FY23 has been a rollercoaster ride for Indian equity markets, leaving even the most experienced investors on the edge of their seats. The market has been volatile, with a record-breaking bull run followed by a sudden downturn, keeping investors alert. The year began with the economy started recovering from the pandemic-induced slowdown. However, fear of new variants, supply chain disruptions due to the Russia-Ukraine crisis, and prolonged monetary tightening dampened market sentiment, leading to sell-offs in some sectors. This article will delve into the key events and trends that shaped Indian equity markets in FY23, along with crucial takeaways for investors.

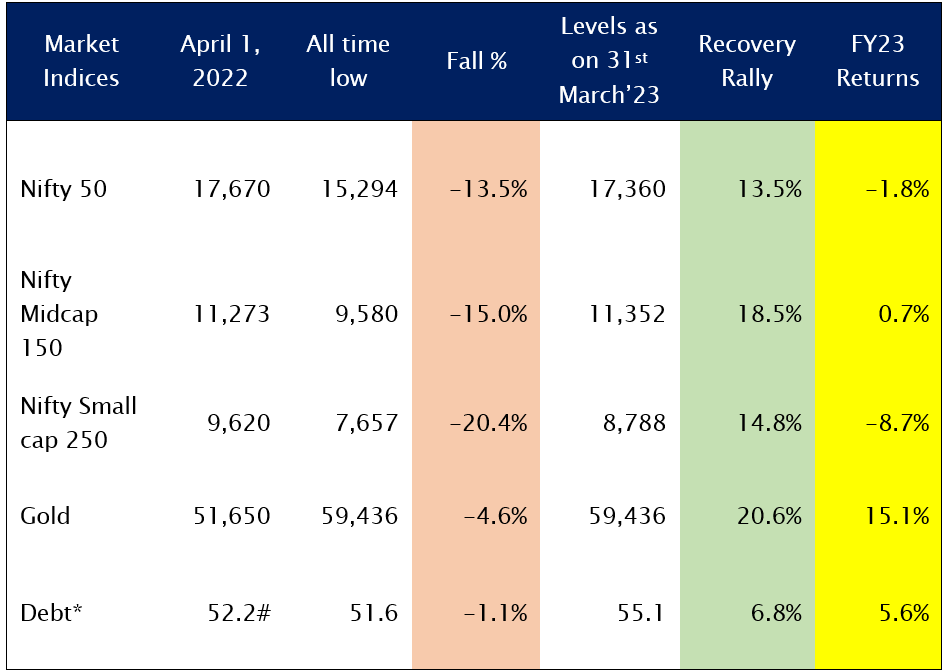

Here’s a recap of what happened to different asset classes:

Source: ACE MF, Fisdom Research. *For debt returns net asset values for SBI magnum gilt fund has been considered. #NAV of 04th April has been considered.

Key events that had an impact on the market are as follows:

- Russia-Ukraine War

- Covid-19 reopening.

- Quantitative tightening by global central banks

- Adani Fiasco

- Union Budget FY24

Despite the volatility in the equity markets, 40% of the BSE 500 companies have generated positive returns, with 6% of the companies delivering returns of over 50%

We have listed the top five stocks from BSE 500 universe for FY23:

| Stock Name | % Returns – FY23* | Market Cap | Count of MF schemes invested |

| Mazagon Dock Shipbuilders Ltd. | 163.9 | Mid Cap | 12 |

| Varun Beverages Ltd. | 121.6 | Large Cap | 77 |

| Finolex Cables Ltd. | 105.9 | Mid Cap | 32 |

| Rail Vikas Nigam Ltd. | 105.7 | Mid Cap | 12 |

| UCO Bank | 100.8 | Mid Cap | 11 |

Source: ACE MF. *Data as on 29th Mar 2023

Lessons learned and their relevance today

I. How asset allocation beats market timing: A winning investment strategy

| Asset | Scenario I | Scenario II | Scenario III | Scenario IV | Scenario V |

| Nifty 50 | 10% | 30% | 50% | 70% | 90% |

| Gold | 30% | 20% | 20% | 10% | 5% |

| Debt* | 60% | 50% | 30% | 20% | 5% |

| Returns FY23 | 7.7% | 5.3% | 3.8% | 1.4% | -0.5% |

| O/s over Nifty | 9.5% | 7.1% | 5.6% | 3.2% | 1.3% |

Source: ACE MF, Fisdom Research. *For debt returns net asset values for SBI magnum gilt fund has been considered. #NAV of 04th April has been considered.

