Mutual Fund Industry’s YoY Growth Remains Positive, MoM AUM Decline

Overall inflows remain positive; Net Average AUM above Rs. 40 tn

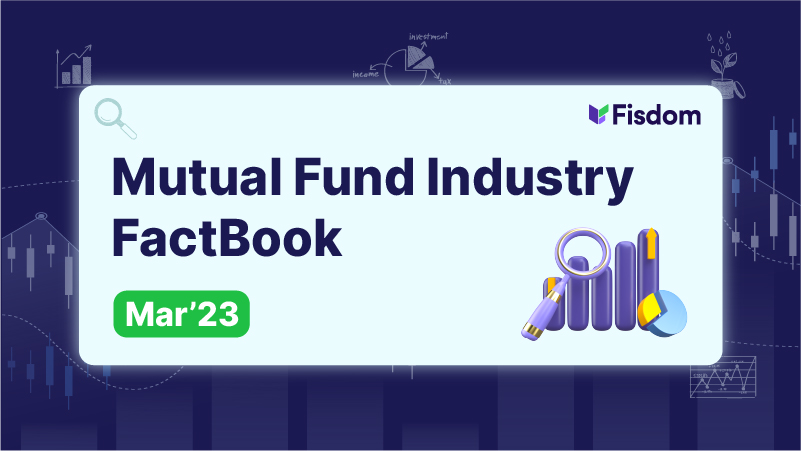

- Mutual Fund (MF) Industry Witnesses Modest MoM AUM Decline, YoY Growth Remains Positive. The MF industry in India saw a marginal decline in its assets under management (AUM) by 0.4 percent on a month-on-month (MoM) basis, according to recent data released by the Association of Mutual Funds in India (AMFI). However, on a year-on-year (YoY) basis, the AUM has increased by 5 percent. Notably, the average industry AUM has remained above Rs. 40 trillion.

- Despite the MoM AUM dip, the industry has witnessed positive overall inflows since October 2022. Equity market volatility and consistent outflows from debt categories were the primary reasons for the decline in AUM.

- The MF industry’s growth trajectory has been impressive, achieving several milestones in a short span of time. Strong retail participation, consistent Systematic Investment Plan (SIP) flows, and awareness campaigns about mutual funds by AMFI have been the key drivers behind this growth. In conclusion, while the MF industry faced a slight setback in its MoM AUM, its YoY growth remained positive. The industry’s continued efforts to educate and attract investors, coupled with strong retail participation, bode well for its future growth prospects.

