Hot Stuff this week: Two-wheeler volumes on recovery path

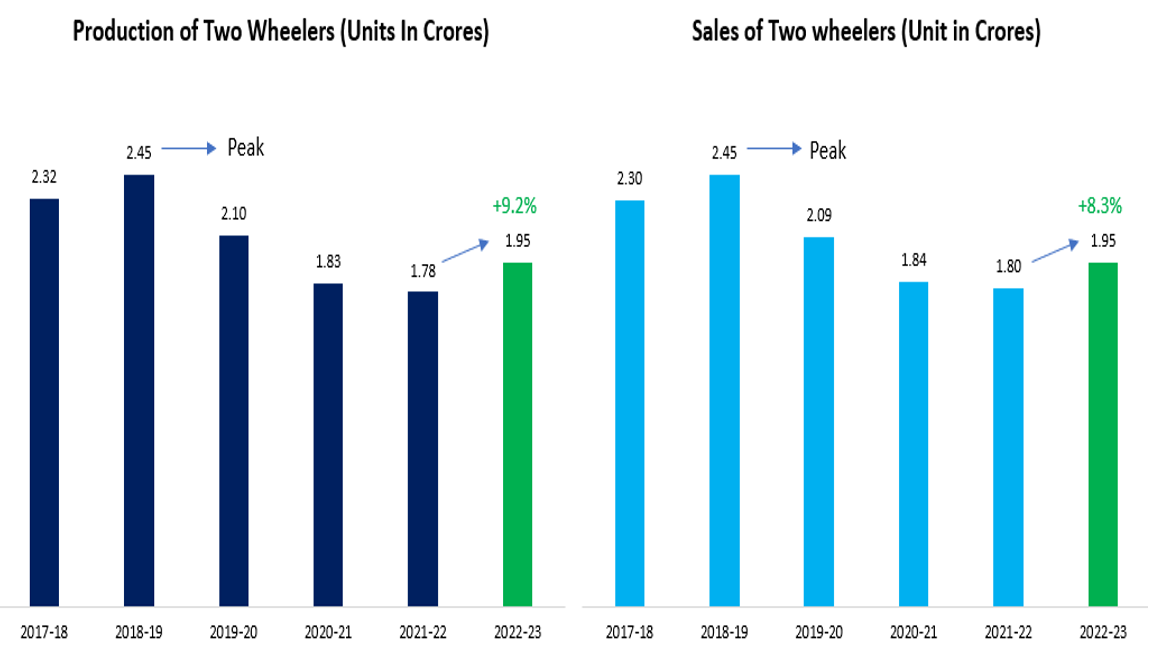

In FY2022-23, production of two wheelers rose by an impressive 9.2%. This is a welcome development after experiencing a decline in production for three consecutive years. Specifically, production fell by 14.2% in 2019-20, followed by a 12.8% decrease in 2020-21, and a 2.9% drop in 2021-22.

Similarly, the sale of two wheelers in 2022-23 saw a handsome increase of 8.3%. However, it is important to note that between 2018-19 and 2021-22, the sale of two wheelers contracted significantly by 26.4%. Therefore, despite the increase in sales in 2022-23, the sector is yet to recover fully from the three-year contraction.

