| L&T Financial Services | 4.90% |

| DBS Bank | 4.80% |

| Societe Generale | 4.40% |

Source: Moneycontrol, Fisdom Research

4. Favourable Monsoon:

- The India Meteorological Department predicts that rainfall during the June-September season will be around 96 percent of the long-term average.

- Indian agriculture is heavily dependent on monsoon rainfall, which plays a critical role in sustaining farming activities. Approximately 56% of the net cultivated area relies on rainfall, making it a crucial water source for agricultural production.

- The significance of monsoon rainfall becomes evident in its contribution to food production. Rain-fed farming accounts for approximately 44% of the total food production in India. Adequate rainfall is crucial for ensuring robust crop growth and yield.

- Normal monsoon rainfall is instrumental in maintaining stable food prices, particularly for vegetables. A successful monsoon season resulting in ample crop production helps prevent significant price fluctuations in the market, ensuring affordability and availability of essential food items.

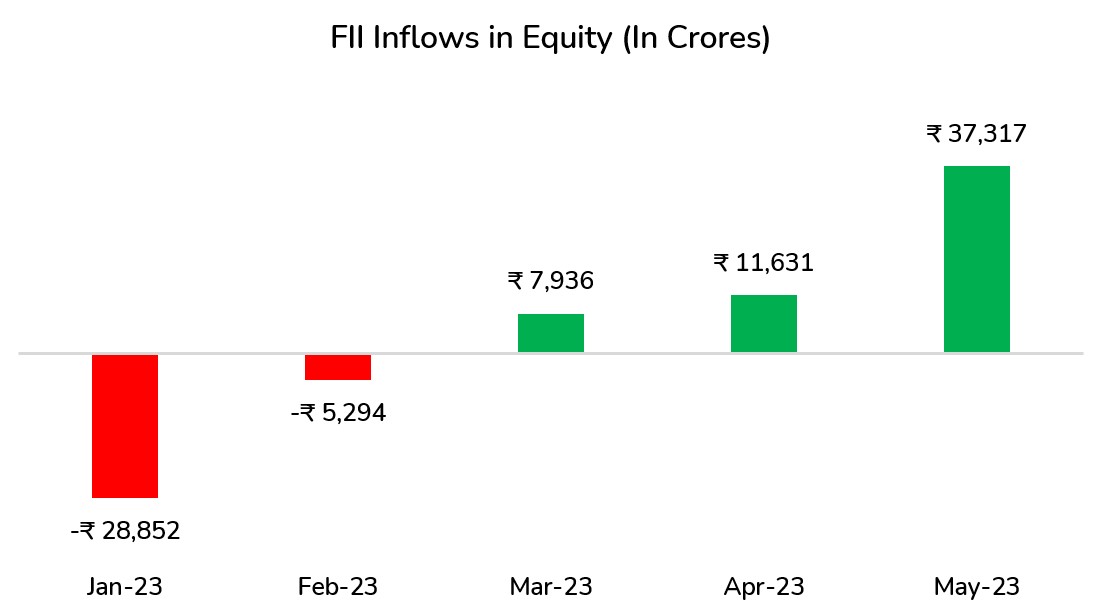

5. FPI Buying Continues:

Encouraging corporate results, positive macro indicators, and improved global-risk sentiment have led to heightened buying activity by foreign portfolio investors (FPIs), marking the strongest inflow in nine months.

- FPIs have been net buyers of equities worth ₹37,317 crore this month, the highest since August of the previous year. FPIs turned buyers in March amid moderating valuations post being net sellers during the first two months of the calendar year 2023.

- The Indian markets experienced a correction of nearly 10 percent between December and March. The ongoing FPI buying is driven by the belief that rate hikes by the US Federal Reserve have reached their peak.

Source: ACEMF, Fisdom Research. Data as on 26th May 2023

Conclusion: The Indian stock market has witnessed notable gains in May, with the Sensex and Nifty rising by 2.3 percent, accompanied by impressive growth in the BSE MidCap and SmallCap indices. This market rally can be attributed to several key factors. Firstly, positive global factors, including the strong performance of chipmakers in the US and Europe and progress in US debt ceiling negotiations, have boosted investor sentiment. Additionally, Jefferies’ optimistic forecast and portfolio adjustments have contributed to the market’s positive momentum. The GDP growth estimate for the final quarter of 2022-23 suggests an improvement, with the services sector and net services exports playing a vital role in driving growth. Furthermore, there is growing optimism among experts that the full-year GDP estimate could surpass expectations. The easing of inflation concerns and the anticipation of a favorable monsoon season further support positive market sentiment. Lastly, foreign portfolio investors continue to show strong buying activity, driven by encouraging corporate results and improved global-risk sentiment. Overall, these factors combine to create an optimistic outlook for the Indian economy and stock market.

Markets this week

| 22nd May 2023 (Open) | 26th May 2023 (Close) | %Change | |

| Nifty 50 | 18,201 | 18,499 | +1.6% |

| Sensex | 61,580 | 60,502 | +1.5% |

Source: BSE and NSE

- Markets witnessed ended on a positive note.

- The market rebounds, reaching a five-month high despite global volatility surrounding US debt ceiling discussions.

- Support from institutional shareholders, positive earnings, and anticipation of a normal monsoon contribute to the rally.

- All sectoral indices close in positive territory: Nifty Metal gains 5.6%, Pharma rises 4%, Nifty Media sees a 3.8% increase, Nifty Healthcare and Nifty Information Technology both add 3.7%.

- Foreign institutional investors (FIIs) buy equities worth Rs 3,230.49 crore, while domestic institutional investors (DIIs) purchase equities worth Rs 3,482.21 crore during the week.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Adani Enterprises | ▲ +30.1% | HDFC Ltd | ▼ -2.23% |

| Divi’s Lab | ▲ +13.42% | HDFC Bank | ▼ -1.89% |

| ITC Ltd | ▲ +5.66% | Grasim Ind | ▼ -1.62% |

| Adani Ports & SEZ | ▲ +5.63% | TATA Motors | ▼ -1.24% |

| Sun Pharma | ▲ +4.76% | ONGC | ▼ -0.70% |

Source: BSE

Stocks that made the news this week:

- Reliance Industries (RIL) made an announcement regarding Reliance Consumer Products (RCPL), a wholly-owned subsidiary of Reliance Retail Ventures (RRVL) and its FMCG arm. RCPL successfully concluded the acquisition of a 51% controlling stake in Lotus Chocolate Company. This acquisition was executed with a total consideration of Rs. 74 crore. Additionally, RCPL also invested in non-cumulative redeemable preference shares of Lotus Chocolate Company, amounting to Rs. 25 crore.

- Grasim Industries recorded a substantial decline in net profit for the fourth quarter, reaching Rs 93.5 crore. This figure represents 88.5 percent decline compared to the year-ago period, when the net profit stood at Rs 814 crore. Furthermore, the reported net profit fell significantly below the estimate of Rs 329 crore predicted by CNBC-TV18. The diminished profitability can be primarily attributed to a high base effect caused by a tax write-back in the year-ago period, as well as a softening of realizations in the chemicals business.

- The Life Insurance Corporation of India (LIC) has identified profitable growth as its primary objective. In line with this objective, LIC intends to cultivate a portfolio of high-margin products that will be actively promoted. By focusing on products with favorable profit margins, LIC aims to sustain its growth trajectory and enhance its financial performance. This strategic approach underscores LIC’s commitment to maximizing profitability while meeting the evolving insurance needs of its customers.