Source: AMFI, Fisdom Research

Equity AUM Declines Amid Recent Market Downturn

Robust inflows into equity mutual funds amidst market volatility

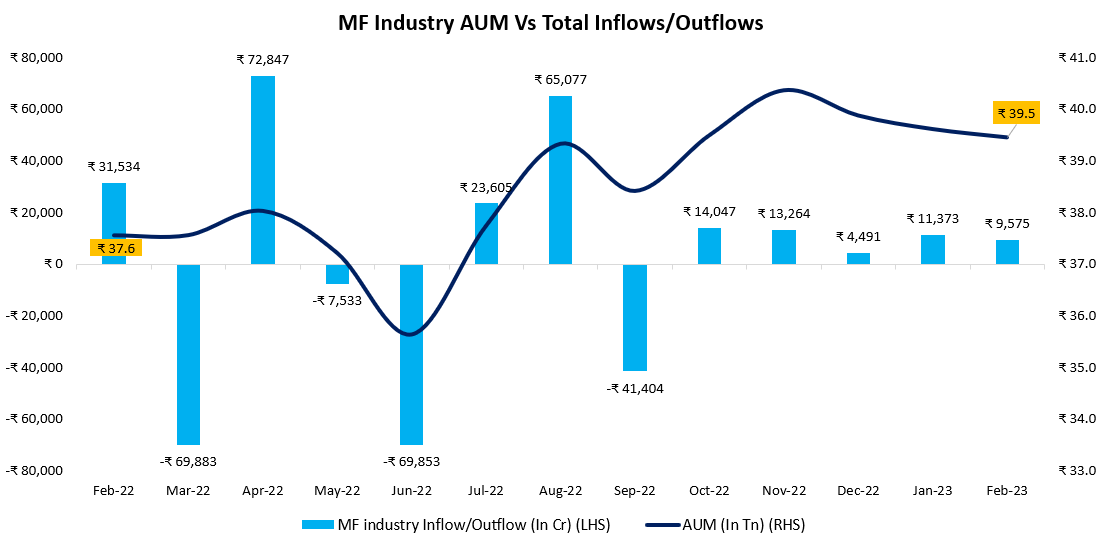

- The Nifty 50 has experienced a decline for seven months out of the past 13 months, and equity assets under management (AUM) have followed suit, declining for the past three months. Despite this decline, inflows in equity categories have remained robust, with strong inflows witnessed on a monthly basis, even amidst market volatility

- While the recent dip in the equity market can be attributed to various factors such as global market uncertainty, inflation concerns, investors seem to be undeterred by the market’s fluctuations and remain bullish on the long-term prospects of equity investments.

- while the Nifty 50 and equity AUM have experienced a decline in recent months, the strong inflows into equity categories are an indication that investors remain bullish on the long-term growth prospects of the Indian equity market

Source: AMFI, Fisdom Research

Debt Mutual Funds Witness AUM Decline in Feb’23

Debt mutual fund AUM declines as inflation concerns persist

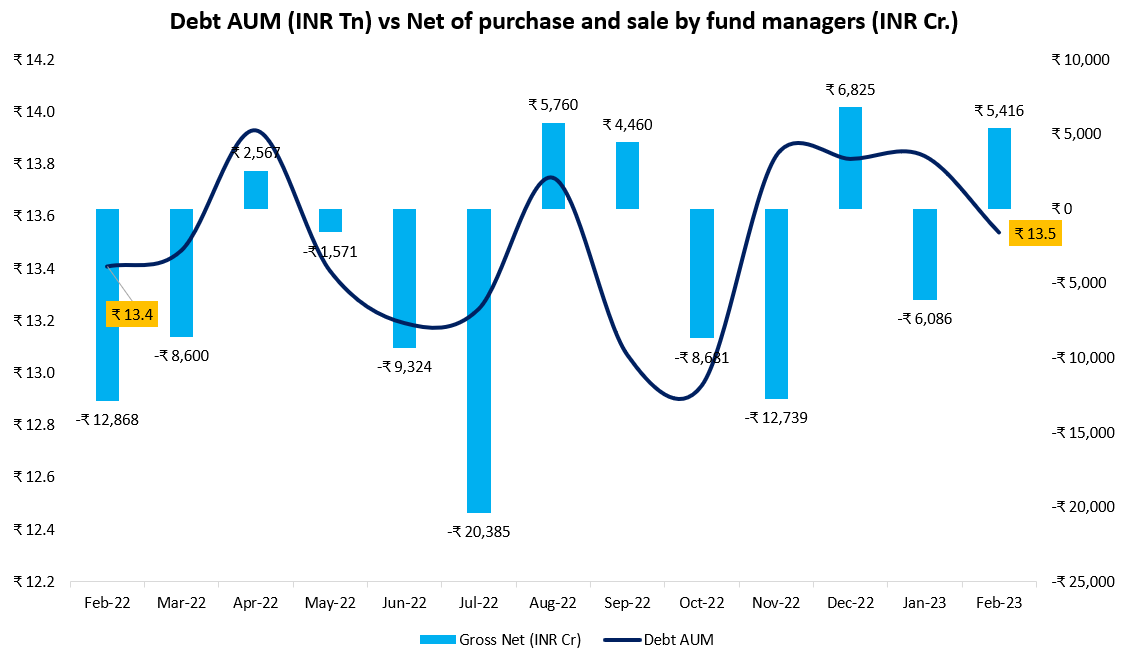

- Debt mutual funds have faced a challenging time in Feb’23, with a decline of 2.1 percent on a m-o-m basis in AUM. This decline can be attributed to consistent outflows and concerns around sticky inflation and rising interest rates.

- Despite the challenges, there is optimism that the category will see a reversal in the second half of CY23 as interest rate cycles are expected to peak, offering a good entry point for investors to lock in yields.

Source: AMFI, Fisdom Research