1. Overview

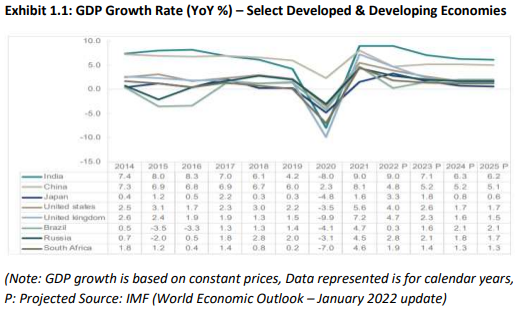

India drives in the fast lane to economic growth. Despite being significantly sensitive

to the pandemic and still reeling under the pressure of adverse fallouts, the domestic

economic growth story remains resilient.

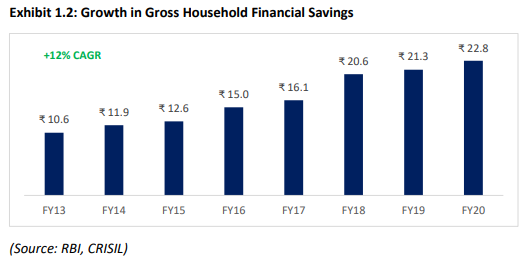

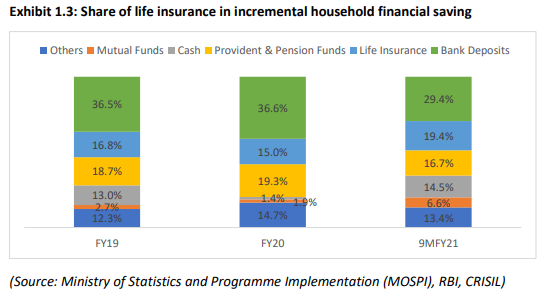

The middle-income and affluent cohort of the Indian demography have been growing

fast over the past decade, and the trajectory is expected to sustain, if not accentuate.

Improved literacy, education, awareness, infrastructure, infrastructure, facilities, and

general standard of living have been vital contributors to the swelling bracket of such

households. Atypical of nations with an economic progress-bound population, India

too is witnessing active financialization of assets.

Along with many other sectors, especially ones engaged in the business of financial

services, the insurance industry also features as a key beneficiary. Awareness around

the need for life insurance through higher financial literacy, enhanced education

levels, and finally, the pandemic-propelled demand have augured well for the life

insurance specifically.

2. About Life Insurance Corporation (LIC) and the Initial Public Offer

Life Insurance Corporation is the only government-owned life insurer in India among a

total of 24 life insurers operating in the country. LIC clearly dominates the life

insurance segment with a 60%+ market share in terms of gross written premium as

well as new business premium. The share goes up to ~72% in terms of number of

individual policies issued and ~89% in terms of group policies issued. The corporation

has been operational for over 65 years and boasts of its large individual agent network,

comprising of ~55% of total number of agents in India, as a key business driver.

The LIC IPO is a strategic stake sale by Government of India to raise funds. This exercise

has been a key assumption in the Government’s divestment and fund-raising agenda.

The government seeks to dilute 3.5% of its holdings via the offer.

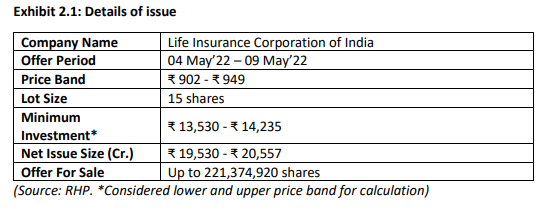

The offer, opening on 4th May’22 for the general public and 2nd May’22 for anchor

investors, will attempt to raise almost INR 21,000 Crores. The offer takes the

corporation’s valuation to ~INR 6.1 Lakh Crore which, by far, is the largest public offer

India has witnessed.

To sweeten the deal further for key stakeholders, LIC has decided to reserve 10% of

the offering for policyholders and 0.7% for employees, offering each a discount of INR

60 and INR 40 per share, respectively.

The market leadership of the issuer, size of issuance, strategic importance of the offer

to national accounts and the shift in the 100% public sector entity status makes this

offer a matter of great significance.