Investors should learn from FY23 that diversifying their assets across various asset classes based on their risk profile is crucial. Those who followed this approach were the main beneficiaries and emerged as winners.

II. Advisor/consultant Jaruri Hai

The fiscal year 2023 has emphasized the importance of seeking guidance from advisors or consultants, especially given that only 40% of stocks performed well and many of us may have missed out on those opportunities. At Fisdom, our “Analyst View” feature has been helpful in guiding investors to make informed investment decisions.

As we enter fiscal year 2024, there are two approaches that investors should consider:

Seek advice from an advisor/consultant team before making any investment decisions, particularly in an expected volatile environment.

Consider investing in top-performing mutual funds to avoid missing out on opportunities, like which were there in FY23.

Write to “research@fisdom.com” explaining the situation and we will be glad to offer assistance.

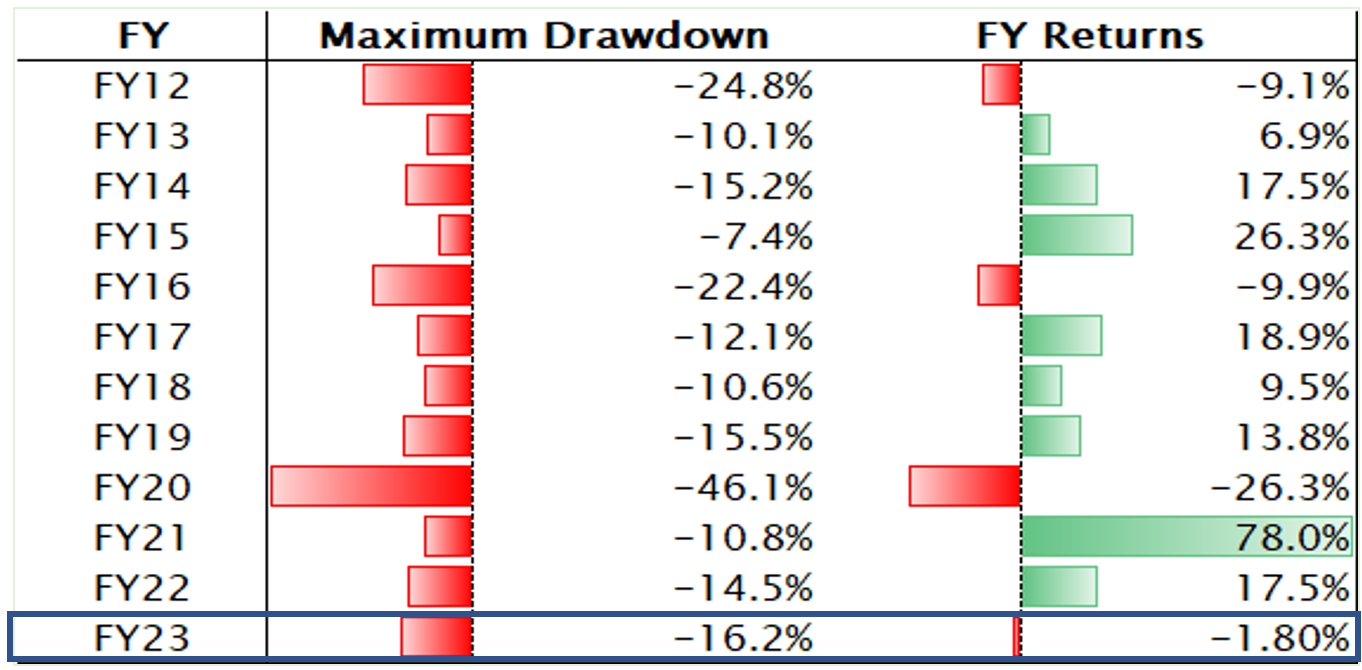

III. Drawdowns in equity markets: even bull markets experience them

Source: ACE MF, Fisdom Research. Returns are absolute.

