Starting off right from the first-rate hike in calendar year 2022, RBIs off schedule repo rate hike in May 2022 gave us a grim reminder about economy’s challenged state of affairs. A similar stance was maintained in the June and August meet, where RBI’s key focus was on withdrawal of accommodation.

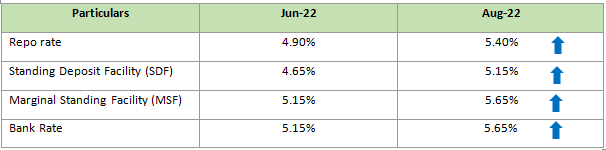

Below table highlights the key changes from June MPC meet:

The recent rate hike action takes the total of rate hikes since May 2022 to 140 basis points. The announcement sighed relief to banks as the CRR ratio was unchanged at 4.50%.

Banks earlier requested the central banks not to increase the non-interest-bearing reserve ratio as the liquidity was reduced in the economy.

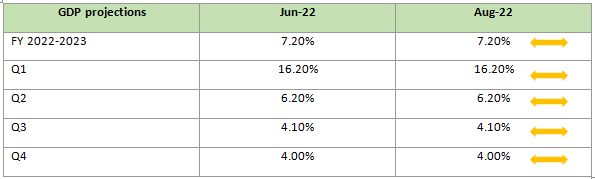

GDP projections for FY 2022-2023 have remained unchanged

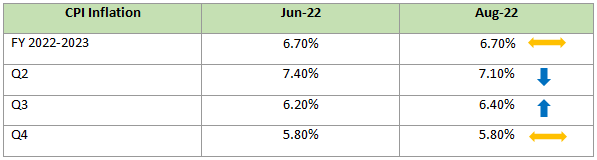

Inflation projections for FY 2022-2023

Impact on bond markets

The 10-year G-sec yield hardened during the day as market participants hinted toward the hawkish stance of the RBI governor. Higher supply-side pressure and lack of positive triggers have weighed on investor sentiments.

Impact on end consumer

An increase in interest rates may lead to a rise in the cost of borrowing for banks and will result in a reduction in the money supply in the system and return; this will help tame inflation. Home loans, personal loans and all other types of loans are set to be more expensive.

What can debt fund investors do?

Debt investments are set to become more attractive amid the interest rate hike cycle. In light of developments in policy rates and sovereign and corporate bond yields, fixed-income investors can invest in funds with an effective maturity of 3 to 5 years following a roll-down strategy.

A mix of PSU and SDL-backed papers can also offer strong quality to the mix. A mix of target maturity fund with the objective of held till maturity may augur well for investors with specific time horizon.