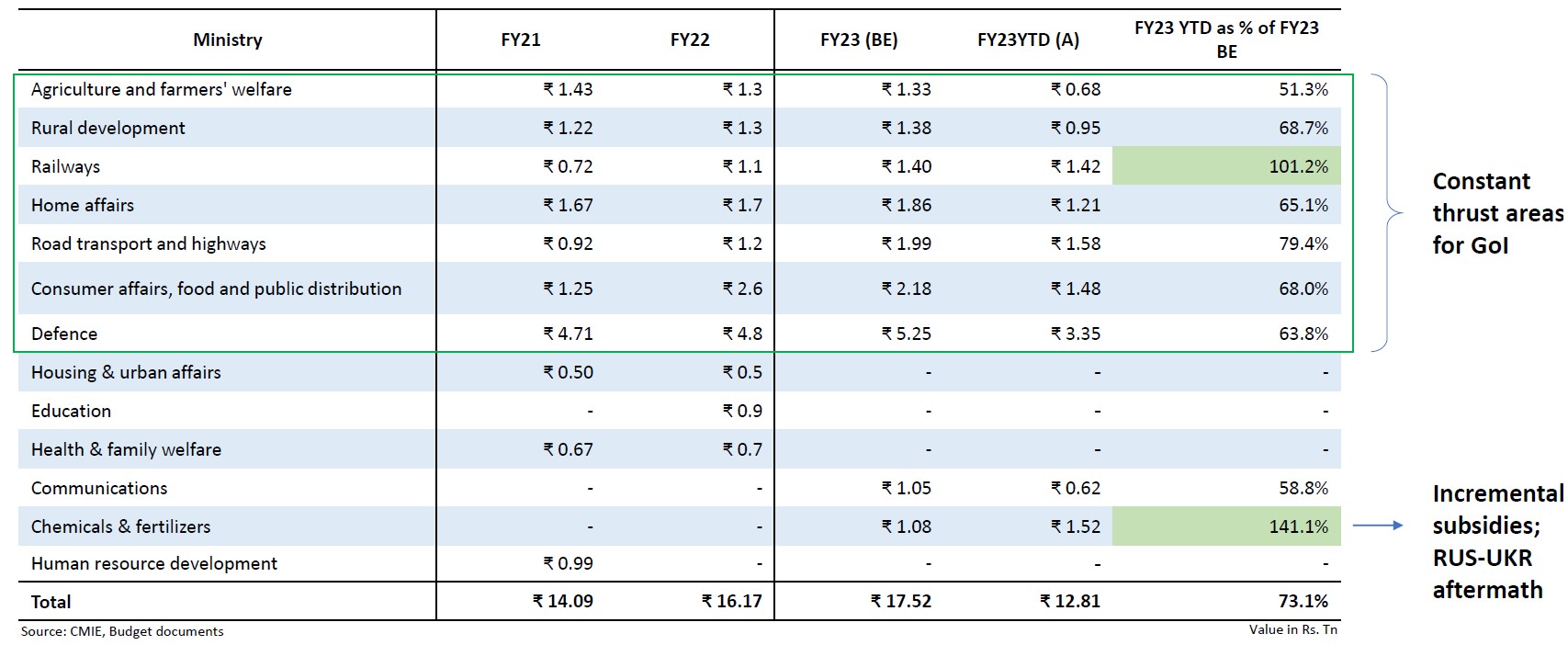

Railways and Chemicals + Fertilizer segments have absorbed higher than budget estimates

Notes/Highlights

- Railways expected to gain incremental allocation ministry requested for additional funds of 25 for FY 23 in the pre budget meet Similar prioritization expected for road transport and highways

- Amid economic distress and weak sentiments, the Ministry for Rural Development is expected to garner incremental attention in the budget