3. Business profile

3.a. Business Competencies

i. Market dominance vs. global peers

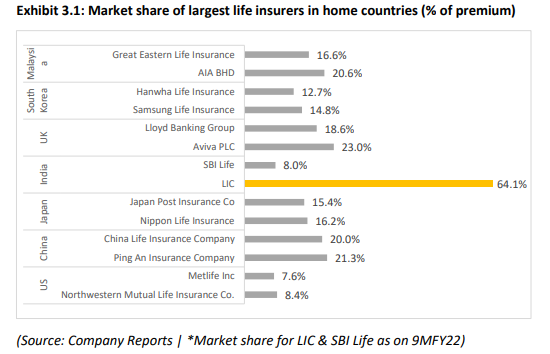

While LIC dominates a majority share in the Indian life insurance segment, the market

share is significantly greater than what dominant players enjoy in respective countries.

ii. Global positioning

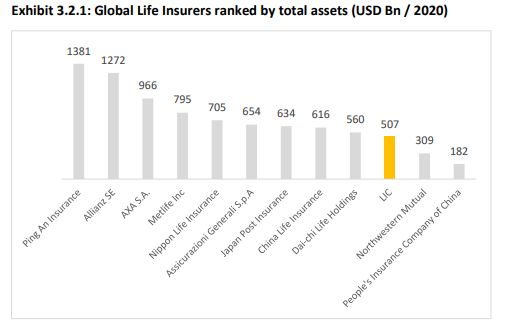

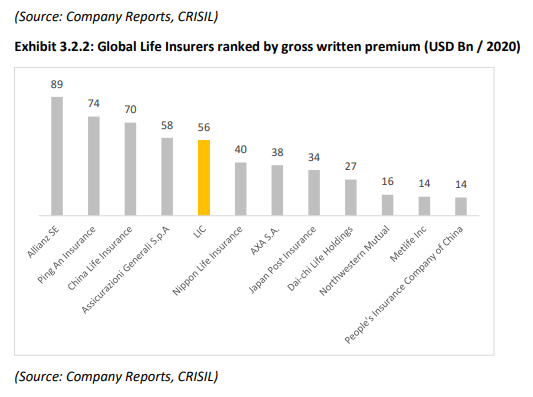

LIC ranks fifth on the global life insurance leaderboard in terms of life insurance

premium and tenth in terms of total assets.

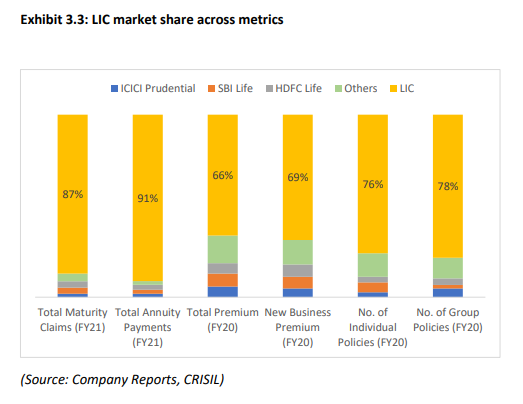

iii. Highest market share

LIC enjoys the position of the single-largest player in the life insurance segment across

parameters.

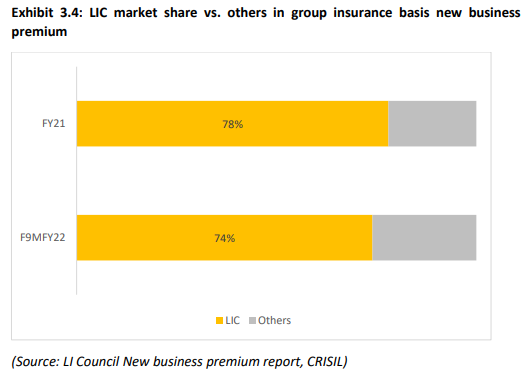

iv. Single Largest Player – Group Insurance – New Business Premium

LIC owns a majority of the group insurance segment in terms of New Business

Premium.

v. Highest network of individual sales agents with pan-India coverage

LIC boasts a network of ~1.35 million individual insurance sales agents which comprise

~55% of the total set operating in India. Through its channels, LIC enjoys thorough panIndia distribution.

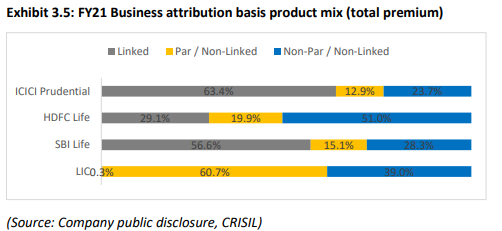

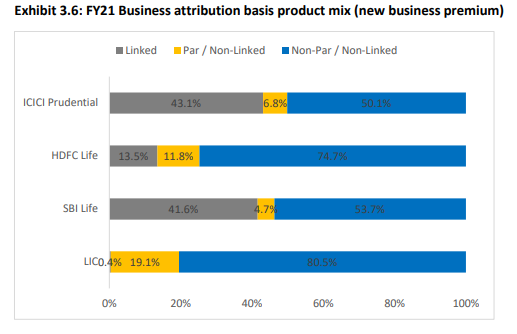

vi. Higher business attribution to non-linked products insulates against capital

market cyclicality

LIC’s business attribution basis product mix is skewed in favour of non-linked policies.

