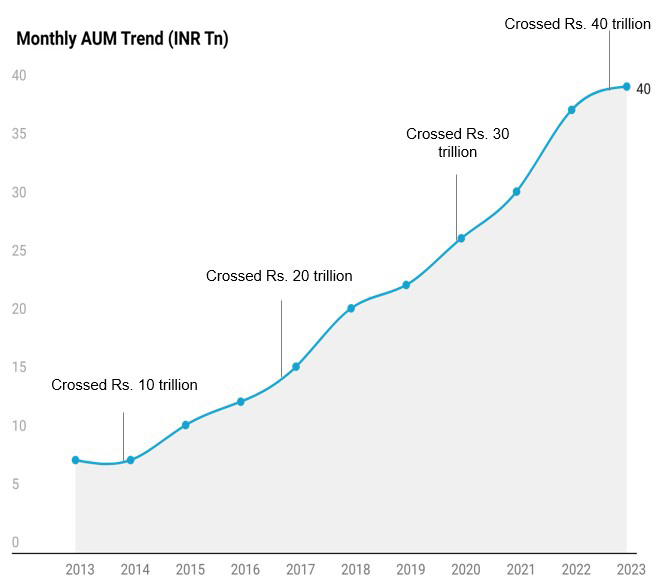

Mutual Fund Industry Asset Under Management

AUM crossed Rs. 40 Tn mark in CY22

Latest Data point as on December 2022

Chart: Fisdom Research • Source AMFI • Created with Datawrapper

| Date | AUM (INR Tn) | Trillion Growth | Years Taken | Milestone |

| Dec-12 Dec-13 |

₹ 8 | |||

| Dec-14 | ₹ 11 | ₹ 3 | 2 | Crossed Rs. 10 Trillion |

| Dec-15 Dec-16 |

₹ 13 ₹ 16 |

|||

| Dec-17 | ₹ 21 | ₹ 11 | 3 | Crossed Rs. 20 Trillion |

| Dec-18 Dec-19 |

₹ 23 ₹ 27 |

|||

| Dec-20 | ₹ 31 | ₹ 10 | 3 | Touched Rs. 30 Trillion |

| Dec-21 | ₹ 38 | |||

| Dec-22 | ₹ 40 | ₹ 9 | 2 | Crossed Rs. 40 Trillion |

- MF industry marked a new milestone. It crossed Rs. 40 Trillion AUM mark in CY’22 for the first time in history. AUM went up Rs.10 trillion in just two years compared to the average period of three years earlier.

- Multiple awareness campaigns about mutual funds by AMFI, strong retail participation, consistent SIP flows and a broad-based market rally were key drivers behind it.