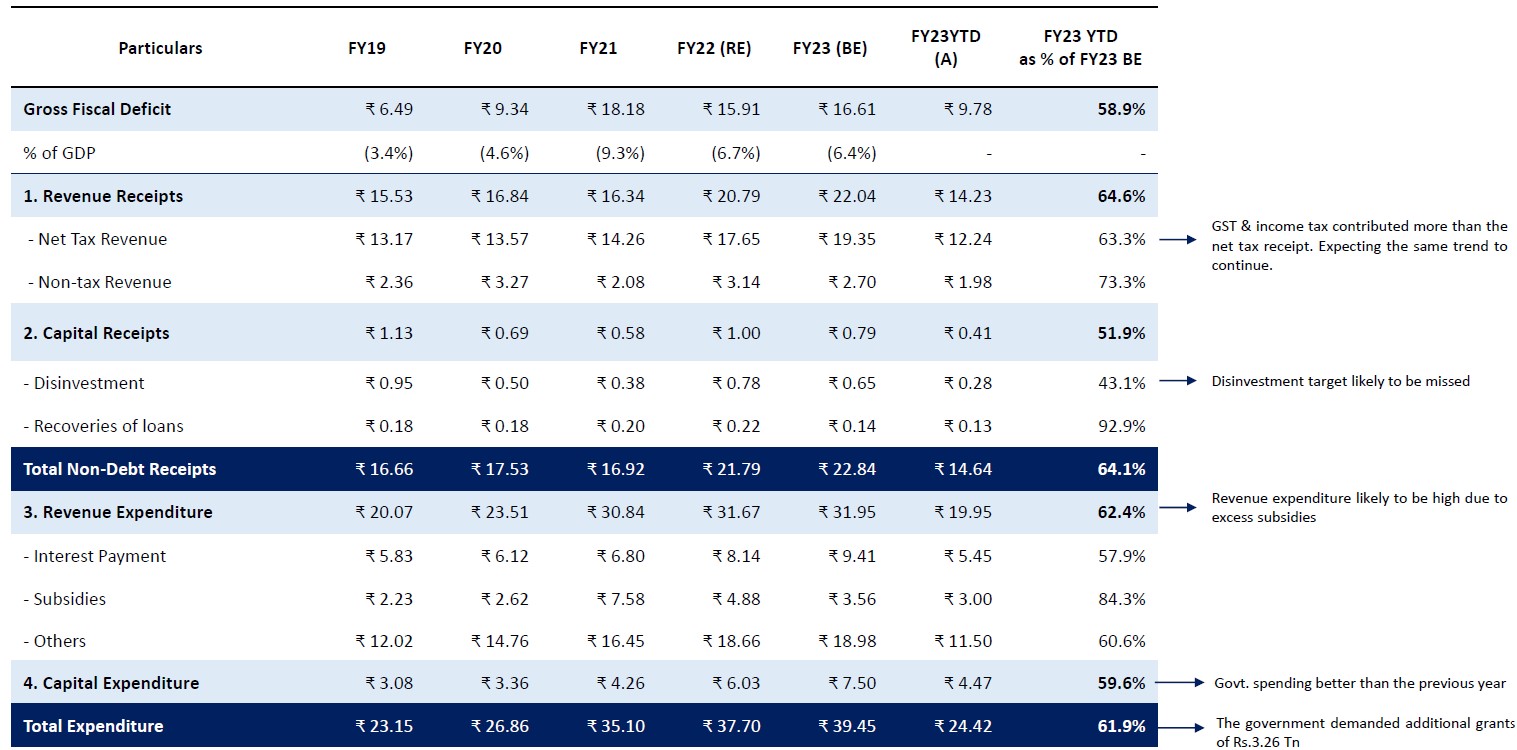

The fiscal situation looks comfortable despite additional spending

Key Theme I: Capital Expenditure (Capex)

| Key Theme | Rationale | Top Picks |

| Capex | The last budget allocated a record-breaking Rs.7.5tn for capital expenditure through the Gati shakti mission. It includes impetus to road, railways, airways, ports & logistics development. |

