When the great investor Warren Buffet says, ‘buy when there’s blood on the Street.’ He refers to the bottom phase. Before jumping on to the question of whether markets have bottomed out at this point, let us first try to understand the key attributes of identifying when the markets have reached a bottom.

Long-term investors who have survived through the bear markets of 2001, 2008-09 can provide a novice investor the divine enlightenment about wealth creation. Stocks bought during this market bottom phase are the biggest wealth creators in their equity portfolio.

Here are a few signs that one can keep an eye on to gauge whether the markets have reached their bottom or not:

Heightened volatility: India VIX is a gauge for market volatility. In times of extreme fear, VIX tends to shoot up significantly. In the period of extreme uncertainty, VIX has shot up more than 70, and it even reached 86 in the latest market downfall in March 2022. A VIX of 20-21 range in the current scenario does not point out any such panic in the markets.

Prolonged correction: Markets have seen a correction of 40-50% in the past, and even such corrections stayed for 10-18 months in worst-case scenarios. Looking from the current context, the benchmark indices Nifty 50, anything of this sort has not happened yet. Nifty 50 corrected by less than 20 percent since it reached its all-time high in October 2021.

MF Investors losing interest: During the market bottom phases, MF investors or retail investors are the first ones to take an exit as they witness a bloodbath in their portfolio. They often book losses and move towards haven assets towards traditional instruments. However, this time the situation is not the same; domestic investors have been mature enough to continuously pump in money throughout the market correction in the last eight months. If one looks at the pace of new SIPs being registered in the past few months, SIP contribution has been robust, crossing INR. 11,000 crore for seven months in a row and has remained above INR 12,000 crore mark in May 2022.

Looking at the factors mentioned above and considering a few others like the advance-decline ratio and correction in much broader segments of the market, we can conclude that the Indian market is yet to reach the bottom, and there is a high possibility that it might not! Honestly, nobody knows the exact bottom of the market but what one does know is what follows after the market bottom.

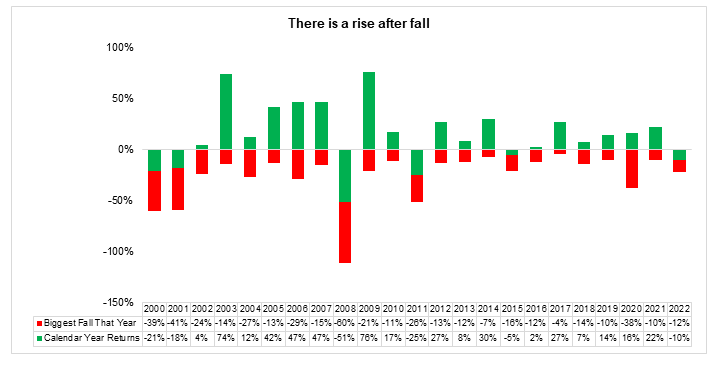

The average index delivers average annual calendar year returns of 15% vs. average drawdowns of -20%. The data above is evidence enough to prove that troughs and peaks are part-&-parcel of market behaviour. It is these erratic movements that make markets what they are.

Now circle back to the secret to making money which is to stay invested. It sounds very simple in principle but is super effective in practice. Mastering this behaviour means you don’t have to worry about which virus hits next or what vaccine turns out ineffective. All you need to know or do is to realize that inaction is often the smartest action.

As an investor pro-tip, don’t go about doing permanent damage to temporary problems.

Spread the word and be a part of the minority today. And for when you stumble, we fisdom folks are always to hand-hold you through your investment journey.

As always, we excitedly await to hear from you.

Till then, have a good weekend

Thank you.