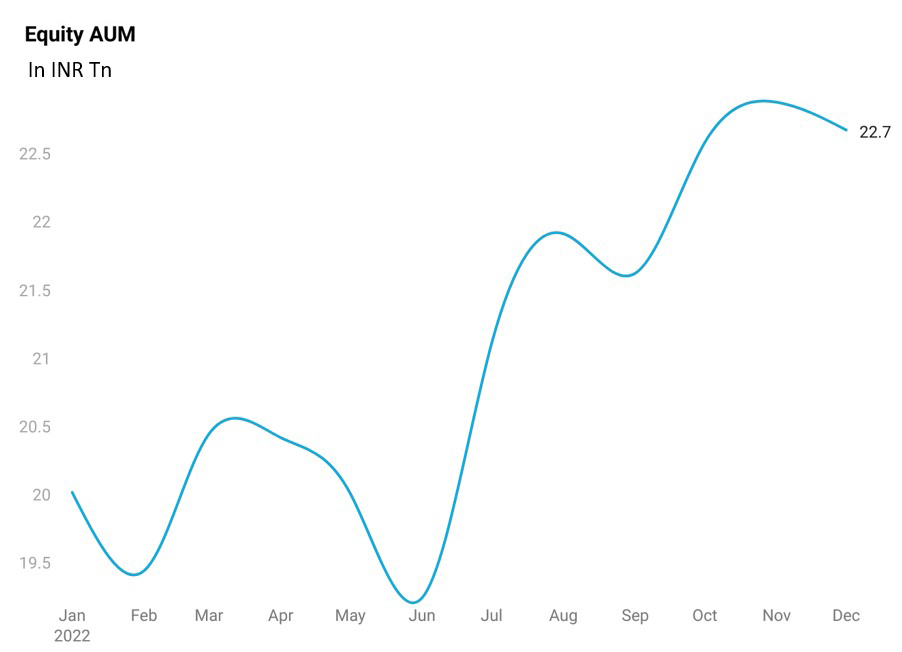

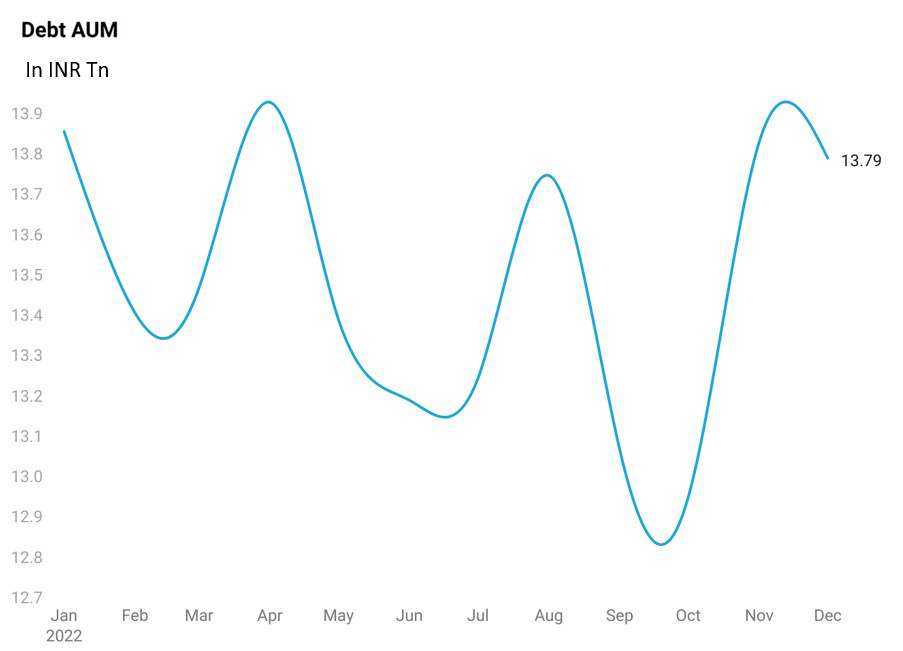

Equity & Debt Asset Under Management

Equity AUM saw modest decline; Debt AUM surges

Chart: Fisdom Research • Source AMFI, ACE MF • Created with Datawrapper

Chart: Fisdom Research • Source AMFI, ACE MF • Created with Datawrapper

- The equity AUM stood at Rs. 22.7 Trillion in Dec’2022, an increase of 14% YoY & modest decline of Rs. 0.2 trillion on a sequential basis. SIP inflows limit the overall outflow. Equity markets volatility & moderation in the pace of new fund offers were crucial reasons for the sequential decline. The mutual fund industry launched only a handful of 4-5 new fund offers in Dec’22.

- Even the debt AUM saw a sequential decline of a mere 0.3% and was more or less in line with where it was a year back. Though debt categories have seen net outflows, new fund offers offered some relief. A total of 31 new fund offers got launched in Dec’22,60% of which are fixed maturity plans. The interest rate cycle is close to, but not fully peaked, out yet; hence, the debt category flows may see some pressure in the short term.

Top 10 AMCs by AUM

Edelweiss AMC has seen an AUM uptick as equity markets seen more volatility

| AMC | Rank | Total AUM In Nov (Cr.) | Total AUM In Dec (Cr.) | M-o-M% |

| Edelweiss Asset Management Limited | 10 | 113,090 | 117,587 | 4.0 |

| SBI Funds Management Limited | 1 | 722,788 | 719,878 | -0.4 |

| HDFC Asset Management Company Limited | 3 | 457,186 | 453,501 | -0.8 |

| Kotak Mahindra Asset Management Company Limited | 5 | 286,183 | 282,903 | -1.1 |

| Aditya Birla Sun Life Asset Management | 6 | 281,594 | 277,864 | -1.3 |

| ICICI Prudential Asset Management Company | 2 | 517,087 | 510,093 | -1.4 |

| Nippon Life India Asset Management Limited | 4 | 297,216 | 288,688 | -2.9 |

| Axis Asset Management Company Ltd. | 7 | 250,237 | 242,906 | -2.9 |

| Mirae Asset Investment Managers (India) Private Limited | 9 | 122,324 | 118,687 | -3.0 |

| UTI Asset Management Company Private Limited | 8 | 242,999 | 233,894 | -3.7 |

Value in INR

Table: Fisdom Research • Source ACEMF • Created with Datawrapper

- Among the top 10 AMCs by AUM, Edelweiss AMC is the only one that has seen sequential growth. Debt AUM played a significant role in this growth. It has grown by ~7% on a sequential basis. It is the only AMC that has diversified its debt offering by launching passive target maturity schemes almost for all maturities. Bharat bond was a key contributor among all of these. Another thing that went in favour of the AMC is the decline in the equity indices, as equity AUM contributes ~20% of the overall AUM of the AMC.

