The year is come to an end, with markets touching all-time highs and investors are asking:

- Is this the last peak markets will hit?

- How long can markets sustain at this level?

- Is it possible to make money in today’s markets?

- The markets may go down from here. Is it best to wait out the fall and then invest?

While these questions are valid, we go a step further and ask, “What is All-Time High, and does it hold any significance?”

Simply put, all-time highs are when markets beat their previously recorded highest levels.

And their significance?

Well, that answer varies depending on your investing style:

- For traders (short-term participants), markets making new highs is extremely attractive as it fits well in their approach of making a quick buck

- For investors (long-term participants), markets making new highs is another good day at the office but holds less weight in their adopted approach.

If anything, the shooting up of equity valuations can cause asset allocation mismatch.

(Get your portfolio vetted today with Fisdom research)

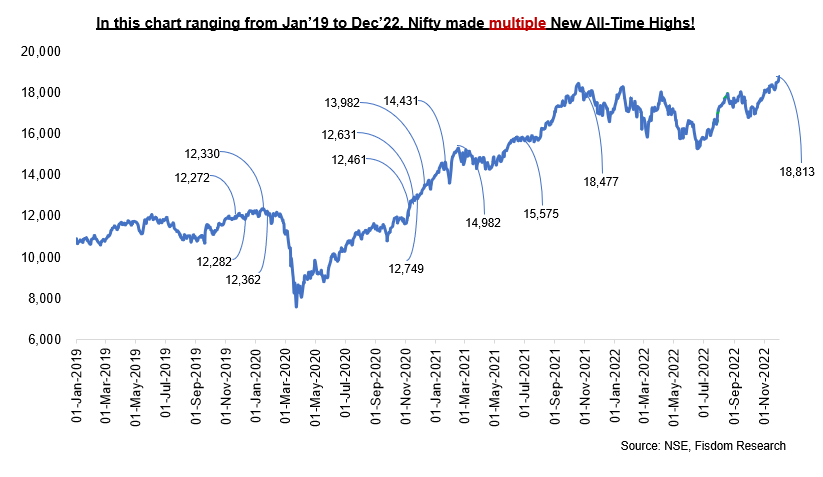

Building on this insight, let us see why the market making peaks more normal than the news and noise around it:

So, are markets peaking a frequent instance? No.

So, should I exit my investments to realise market potential at its upside best? Also, No

Saying yes to the 2nd question would mean that markets will never materialise at current levels. However, as we saw from the graph above, this is false.

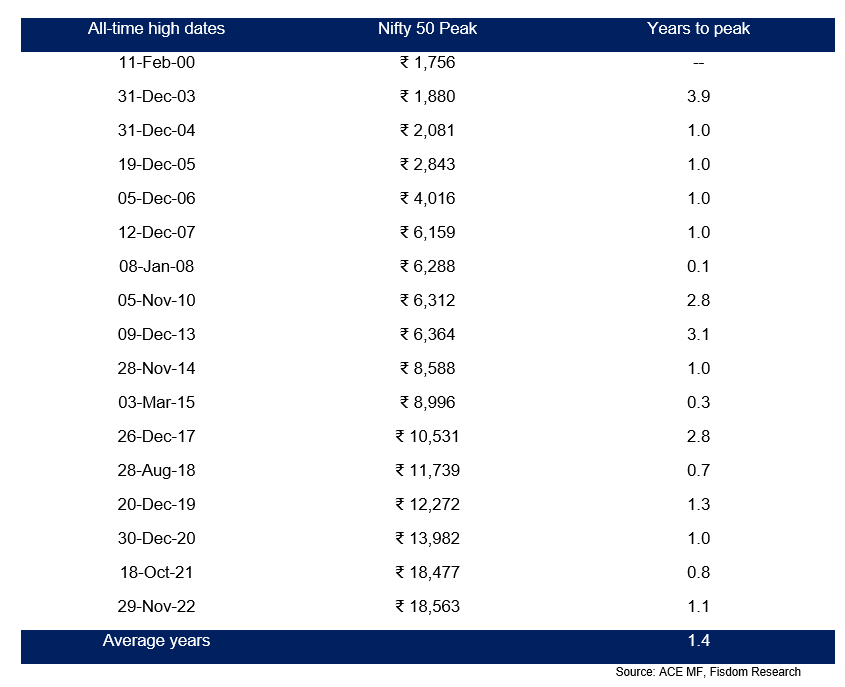

Another interesting fact here is that, on average, it took only 1.4 years for Nifty50 to reach a new peak. Here are some figures to look at:

Hence, those who redeemed their investments in any year, considering the current year’s market levels as the peak, have missed better opportunities ahead.

Today, while markets are not particularly range-bound, it is touching new all-time highs.

So, can SIPs work in today’s markets? Instead, how effective is it as a tool for investing when markets are at their peak?

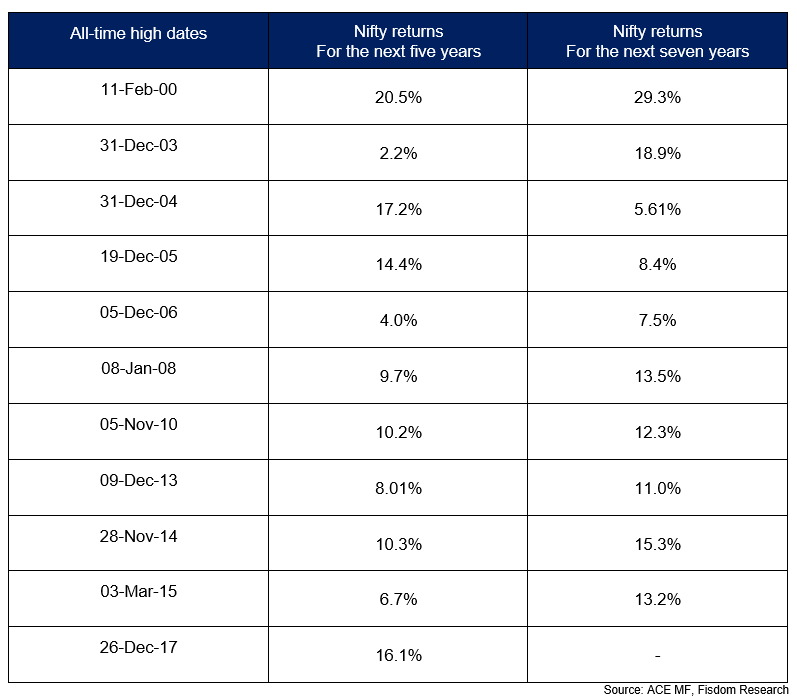

Case in point: SIP investments, if started at the previous market, peak

Irrespective of market levels, even those who have precisely timed the market and started the investments at the peak have also made inflation-beating returns.

The lesson that investors should learn from the past is to focus on time rather than timing.

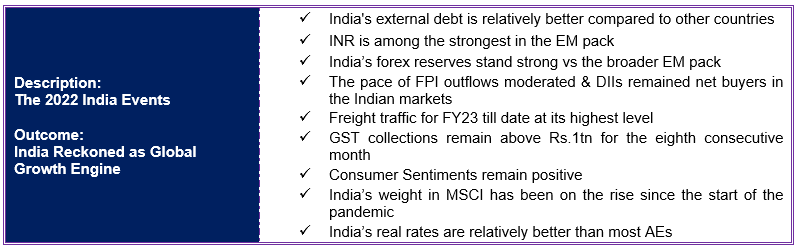

Now, as you might have understood that the reason why we feel making a peak is more normal than the news and noise around it, let’s also understand why we feel the peak is normal and backed by strong fundamentals.

Few of them are listed below:

Investor Takeaway

“The stock market is designed to transfer money from the active to the patient” –> Warren Buffet.

At 93, Mr Buffett has sworn by these words since age 11, and look at where he stands today.

Fun fact: Mr Buffett had most of his wealth created after age 65.

As time passes, markets will caress newer highs only to solicit the old reactions. And for when that happens, resort back to this note to keep emotions at bay and act in the interest of investing principles.

