The banking system in the country is fast evolving and with the introduction of fintech and neobanks, the space is fast becoming more dynamic. The core banking system, therefore, focuses on meeting customer expectations in this post-pandemic dynamic global world through its various innovations and commitments by successive governments for ultimate financial inclusion. So what is the core banking system of India? Given here is the answer to this question and related details.

Read More: Your guide to Banking and PSU Debt fund

What is Core Banking System and how does it work?

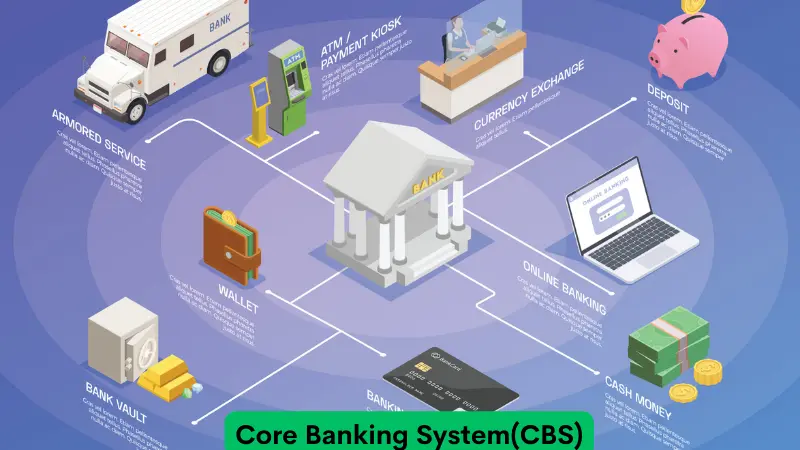

Core Banking System (CBS) is the banking solution that enables banks to provide centralized services to their customers from any of their branches. It revolutionalised the banking sector when it was conceptualized and implemented through the 1990s. Core Banking System is a technology-based solution that helps banks to manage their transactions and customer information effectively. It is also instrumental in providing real-time access to customer accounts and other modern banking services.

The RBI in India has mandated that all commercial banks implement the Core Banking System (CBS) where the transactions are processed electronically and the customer information is maintained in a centralized database that is accessible by all branches of the bank. This centralized banking system allows the banks to perform various functions like account opening, deposits, withdrawals, fund transfers, loan processing, and other banking services and allows customers to access their accounts and carry out banking transactions irrespective of the location of their home branch.

What are the components of the Core Banking System in India?

The Core Banking System in India is a form of comprehensive banking solution that allows banks to offer centralised banking services through various components. The key components in the Core Banking System include the

- Account management component responsible for the opening-closing and maintaining of customer accounts

- Deposit management component is responsible for the management of all types of deposit accounts offered by the bank

- Loan management component is responsible for the management of all types of loans offered by the bank.

- Customer relationship management component is responsible for the management of all customer-related information.

- General ledger management component is responsible for managing the financial transactions of the bank and its reconciliation.

- The payment and Settlement System component is responsible for managing all payments and settlements routed through the bank and received by the bank.

- Risk management component is responsible for managing the overall risk exposure of the bank

- Compliance management component that is responsible for successful compliance with all banking and legal regulations from time to time

- ATM management component is responsible for managing the ATM networks of the bank and its security-related issues.

What are the advantages of the Core Banking System?

The Core Banking System in India has brought numerous changes to the banking system that has multiple advantages. These advantages are highlighted hereunder.

Efficiency of operations

CBS has brought much-needed efficiency to banking operations through significant automation at various levels. The time taken for the execution of transactions has significantly reduced enabling enhanced customer experience.

Enhanced security

The technology-driven core banking system provides enhanced security for banking transactions as well as consumer data. This is instrumental in the transfer of huge volumes of funds between parties as well as countries in real-time at the same time protecting customers from data privacy issues.

Better integration and access for customers

Core Banking System allows customers to access their accounts in real-time on multiple devices through their single secure login. There is reduced human intervention resulting in lower errors and cases of fraud in the system.

Cost-effective banking operations

The automated banking process has reduced the burden of paperwork on the entire banking system as a whole. It has made the processes more cost-effective in terms of reduced operations costs, storage costs, transportation costs, and more.

What are the limitations of the Core Banking System?

The core banking system has become the basis of modern-day banking. However, there are a few limitations in CBS too. These limitations are highlighted below.

High initial investment cost

The Core Banking System requires banks and financial institutions to invest in significant assets like the infrastructure and the hardware and software needed for the successful implementation of the banking systems. Such initial investment costs can be quite high, especially for small or medium-sized banks, and can break them even before they get a chance to flourish.

Technical and cyber security risks

The security of the customer’s data is of paramount importance in a banking system. This data is often prone to cyber security breaches and other technical risks that can lead to damage or loss of customer data or key banking transactions.

Dependence on technology for connectivity

The basis of the Core Banking System is the use of technology for the integration of all the branches of the bank and to provide a seamless banking experience to the customers irrespective of their location. Therefore, CBS has a huge reliance on technology, and any minor or major disruption in the system can lead to a delay in the transfer of funds or in extreme cases, loss of funds or the relevant data.

Constant updation to technological advancements

Users of CBS need to constantly adapt to the changing technical scenario in the banking sector. This can be quite challenging, especially for small and medium-sized banks as the high costs of technologies and the constant updation of their systems can eat into their profits.

Conclusion

The implementation of the core banking system in the country revolutionalised the banking sector and brought it to par with the global world. It has become an essential part of the banking industry in India, and it has helped banks to streamline their operations, reduce costs, and provide better customer service. With the increasing adaptation of fintech and new-age banking services, CBS is viewed to play a critical role and fulfill the needs of the average consumers.

FAQs

The biggest advantage of CBS in the country is streamlining the banking process and the integration of data from various branches into a single or centralised data system.

The basic features of the Core Banking System include loan processing, processing and recording deposits, managing customer information, managing payment systems, 24*7 access to the banking systems, managing internet banking, mobile banking facilities, etc.

The term core in core banking system refers to the Centralised online Real-Time Exchange.

The core banking system in India was introduced in 1980 by Deputy Governer of RBI Dr. C Rangrajan.