- Despite experiencing drawdowns in every financial year since FY12, Nifty has delivered positive returns at the end of most financial years. This highlights the importance of staying invested for the long term despite short-term market fluctuations.

- After every period of negative returns, the market has historically delivered strong returns. This highlights the importance of avoiding emotional decisions based on short-term market fluctuations and staying invested to capture long-term returns.

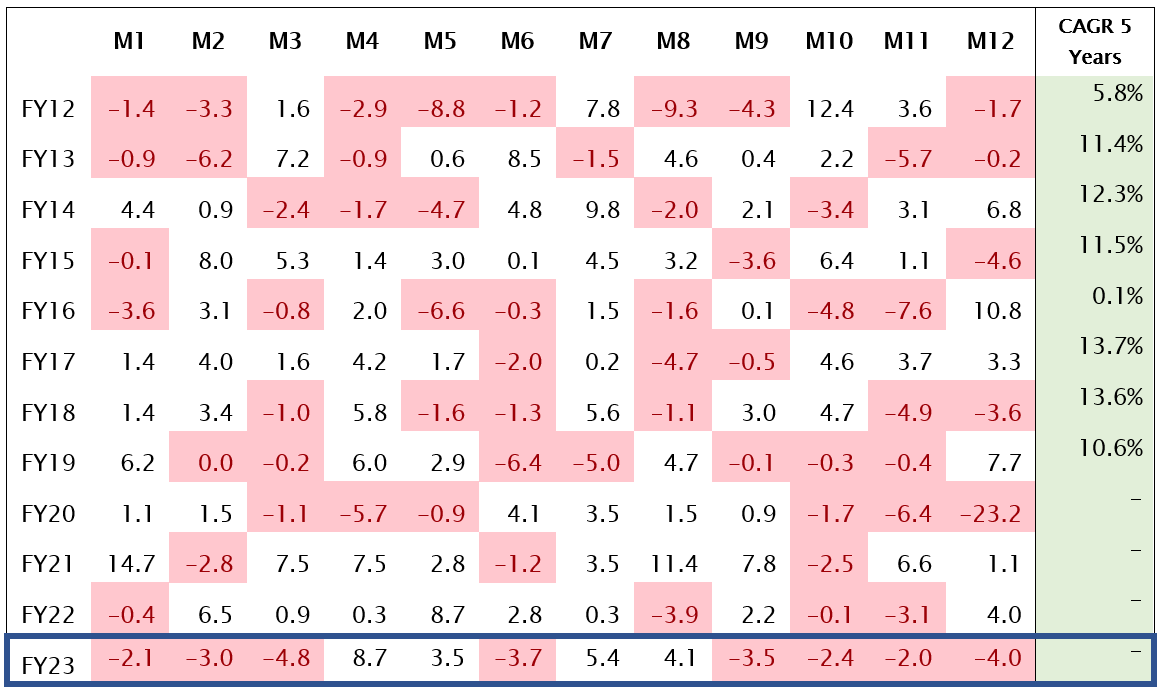

IV. Monthly Performance: Nifty 50

Source: ACE MF, Fisdom Research. M1 starts from April till M12 which is March. Returns are absolute.

How to read this: An investor who had done a lumpsum investment on the first working day April 2011 has got 5.8% CAGR in next five years.

- In FY23, the market saw a monthly decline for the fourth consecutive month, but it remained below 5%. This is the first time since FY01 that the market has seen a fall for four consecutive months.

- Despite the recent volatility, a longer-term analysis of the market’s behavior over the past 20+ fiscal years shows that the current fluctuations are not unprecedented.

- It is worth noting that the market has delivered returns that have outpaced inflation in most fiscal years over the long term.

The key takeaway for FY24 is that drawdowns are a normal part of equity markets and should be expected. Investors who remain disciplined and stay invested for the long term are likely to achieve better results than those who panic and make emotional decisions based on short-term market fluctuation.