And lastly, here’s a fun math fact for all those who think exciting at the market

all-time time high will tide over all their losses:

- If a stock falls by 75% from ₹100 to ₹25, it will need to gain 300% to recover to its original price

- If it falls by 90%, it needs to go up by 900% to recover to its original price

Hence, think wise and act wiser. More critical than valuing market levels is your investment time in the markets.

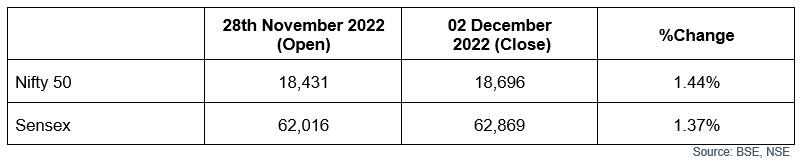

Market This Week:

- Markets ended on a positive note.

- Indian benchmark indices hit a record high in the week gone by amid positive global sentiments after the Fed chairman stated a slowdown in the pace of rate hikes in the future but ended negative on profit selling in domestic shares.

- Buying by FPIs, the falling US dollar, F&O expiry, and stable crude oil prices were other reasons for investors’ confidence.

- During the week, Nifty Bank also remained volatile. Most indices ended negative except Media, Metal, PSU Bank and Realty.

- Next week, market participants will be looking at RBI’s Monetary policy that will influence the market trajectory.

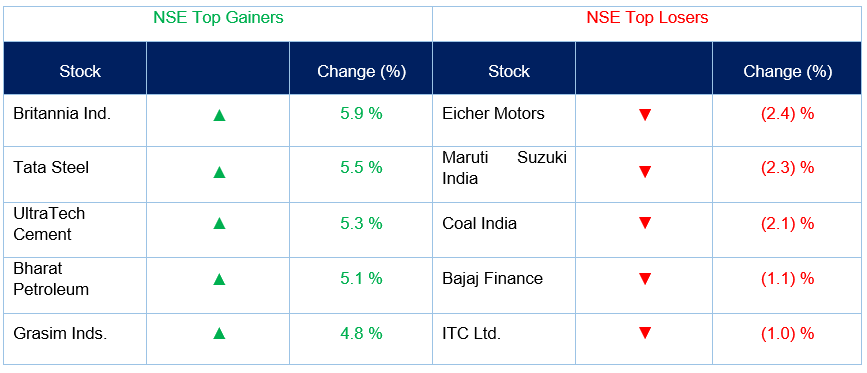

Weekly Leaderboard:

Stocks that made the news this week:

- Paytm on Thursday informed that it currently makes a net payment margin of 7 to 9 bps of GMV on processing. UPI gives us 3 to 4 bps, and other instruments give 15 to 18 bps. Since UPI is growing faster than other instruments, it expects the blended margin to stabilize at 5 to 7 bps.

- Maruti Suzuki India announced on Friday that it plans to hike the prices of its vehicles in January 2023. The hike shall vary across models. Separately, Maruti Suzuki said its total vehicle production rose 4.96% year-on-year to 152,786 units in November 2022.

- Piramal Enterprises’ board of directors approved the issuance of market-linked non-convertible debentures (NCDs) aggregating up to Rs 250 crore on a private placement basis. The size of the issue is up to Rs 50 crore, along with an option to retain over subscription of up to Rs 200 crore, aggregating up to Rs 250 crore.

- Easy Trip Planners (EaseMyTrip) announced that it has entered into a definitive agreement to acquire the 75% stake in Nutana Aviation Capital IFSC. The company said that in a growing charter market across the globe, Nutana Aviation would be carrying business for renting and booking of charter aircraft.

- NDTV hit an upper circuit this week after the company’s founders Prannoy Roy and his wife, Radhika Roy, resigned as the directors of promoter group vehicle RRPR Holding. The board also approved the appointment of Sudipta Bhattacharya, Sanjay Pugalia, and Senthil Sinniah Chengalvarayan, as directors on the board of RRPRH, with immediate effect.