The demand for linked policies is widely perceived to be correlated with capital market

cycles. The focus on non-linked policies insulates the aggregate demand for products

significantly against cyclicality.

3.b. Business Challenges

i. Inefficient Channel Mix

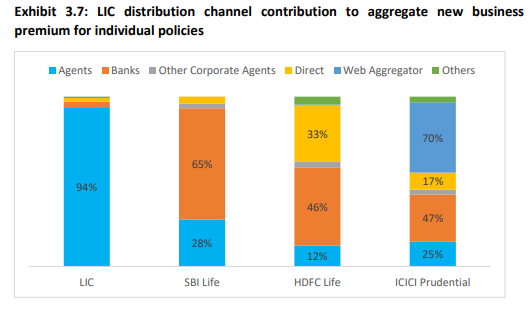

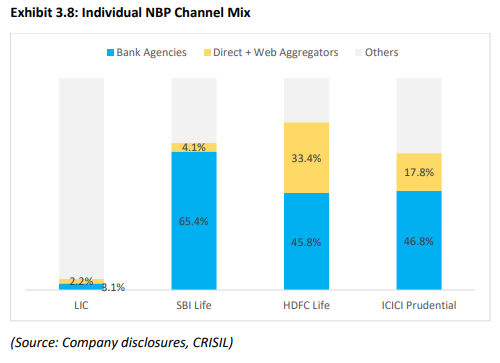

While the distribution channel mix faces the fundamental challenge of concentration,

sole reliance on a channel that is continuously threatened to be obsolete places the

distribution endeavours in a precarious situation. The reliance on individual agents is

as high as an attribution of 94% of new business premium in FY21.

ii. Weak Bancassaurance and Digital channels

Despite boasting a network of 70 bancassurance partners including eight public sector banks and five private sector banks, barely 3.1% of individual NBP can be attributed to the channel. Individual NBP through direct channel is 2.2% with contribution through web aggregators being practically non-existent. In an age of holistic banking, digital first ecosystem and increasing DIY capabilities, the bancassurance channel becomes critical to penetrate through cohorts requiring assisted sales while direct and web aggregator channels indispensable for DIY customers.

iii. High share of single premium policies

From a customer engagement, cross/upsell potential standpoint, regular premium

paying customers are ideal; at least versus single premium customers.

While single premium contribution to LIC’s individual policy NBP is high at 69.7% in

9MFY22, it is even higher in terms of contribution to total NBP at 82.5% for 9MFY22.

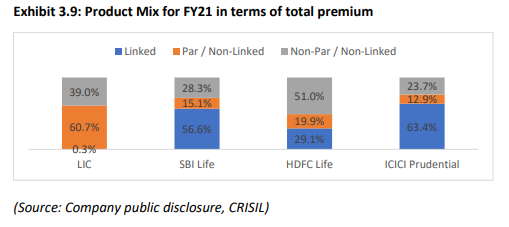

iv. High contribution of less profitable participating policies

Participating policies enable shareholders to participate in the profitability of the

insurer and by virtue of the same, exerts pressure on profitability to shareholders.

Non-participating and protection plans offer a relatively favourable margin

proposition.

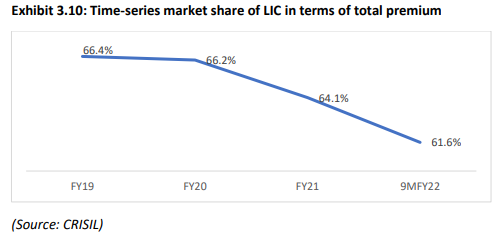

v. Declining market share

LIC has been losing market share to the peer group at a fast pace and do far, there is

limited reason to believe that the corporation will not concede market share to peers

any further.

