1. Dabur LTP 566

| Counter | Dabur LTP 566 |

| Call | Buy-on-dip |

| Target 1 | 585 |

| Target 2 | 615 |

| Stop Loss | 540 |

| Time Horizon | 1 month+ |

| Notes | Buy-on-dip towards 565 & 555; strict stops on closing basis |

Dabur India Ltd is one of India’s leading FMCG Companies with Revenues of over Rs 7,680 Crore & Market Capitalisation of over Rs 48,800 Crore. Dabur is today India’s most trusted name and the world’s largest Ayurvedic and Natural Health Care Company with a portfolio of over 250 Herbal/Ayurvedic products.

| Previous Close | 554.95 | TTM EPS | 9.75 |

| 52 Week High | 610.75 | TTM PE | 58.05 |

| 52 Week Low | 482.25 | P/B | 11.91 |

| Sector PE | 63.69 | Mkt Cap (Rs. Cr.) | 100,281 |

(Source: Moneycontrol, BSE, Fisdom Research)

Technical Outlook

(Source: Fisdom research)

- DABUR gave its 30-Weeks Moving Average high support forming “Higher-Highs” on weekly time-frame.

- The counter has formed “Double Bottom” at around 540 & a higher weekly bottom indicates “Strength”.

- The counter has immediate supports at around 548 & major 540 levels above which counter remains “Range to Positive”

- Dips towards 565 & 555 can be looked for proportionate buying interest for higher levels of 585. Once the level is held sustainably, it can attempt the next positional target of 615 in months to come. 585 will be very crucial in the mid-term time-frame. Initially, any pull-back towards those levels can entail some profit-taking.

Open Interest Study

(Source: Fisdom research)

- Maximum build-up in Dabur is around 560 & 550 levels which indicates possible dips towards 560 & 550 which can attract fresh buying interest.

- On the higher-end, the counter’s hurdles are positioned at 580 and 600 levels. These levels can be potential targets in weeks to come.

- Over the counter downside is capped if it trades sustainably above 550 levels.

F&O Strategy

| Action | Scrip | QTY | IP | LTP |

| BUY | Feb Dabur 560 CE | 1250 | 19.15 | 19.15 |

| SELL | Feb Dabur 590 CE | 1250 | 6.15 | 6.15 |

The broader market (Nifty LTP 18027) is still in consolidation phase and under pressure as it trades below 18200 levels with crucial support at around 17750 odd levels. The Break-Out & Break-down can change the immediate trend of the market. Conservative traders can consider the following option strategy to participate in the stock.

| Strategy | Bull Ratio Spread |

| Scrip | Dabur LTP 566 |

| Risk | Moderate |

| Ratio | 1:1 |

| Breakeven | 573 |

| Bias | BUY ON DIP |

| Max Reward Expected | ~INR 21,250 |

| Max Risk Expected | ~INR 16,250 |

- DABUR has immediate support at around 560 levels thus a “Bulls Spread” with Long of 560 levels & selling of 590 which is resistance can provide good Risk-Reward Ratio.

- The Break-Even of this strategy is above 573 with maximum gains at and above 590 levels.

|

Persistent LTP 4323

| Counter | Persistent LTP 4323 |

| Call | Buy-on-dip |

| Target 1 | 4500 |

| Target 2 | 4700 |

| Stop Loss | 4000 |

| Time Horizon | 2-3 weeks |

| Notes | Buy-on-dip towards 4250 & 4150; strict stops on closing basis |

Persistent Systems is a global solutions company having technical expertise and industry experience of 30 yrs providing digital business transformation. The company has industry expertise in Banking and Financial Services, Insurance, Healthcare, Life sciences. Industrial, Software & Hi-Tech, Telecom & Media.

| Previous Close | 4258.15 | TTM EPS | 105.86 |

| 52 Week High | 4987.50 | TTM PE | 40.84 |

| 52 Week Low | 3092.05 | P/B | 10.16 |

| Sector PE | 29.98 | Mkt Cap (Rs. Cr.) | 33,042 |

(Source: Moneycontrol, BSE, Fisdom Research)

Technical Outlook

(Source: Fisdom research)

- Persistent was trading with a “Range to Positive” outlook above 3800 levels since Nov-22 and gave a weekly closing at its consolidation break-out pegged above 4200 levels last week

- The counter continues to trade in the “overbought” zone on a weekly time-frame. However, as per price study, the counter remains Buy-on-Dip above 4200 & major interim support levels of 3800 levels

