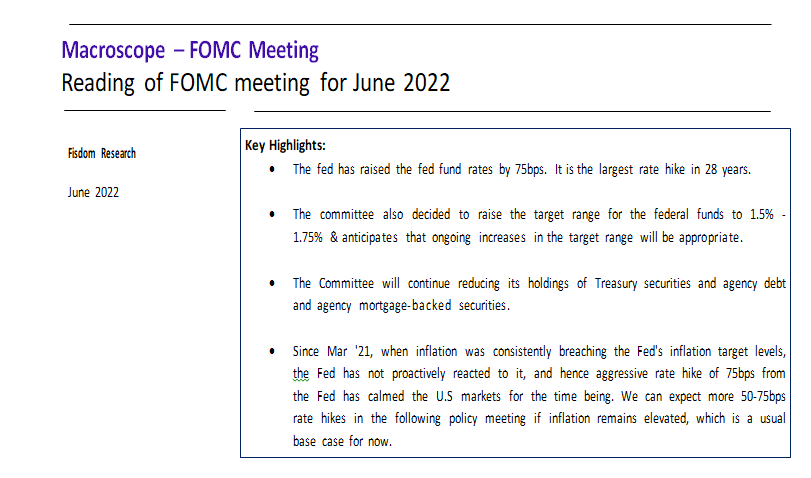

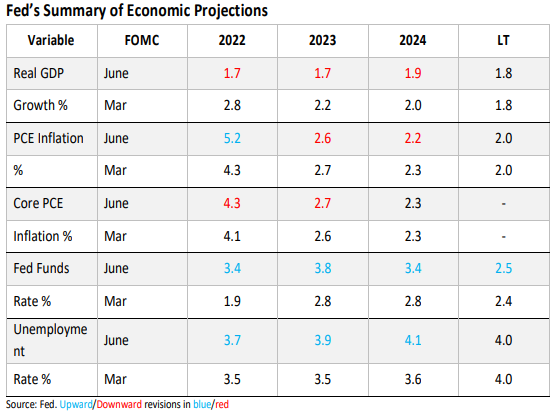

- Along with the rate hike of 75 bps, the Federal Open Market Committee’s (FOMC) latest projections showed sharp jump from the March 2022, with federal fund rates target rising to 3.4% by year end, moving towards another 175 bps of tightening this year itself and 3.8 percent in 2023, before reaching at 3.4 percent in 2024. Previous projections were about 1.9 percent for 2022 and 2.8 percent for 2023.

- The economy related projections shows moderation, with the unemployment rate to increase by 3.7 percent at the end of 2022 and 4.1 percent in 2024, GDP growth projections were cut down to 1.7% in 2022, and 2023, from 2.8% and 2.2% in March. Officials of Fed still expect inflation to significantly trim down in 2023.

- The Federal Reserve is also committed for a reduction in balance sheet from 1st June 2022, trimming down the bond portfolio by $47.5 bn monthly and increasing it upto $90 bn in September 2022.

Where is US inflation headed?

- Personal Consumption Expenditures Price Index a primary measure of inflation is expected

to be at 5.2 percent by the year end, which is up from 4.3 percent March 2022 projections.

- The US long term average inflation is around 3.2%, and last 12-month average is from April

2021 is at 6.3 percent which is at a 40-year high.

- On a month-on-month basis Natural gas and Energy segment showed the biggest jump in

growth where as apparels and all items less food and energy showed a decline month on

month.

What is the Impact on India?

RBI Remains Proactive

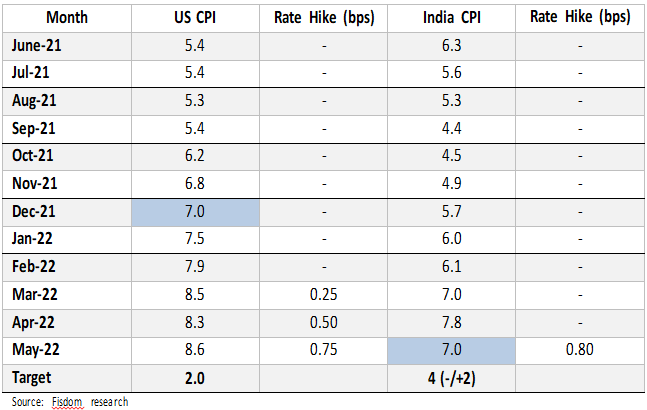

Since Mar ’21, when inflation was consistently breaching the Fed’s inflation target levels, the Fed

has not proactively reacted to it, and hence aggressive rate hike of 75bps from the Fed has calmed

the U.S markets for the time being. RBI has been quick to react on the evolving dynamics around

inflation and have proactively raised interest rates quickly enough post breaching the upper band

target of 6 percent of inflation.

Indian markets remains resilient

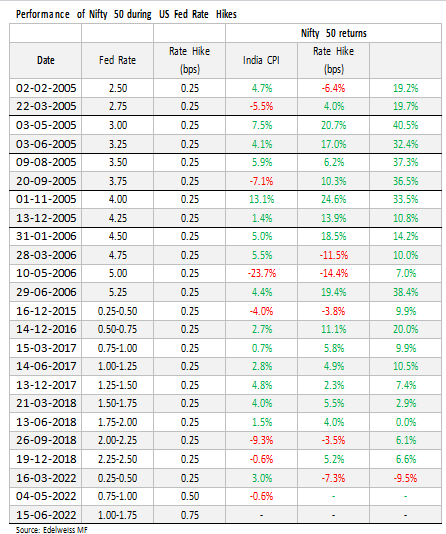

During the period Dec 2015 and Dec 2018, the Fed increased interest rates by 200 bps while during

the same period Nifty gained by 40%. As the below data suggested Indian market has remained

resilient most of the times when it comes to rate hikes. Market indeed rises after Fed hiked its

interest rates if one looks at historical data

Way ahead:

The pace of rise in global yields is narrowing the interest rate difference between India and US because of rapid hikes by the Federal Reserve. However, if one looks at the real interest rate spread between the US and India, India still remains attractive and this might bring some moderation in dollar outflows from Indian debt and equity markets. The USD/INR rate has been depreciating at a faster pace since Jan 2022.

There is a heightened threat of imported inflation coming from the currency route. Rising imports are widening current account deficit which would further put pressure on rupee. Forex reserves of India stands at $600 bn which provides a cushion for further downside in rupee as RBI has been intervening in the forex market to reduce volatility.

Investors looking for fresh investment into debt mutual funds can look at target maturity bond ETFs/ index funds maturing at different intervals depending on investors investment horizon.