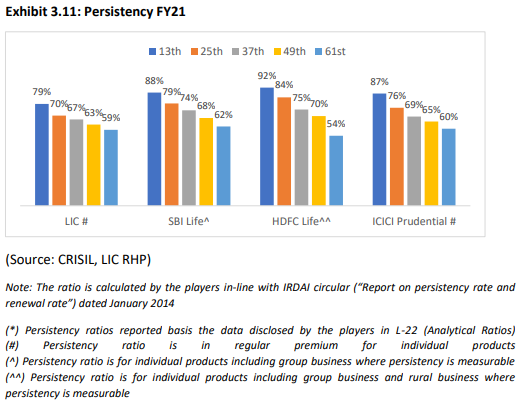

vi. Low persistency

A lower persistency would imply a lesser number of policies continuing in the books.

This challenges the ability to manage future fixed costs and have an adverse impact on

the cash flows and consequently profitability of the business.

Versus private peers, LIC exhibits meaningfully low persistency which can be roughly

translated as a challenge to the company to be able to secure renewal premiums from

customers.

4. Financial Profile

4.a. Financial Competencies

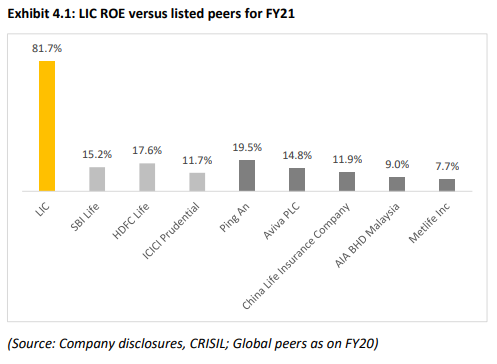

i. Relatively higher ROE

In terms of Returns on Equity (ROE), implying the health of earnings relative to

investments from shareholders, LIC returns significantly higher versus private listed

players and top ROE-earning global peers.

It is worth noting that LIC is in a unique situation and the higher ROE is largely

attributable to the unrealistically low equity denominator that has cause the ratio to

flare. Though sustainability of such a ratio post-issue is highly questionable, a

reasonable assessment of business prospects and financials lead to an expectation of

a relatively and marginally favourable ROE post-issue. Reality may be very different

from this expectation.

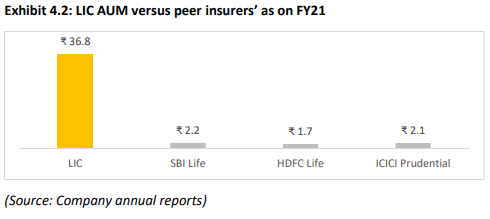

ii. Largest AUM manager

With an asset base of ~INR 36.8 Lakh Crore as on FY21, LIC stands as India’s largest

asset manager. For context, the asset size managed by LIC is ~20% higher than what

has been managed by the entire mutual fund industry as on FY21. Reportedly, per LIC’s

RHP, this amount is 19% of India’s GDP for FY21. The size of assets also contributes to

making it the largest domestic institutional investor in the Indian Financial sector with

an investment of ~INR 8 Lakh Crore in listed equity as on FY21 which could translate to

an approximate 4% share in the total market capitalisation as on the date.

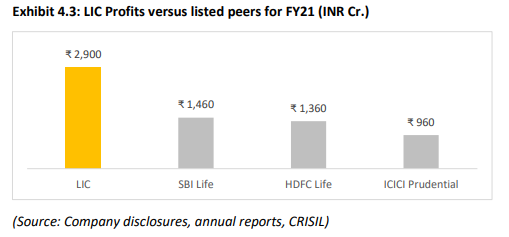

iii. Large profit base

LIC’s bottom-line is significantly larger than listed peers allowing it the ability to

allocate capital towards growth endeavours.

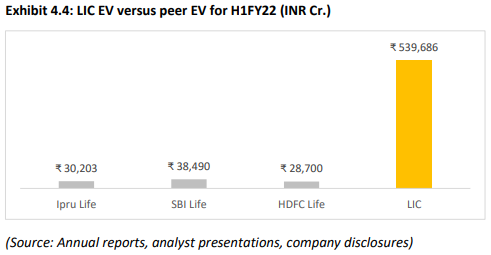

iv. High embedded value

LIC exhibits an embedded value that is significantly higher versus listed peers reflecting

a strong base of net assets and expected cash flows from value in force.

LIC’s embedded value dwarfs the same for listed peers by significant margin.

4.b. Financial Challenges

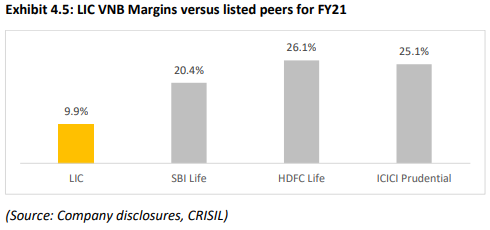

i. Relatively lower VNB Margins

LIC’s VNB margins are significantly lower versus other listed players. The same can be

meaningfully attributed to the higher contribution of endowment plans to overall

business which, by virtue of structure, carries higher operating expenses having a

direct and adverse impact on the VNB margin.

