Mutual Fund Industry Asset Under Management

AUM crossed Rs.39 tn in Oct’22

Data point as on October every month

Chart: Fisdom Research • Source: NSE India • Created with Data wrapper

| Date | AUM (INR Tn) | Trillion Growth | Milestone | Years Taken |

| Oct-12 | ₹ 7.70 | |||

| Oct-13 | ₹ 8.30 | |||

| Oct-14 | ₹ 11.00 | ₹ 3.30 | Crossed Rs. 10 Trillion | 2 |

| Oct-15 | ₹ 13.20 | |||

| Oct-16 | ₹ 16.30 | |||

| Oct-17 | ₹ 21.40 | ₹ 10.50 | Crossed Rs. 20 Trillion | 3 |

| Oct-18 | ₹ 22.20 | |||

| Oct-19 | ₹ 26.30 | |||

| Oct-20 | ₹ 28.20 | ₹ 6.80 | Near Rs. 30 Trillion | 3 |

| Oct-21 | ₹ 37.30 | |||

| Oct-22 | ₹ 39.50 | ₹ 11.30 | About to reach Rs. 40 Trillion | 2 |

After 2012, AUM crossed 7 Trillion in two years, crossed 10 Trillion after that, and within the next three years, it crossed the milestone of 20 Trillion. Recently the AUM crossed 37 Trillion, and in Oct’22 recorded at ₹ 39.5 Trillion. It showed the clear up trend in the mutual fund industry. Consistent flow from retail participation was a vital determinant of a solid uptick in the AUM.

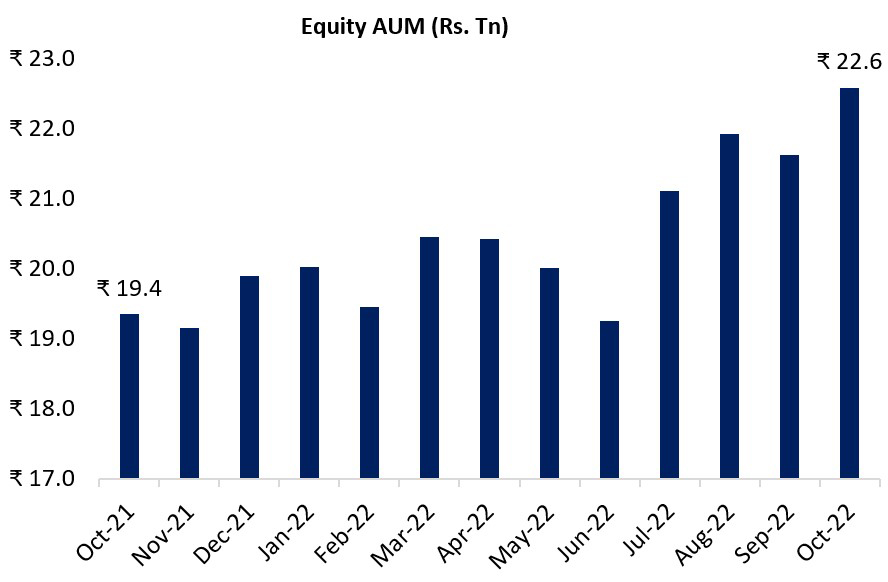

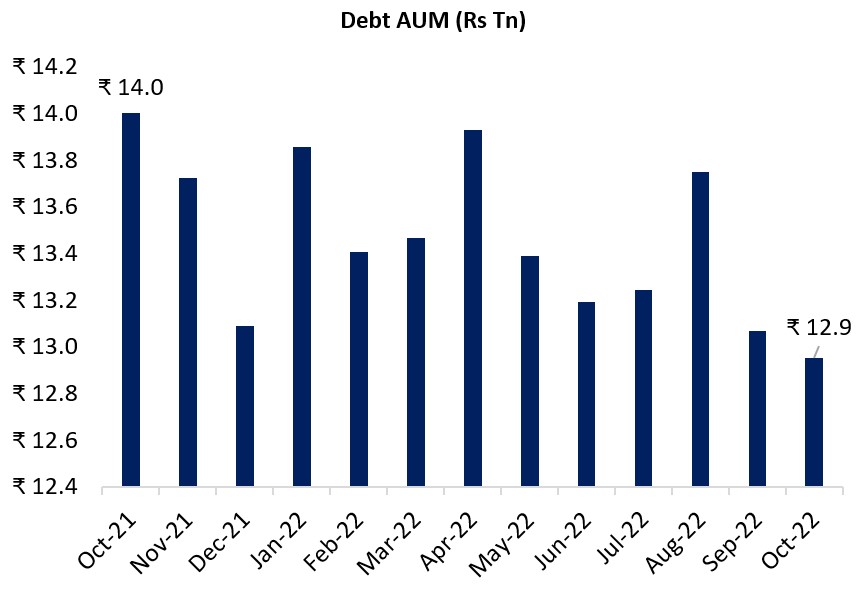

Equity & Debt Asset Under Management

After a decline for last few months equity AUM rose in October 2022

Source: ACE MF.

Source: ACE MF.

The equity AUM stood at ₹ 22.6 Trillion in Oct’2022. Strong macro fundamentals, proactive monetary & fiscal support and strong corporate balance sheets were a few key reasons behind the rise in equity AUM.

The Debt AUM stood at ₹ 12.9Trillion in Oct’2022. The uncertain interest rate environment & hawkish commentaries by global central banks impacted the flows.

Top 10 AMCs By Asset Under Management

SBI AMC remains at the top; UTI AMC seen highest month on month change amongst the top 10 AMCs

| AMC Name | AUM Rank | Total AUM In Sep’22 (Cr.) | Total AUM In Oct’22 (Cr.) | M-o-M% |

| UTI Asset Management Company Private Limited | 8 | ₹ 2,32,207 | ₹ 2,42,870 | 4.60% |

| DSP Investment Managers Private Limited | 10 | ₹ 1,11,511 | ₹ 1,16,419 | 4.40% |

| Kotak Mahindra Asset Management Company Limited | 5 | ₹ 2,77,296 | ₹ 2,88,269 | 4.00% |

| SBI Funds Management Limited | 1 | ₹ 6,85,098 | ₹ 7,12,173 | 4.00% |

| Nippon Life India Asset Management Limited | 4 | ₹ 2,80,282 | ₹ 2,91,204 | 3.90% |

| HDFC Asset Management Company Limited | 3 | ₹ 4,26,892 | ₹ 4,40,933 | 3.30% |

| Axis Asset Management Company Ltd. | 7 | ₹ 2,43,420 | ₹ 2,51,159 | 3.20% |

| ICICI Prudential Asset Management Company Limited | 2 | ₹ 4,91,067 | ₹ 5,05,771 | 3.00% |

| Aditya Birla Sun Life AMC Limited | 6 | ₹ 2,69,330 | ₹ 2,77,144 | 2.90% |

| IDFC Asset Management Company Limited | 9 | ₹ 1,16,200 | ₹ 1,18,837 | 2.30% |

Source: ACE MF