|

| Government capital expenditure remains in line with expectations through FY23YTD. An analysis of spending by key ministries indicates that spending on railways is already over 100% of budgeted numbers in FY23YTD. Yet, the ministry has requested for additional 20%-25% more funds for FY23. | ||

| However, the investment demand remains subdued versus all-time highs witnessed in FY08. Capex revival has constantly featured as a priority agenda item through past couple of budgets. The same can be expected to continue with renewed focus especially considering the need in context of India’s economic position. | ||

| Capex outlay expected to expand to the range of Rs.9.0 lakh crore to Rs. 9.5 lakh crore in the upcoming budget. Railways, road transport & defence are expected to be primary beneficiaries as allied sectors of infrastructure, logistics, capital goods and utilities benefit from second-order effects. |

Key Theme II: Production Linked Incentive Scheme (PLI)

| Key Theme | Rationale | Top Picks |

| Production Linked Incentive Scheme (PLI) | To boost the domestic manufacturing sector, support exports, and attract investments in the manufacturing industry, Government of India declared a Production-linked incentive for five years with a total outlay of Rs 1.97tn. The highest allocation has been earmarked for the auto sector, followed by mobile phones and the manufacturing of batteries. A separate Rs. 0.76tn was explicitly announced for semiconductor manufacturing companies. |

|

| Credit Suisse estimates that PLI schemes can create $150 bn incremental revenue by the end of FY27, contributing up to 1.7 per cent of GDP. | ||

| Key objectives of PLI are to boost manufacturing in India, increase employment opportunities, import substitution & export maximization. All of it will help in improving the current account situation of India. | ||

| Considering the success of PLI, more such announcements are expected in new sectors along with the existing 13 sectors. There might be a specific focus towards the semiconductor industry. |

Key Theme III: Rural

| Key Theme | Rationale | Top Picks |

| Consumption | •We have observed a divergent trend between rural & urban sentiments with the gap widening consistently. It is an indicator reflecting that the rural economy hasn’t quite recovered yet. Inflationary pressure continues to weigh on demand sentiment in the rural segment of India. |

|

| •A sum of Rs.278 billion has already been allocated towards the ministry of rural development on rural employment generation to support incremental expenditures in the segment. Most of this amount is to be spent on the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) and Pradhan Mantri Awas Yojana – Rural (PMAY-R). | ||

| •We think the current allocation is insufficient to revive the rural economy & given that it is the last budget before the upcoming general elections, we expect more populist announcements for the rural sector. Announcements may include a hike in MSP, agro-marketing support, a boost to rural infra, focus on rural employment and aid through cheaper funding can help revive the rural economy. |