Source: SIAM, Fisdom Research

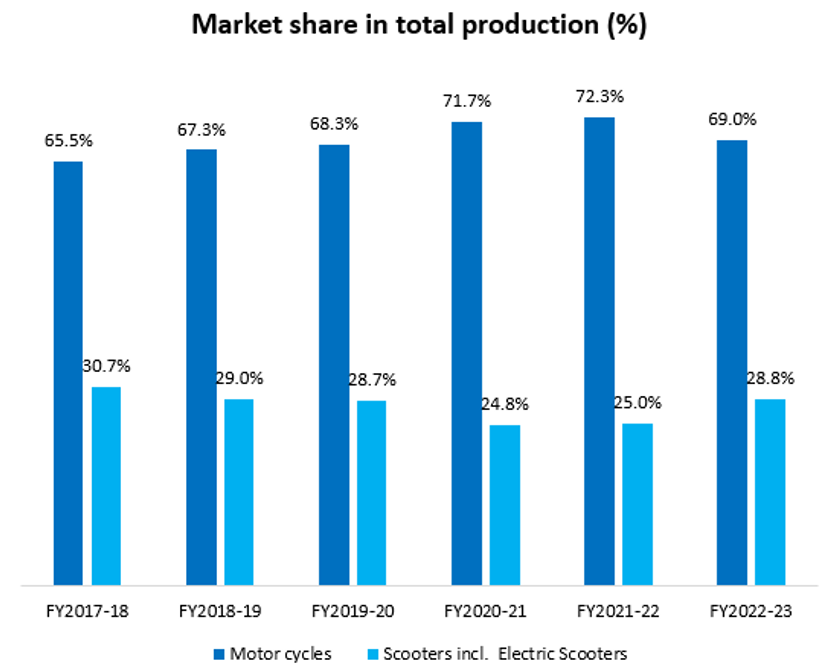

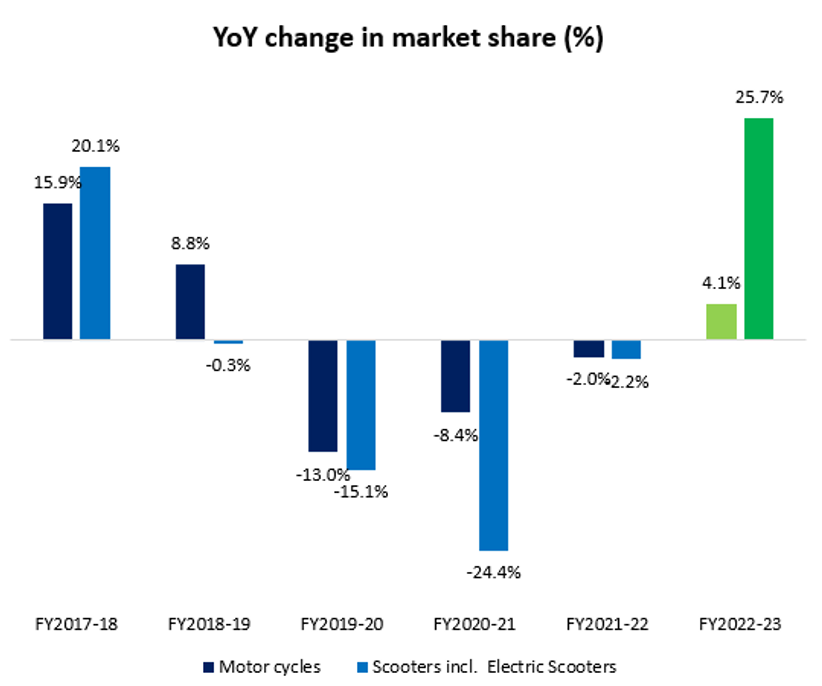

The two-wheeler market has witnessed a substantial surge in sales and production, largely propelled by scooters, which have experienced a remarkable increase of 25.6% and 25.7% in sales and production, respectively. Although scooters account for only 29% of the overall production of two-wheelers, their robust growth has been the driving force behind the industry’s upward trend.

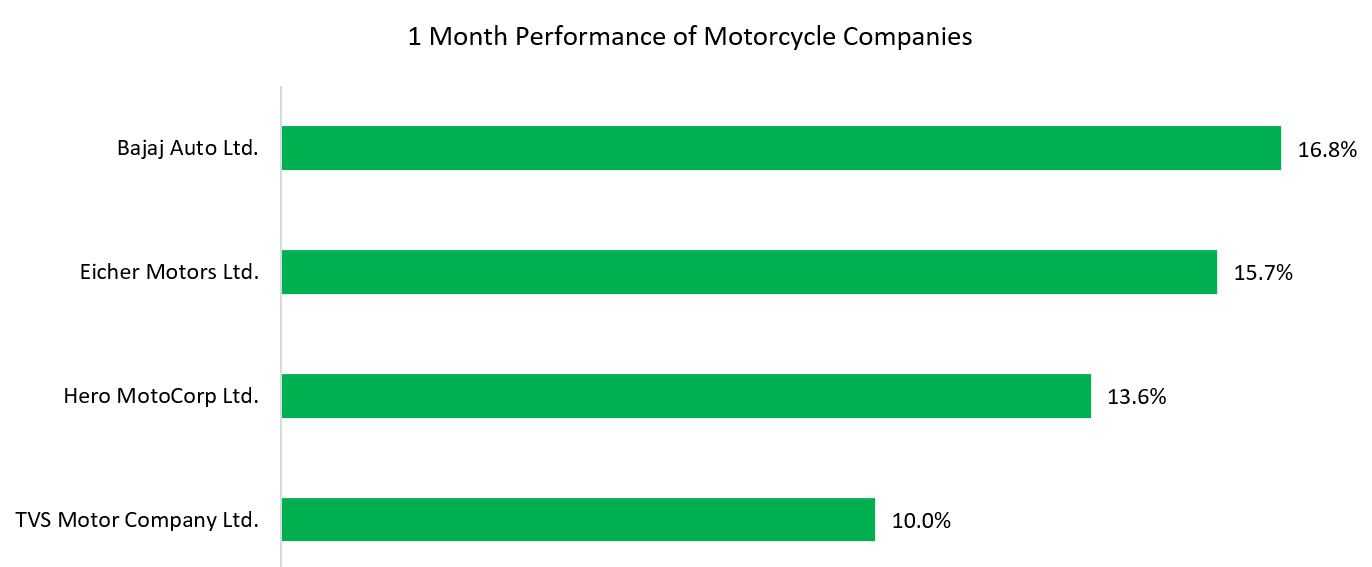

In contrast, the production of motorcycles, which are a significant component of the two-wheeler market, has grown by a relatively modest 4.1% during the 2022-23 period.