Factors supporting the belief that markets will deliver strong returns in the long term

Despite ongoing market volatility, we maintain our belief in the fundamental strength of the country over the long term.

| Description: The FY23 India Events |

| Outcome: India is widely recognized as a global growth engine. |

| • India remains fifth largest fastest growing economy |

| • India’ forex reserves stand strong vs broader EM pack |

| • GST collections remain above Rs.1.4tn |

| • Domestic institutional investors remain net buyers |

| • India’s external debt is relatively better compared to other countries |

| • Manufacturing & Services PMI remains in expansionary zone |

| • India’s core 8 industries growth stayed above pre-pandemic average |

| • An all-time high capex in FY23, which is essential for growth of the economy |

| • Strong SIP Flows |

So, what strategy could an investor in FY24 adopt considering recent learnings?

Time the market? – Regular readers will already know the answer to this one. A bug Two-lettered NO.

Portfolio Rebalance? Yes.

Rebalancing portfolio asset exposure at right/relevant times (after conversing with advisor, if necessary) could have helped investors arrest losses in the downside and amplify returns on the upside.

Overall, the key takeaway is that investors should focus on a long-term investment strategy that includes a diversified portfolio, regular rebalancing, and avoiding emotional decisions based on short-term market fluctuations. By staying disciplined and following a sound investment plan, investors can achieve their financial goals over time.

While past performance is not a guarantee of future results, investors can learn from past mistakes and avoid making similar errors. By remaining calm during drawdowns and maintaining a long-term investment strategy, investors can potentially achieve better results.

Happy Weekend!

Markets this week

| 27th March 2023 (Open) | 31st March 2023 (Close) | %Change | |

| Nifty 50 | 16,984 | 17,360 | 2.20% |

| Sensex | 57,567 | 58,992 | 2.50% |

Source: BSE and NSE

- Markets witnessed ended on a positive note.

- Indian markets witnessed a gain over the past weeks, driven by an increase in Reliance Industries Ltd and banking and IT stocks. Investors are eagerly anticipating the release of the Reserve Bank of India’s (RBI) bimonthly monetary policy.

- According to the latest reports, several economists predict that India’s current account will improve in fiscal year 2024, primarily due to a narrowing trade deficit as commodity prices, especially oil, decrease.

- The RBI Bulletin for March, released during the week, is optimistic about India’s growth, indicating that the current projections for the country’s GDP growth in FY24, which range between 6 and 6.5 percent, may be surpassed.

- Foreign institutional investors (FIIs) became net buyers this week, purchasing equities worth Rs 2,243.74 crore. This coincided with domestic institutional investors (DIIs) buying equities worth Rs 4,955.78 crore. In March, FIIs bought equities worth Rs 1,997.70 crore, and DIIs purchased equities worth a staggering Rs 30,548.77 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Reliance Ind | ▲ +5.80% | Bharti Airtel | ▼ -1.76% |

| IndusInd Bank | ▲ +5.78% | Asian Paints | ▼ -1.32% |

| JSW Steel | ▲ +4.61% | SBI Life Insurance | ▼ -1.00% |

| Hindalco Ind | ▲ +4.36% | Adani Ports & SEZ | ▼ -0.96% |

| Nestle | ▲ +3.96% | Bajaj Finance | ▼ -0.58% |

Source: BSE

Stocks that made the news this week:

?Reliance Industries Ltd (RIL), recently experienced a surge during the week. This rise in Reliance shares can be attributed to the National Company Law Tribunal’s (NCLT) approval of the demerger of RIL and the new non-banking financial company (NBFC), which is expected to be rebranded as Jio Financial Services, in a 1:1 ratio after the takeover.

?Nestle SA is reportedly looking to acquire an Indian brand – Ching’s Secret. While the company has not yet disclosed its plans, this potential deal has the potential to significantly impact the local market. the global parent company’s acquisition bid for the brand could fetch close to $1 billion (over Rs 8,000 crore) for Capital Foods, which owns the Ching’s Secret brand. Since its inception in 1995, Ching’s Secret has played a crucial role in developing the Indian form of Chinese cuisine in the country’s ready-to-cook (RTC) category.

?Defence stocks took the centre stage in the Indian stock market, as several companies in this sector witnessed a significant surge in their share prices, owing to recent order wins. Over the past week, the Ministry of Defence (MoD) placed orders worth a staggering Rs 44,240 crore on local manufacturers, providing a much-needed boost to the entire domestic supply chain.