- Rest nine AMCs saw a sequential decline as equity AUM contributes almost 40% & more of their overall AUM, and also the market went down by 4% in Dec’22. We expect this momentum to sustain if equity markets see the same volatility.

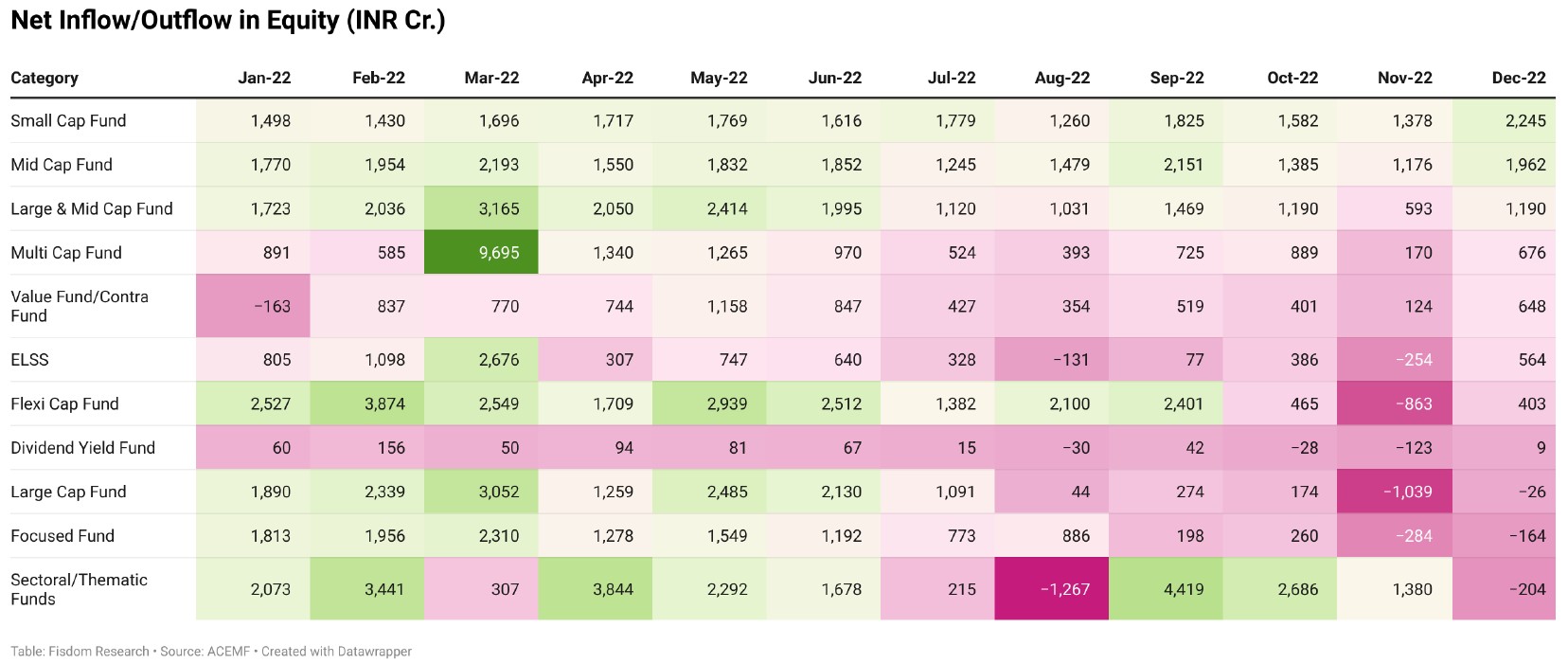

Category Wise Inflows/Outflows: Equity Categories

Midcaps & small-cap categories continued receiving inflows

- Large-cap-oriented categories have seen consistent outflows as investors booked some profits and took some capital off the table amid an enriching series of run-ups across large-cap stocks. The high valuation of large-cap stocks compared to midcap & small-cap also had an impact on the flows.

- Considering the reasonable risk returns tradeoff in midcap & smallcap and the valuations tradeoff vis-à-vis large-cap, we expect both these categories to keep receiving inflows in the near term.