Source: CMIE, Fisdom Research

How are key two wheeler players placed?

Source: Autocarpro, ET, Fisdom Research

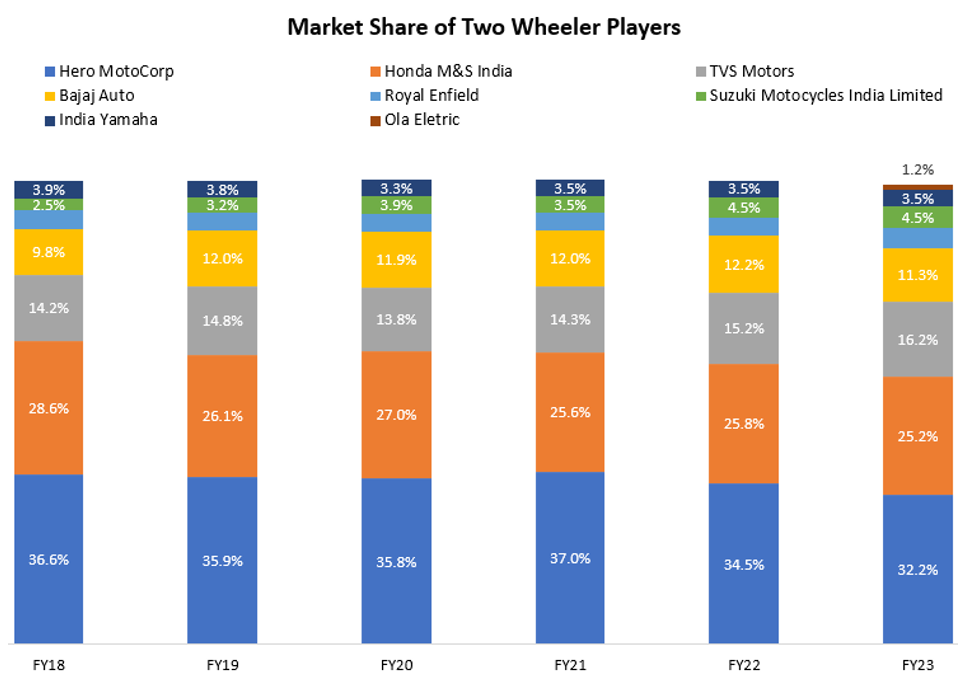

An analysis of the two-wheeler industry sales from the last six fiscal years, including FY2023, has revealed some interesting insights. The four key two wheeler players, HMSI, TVS Motor Co, Hero MotoCorp, and Bajaj Auto, with sales in seven figures, dominate the market with a massive 85% share.

While these companies are traditional internal combustion engine (ICE) players, three of them have diversified into electric vehicles (EVs), with Honda planning to follow suit in the future.

The next three players, Royal Enfield, Suzuki, and Yamaha, account for 12.5% of sales, leaving the remaining market to seven smaller players. TVS Motor Co has been successful in increasing its industry share from 15.2% in FY2022 to 16.2% in FY2023, due to its impressive performance in the scooter market. Moreover, the company has made gains in motorcycle market share as well.

Another player that falls under midsize motorcycle category Royal Enfield, has achieved considerable market share gains by catering to the surging demand for midsize motorcycles segment within India. The company’s eight-model portfolio and 25 variants, with engine capacity ranging from 346cc to 648cc, has enabled it to capitalize on consumers’ growing interest in more powerful models.

Here are some of the key factors impacting the growth in two wheeler industry:

- The auto industry is set to experience an upswing in the coming months, specifically in the April-June quarter of the 2023-24 fiscal year. This is expected to be driven by several factors, including improving rural sentiment, rising income levels, and the start of the marriage season.

- Additionally, the India Meteorological Department’s recent update has indicated a weakening threat of El Niño, which is good news for players such as Hero MotoCorp. Hero has a dominant position in the entry-level segment and derives a significant portion of its revenue from rural markets, so this development is particularly positive for the company.