- Technically, the counter can attempt its previous multi-months’ “Double Top” highs of 4800 levels in weeks to come

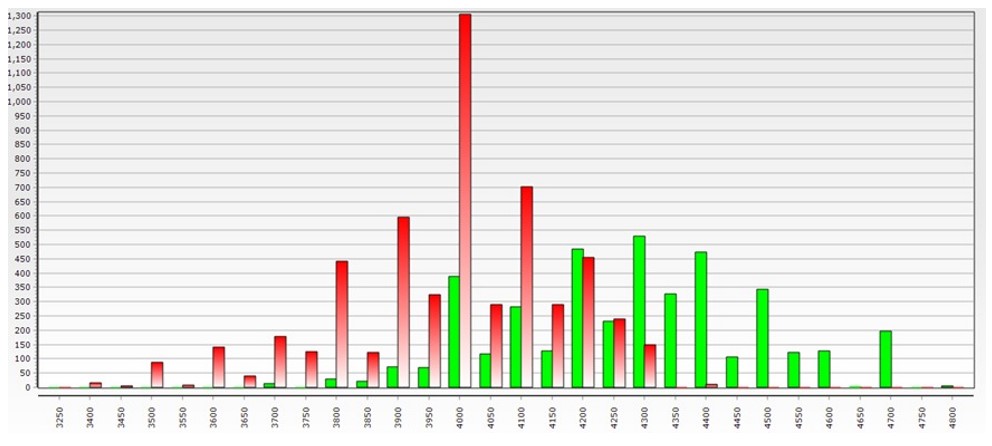

Open Interest

(Source: Fisdom research)

- Max PE build-up indicates support at around 4000 and 3900 levels.

- While on the higher end, for Jan’23 series, maximum call option build-up is witnessed at around 4300 & higher levels.

- Overall build-up suggests Buy-on-dips towards support levels

F&O Strategy

| Action | Scrip | QTY | IP | LTP |

| BUY | Feb Persistent 4200 CE | 175 | 180 | 180 |

| SELL | Feb Persistent 4500 CE | 175 | 70 | 70 |

The broader market (Nifty LTP 18027) is still in consolidation phase and under pressure as it trades below 18200 levels with crucial support at around 17750 odd levels. The Break-Out & Break-down can change the immediate trend of the market. Conservative traders can consider the following option strategy to participate in the stock.

| Strategy | Bull Ratio Spread |

| Scrip | Persistent LTP 4323 |

| Risk | Moderate |

| Ratio | 1:1 |

| Breakeven | 4210 |

| Bias | Buy-on-dip |

| Max Reward Expected | ~INR 33,250 |

| Max Risk Expected | ~INR 19,250 |

- Persistent has immediate support at around 4100 levels; thus, Buying 4200 CE is a Long Bet while Hedging the Cost of Buying Premium by Selling 4500 CE, which is the first major resistance cum target.

- The maximum risk of this strategy is above 4500 while break-even is above 4200 levels

|

Disclaimer: This document is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. If you have received the publication in error please notify the sender immediately. If you are not the named addressee, you should not disseminate, distribute or copy this document. You are hereby notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. This document has no contractual value and is not and should not be construed as advice or as an offer or the solicitation of an offer or a recommendation to take action in consonance in any jurisdiction. Finwizard Technology Private Limited (“Fisdom”) makes no guarantee, representation or warranty and accepts no responsibility or liability for the accuracy or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will Fisdom be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document, even if you advise us of the possibility of such damages, losses or expenses. Fisdom does not undertake any obligation to issue any further publications or update the contents of this document. The information stated and/or opinion(s) expressed herein are expressed solely as general commentary for general information purposes only and do not constitute advice, solicitation or recommendation to act upon thereof. Fisdom does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. Fisdom may have issued other similar documents that are inconsistent with and reach different conclusion from the information presented in this document. The relevant offering documents should be read for further details. You should make such researches/inspections/inquiries as it deems necessary to arrive at an independent evaluation of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks involved. Fisdom makes no representations that the offerings mentioned in this document are available to persons of any other country or are necessarily suitable for any particular person or appropriate in accordance with their local law. Among other things, this means that the disclosures set forth in this document may not conform to rules of the regulatory bodies of any other country and investment in the offer discussed will not afford the protection offered by the local regulatory regime in any other country. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. The historical performance presented in this document is not indicative of and should not be construed as being indicative of or otherwise used as a proxy for future or specific investments. The relevant product documents should be read for further details. Fisdom does not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at anytime.