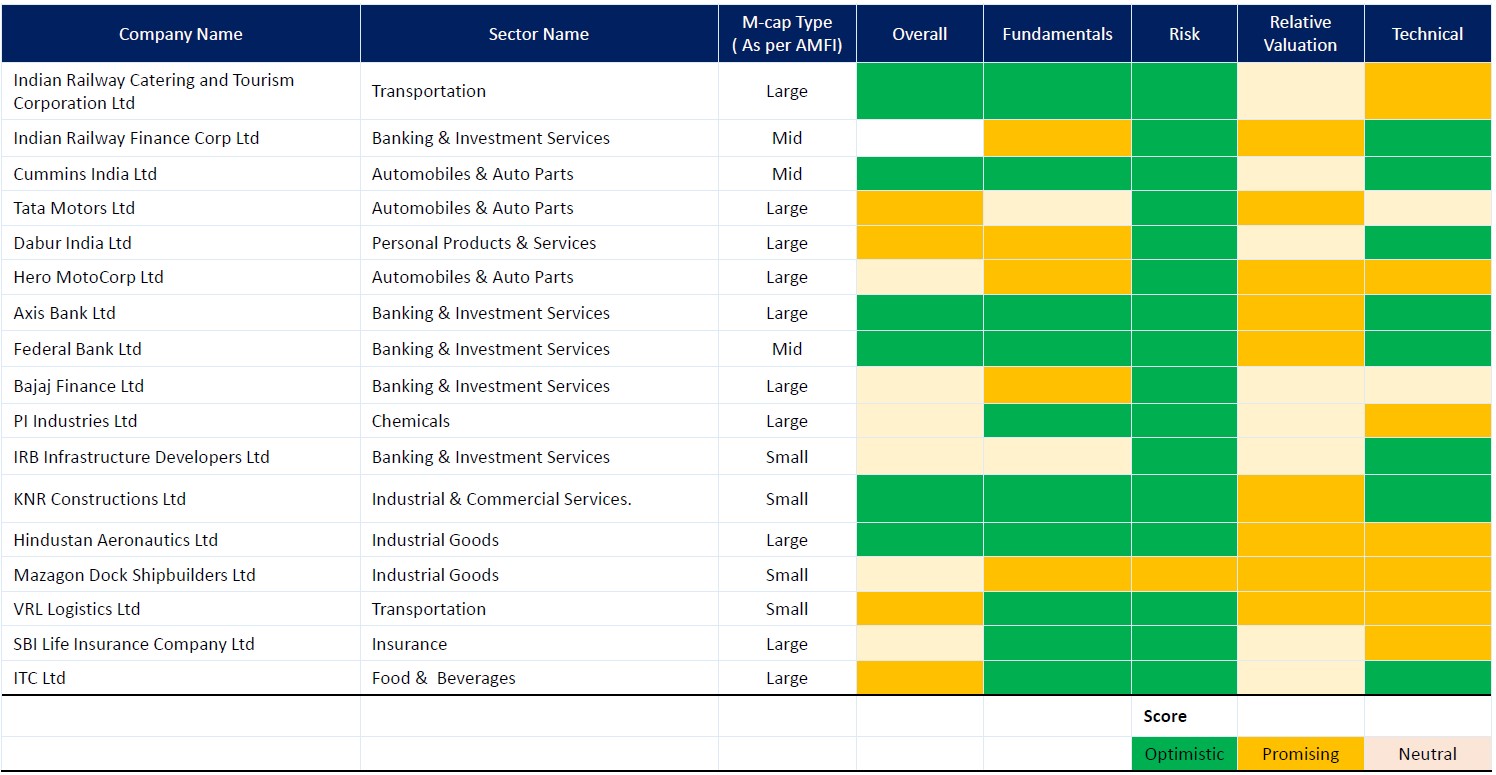

Top stock picks

Top mutual fund picks

| Company Name | Sector Name | Largecap | Midcap | Small cap | Cash (%) | Fisdom Rating |

| SBI Banking & Financial Services Fund | Financial Services | 77.80% | 9.90% | 9.40% | 2.90% | ★ ★ ★ ★ ★ |

| ICICI Prudential Banking and Financial Services Fund | Financial Services | 74.80% | 6.70% | 12.30% | 6.30% | ★ ★ ★ ★ ★ |

| UTI Transportation & Logistics Fund | Automobiles & Auto Parts | 66.80% | 20.20% | 9.70% | 3.40% | ★ ★ ★ ★ |

| Aditya Birla Sun Life Digital India Fund | Technology | 74.90% | 11.10% | 13.10% | 0.90% | ★ ★ ★ ★ ★ |

| Aditya Birla Sun Life India GenNext Fund | Consumption | 62.30% | 24.10% | 11.00% | 2.60% | ★ ★ ★ ★ ★ |

| Canara Robeco Consumer Trends Fund | Consumption | 63.70% | 22.00% | 10.20% | 4.10% | ★ ★ ★ ★ |

Investors can seek to include the following funds as a part of defined tactical allocations. Maintaining overall target allocations and a long-term holding horizon for expected performance to materialize fully is recommended.