- Furthermore, the auto industry is expected to see steady volume growth across segments in FY24, thanks to a healthy agricultural output in the rabi season and an expected uptick in the rural economy. This sentiment is further bolstered by the IMD’s recent prediction of “normal” rainfall during the southwest monsoon season, despite the possibility of El Niño conditions.

- Against this backdrop, TVS Motor’s increasing share in the electric two-wheeler market and high exposure to growth categories of premium motorcycles, scooters, and exports are affirmative factors that should enable the company to ride the strong recovery wave already underway in the two-wheeler industry.

- This wave is underpinned by a lower base, a revival in rural demand, a strong replacement cycle, lower inventory, and stable ownership costs.

Emphasis on EV

- India has set its sights on achieving 100% electrification by 2030, and the government is taking steps to achieve this goal by shifting towards cleaner transportation and personal mobility. This shift is opening up opportunities for both traditional companies and startups in the electric vehicle space.

- Traditional two wheeler players like Mahindra Electric and Hero Motocorp Ltd. are making rapid strides in this sector, increasing their presence in the electric vehicle market. Meanwhile, startups like Ola Electric, Okinawa Autotech, and Ather Energy are also making a significant impact. These new-age companies have demonstrated impressive sales growth over the years, positioning themselves as key players in the electric vehicle industry.

- As the Indian government continues to incentivize electric vehicle adoption and increase the infrastructure necessary for charging and other support systems, the growth potential for companies in this space is enormous. With the collective efforts of traditional and new-age players, India’s vision for 100% electrification by 2030 could become a reality.

In conclusion:

The two-wheeler industry in India has begun to show signs of recovery, although it is still premature to rejoice. Having endured one of the most severe economic downturns in recent times, the industry has now reported double-digit growth in FY23. However, there are early indications of a strong production upcycle amid favourable domestic demand.

Source: ACEMF, Data as on 28th April 2023

Markets this week

| 24th April 2023 (Open) | 29th April 2023 (Close) | %Change | |

| Nifty 50 | 17,707 | 18,065 | 2.0% |

| Sensex | 59,874 | 61,112 | 2.1% |

Source: BSE and NSE

- Markets witnessed ended on a positive note.

- The Indian market rebounded from previous week losses, recording a 2.5% gain for the week ending April 28th.

- The equity market showed strength due to the support of Foreign Institutional Investors (FIIs), better-than-expected corporate earnings, and falling crude oil prices.

- All the sectoral indices ended in the green, with Nifty PSU Bank index adding 7.3%, Realty up 5%, Infra index up 3.6%, and Information Technology up 3.3%.

- In the week ended April 28th, FIIs purchased equities worth Rs 5,395.13 crore and domestic institutional investors (DIIs) purchased equities worth Rs 1,874.25 crore.

- In the month of April, FIIs bought equities worth Rs 5,711.80 crore and DIIs bought equities worth Rs 2,216.57 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| TATA Consumer Products | ▲ +9.06% | HUL | ▼ -1.63% |

| Adani Enterprises | ▲ +6.76% | Cipla | ▼ -0.76% |

| L&T | ▲ +6.74% | Axis Bank | ▼ -0.49% |

| SBI | ▲ +6.47% | ONGC | ▼ -0.41% |

| Nestle India | ▲ +6.17% | Sun Pharma | ▼ -0.18% |

Source: BSE

Stocks that made the news this week:

- Wipro has approved a share buyback plan of up to Rs 12,000 crore. The buyback will be conducted through a tender offer route, with a share price of Rs 445 per equity share on a proportionate basis. The company aims to buyback up to 26.96 crore equity shares, which represents 4.91% of its total paid-up equity shares. It is worth noting that members of the promoter and promoter group have expressed their interest in participating in the proposed buyback.

- Nestle India surpassed analysts’ expectations with its first quarter results for CY2023, reporting a net profit of Rs 736 crore, beating the estimated figure of Rs 674 crore. The revenue from operations for the March quarter saw a substantial increase of 21.3% YoY, reaching Rs 4,830 crore. This was the highest revenue growth rate observed by the company in the past ten years, marking a significant achievement for Nestle India.

- Larsen & Toubro Ltd (L&T) shares reached an all-time high, during the week. The company is set to release its March quarter earnings on May 10, and analysts are optimistic about strong order inflows and efficient execution during the quarter. Jefferies, a brokerage firm, predicts that in FY24, L&T will receive backing from both the Middle East and India’s private sector capital expenditure. This follows the announcement of Rs 25,800 crore worth of orders for the quarter ending in March. L&T is expected to meet or even surpass the upper limit of its year-on-year order flow guidance of 15% for FY23.