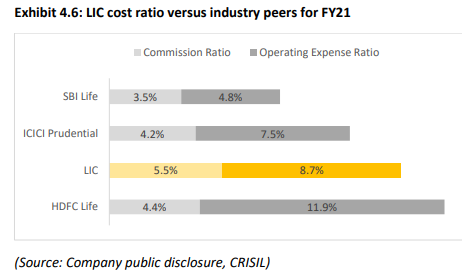

ii. Stressed cost ratio

A look at the cost ratio as an insight into unit profitability, LIC’s cost ratio is relatively

on the higher side reflecting higher acquisition and operating costs. While the ratio

may not be sufficient in isolation to derive profitability potential, the efficiency

perspective does reflect very solid promise either.

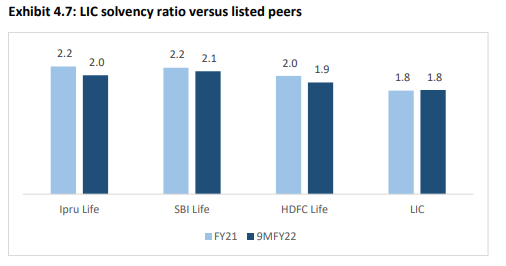

iii. Looming pressure on solvency

The solvency ratio is an indicative metric lending insight into the claim-paying ability

of the insurer. While IRDAI mandates a minimum of 1.5x and LIC is clearly above board,

others have been able to offer significant headroom beyond the mandate.

5. Additional commentary on business, valuation and public offer

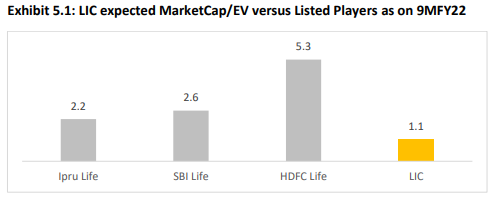

i. Fuzzy story on MarketCap/EV

LIC’s public offer is priced at a 1.1x marketcap/embedded value multiple. This sure is

significantly lower than listed peers trading at an average of 3.5x. However, it is worth

to note that there has been a significant adjustment that caused the embedded value

to jump from INR 95,605 Cr. as on 31st Mar’21 to INR 5,39,686 Cr. as on 30

September’21 – jump of almost 6x in 6 months.

The genesis of this adjustment can be found in the amendment made to the Life

Insurance Corporation Act by the Finance Act 2021 which requires LIC to have distinct

participating and non-participating funds with surpluses from non-participating funds

to be transferred to shareholders in entirety. The insurer, previously, had only one

fund with policyholders receiving 95% of profits; this will eventually move to 90% in

alignment with industry norms.

As on 31st Mar’21, the life fund was valued at ~INR 34.3 Tn which grew and split into

~INR 25.1 Tn in participating fund and ~INR 11.6 Tn as on 9MFY22.

The increment in embedded value is primarily attributable to an increase in the valuein-force (VIF). Key driver of the spike in VIF is on account of an increase in the present value of future profits distributable to shareholders. This increased mainly because of the segregation of the life fund ascribing higher distributable profit to shareholders.

The adjusted net worth has also been revised upwards due to marking to market of assets allocated to in-force covered business. This value is not necessarily required to support the covered business.

ii. The IDBI Bank angle

LIC’s ownership of IDBI Bank makes the insurer sensitive to changes in IDBI Bank’s financial position on a consolidated basis. LIC has mentioned in its offer document about its expectation that IDBI Bank may not need to raise additional capital. However, failure on part of the bank to secure funds from other sources before expiry of the RBI mandated recapitalisation period of five years may exert pressure on the insurer’s cash

flow as it will need to support the fundraise.

6. Analyst Inferences

LIC’s dominant position in the life insurance segment affords it a strong footing in

terms of capitalising on the protection gap and fast-paced life insurance adoption rate.

Its large asset base continues to be a key lever to accentuate value through capital

market appreciation. The large and diverse expanse of individual sales agents enable

a pan-India coverage ready for further penetration.

However, on the flipside, complete reliance on the individual sales channel threatens

business scalability as bancassurance takes centre-stage for assisted sales and digital

grows to be the preferred channel for savvy customers. Persistency continues to be a

challenge versus private peers given the limited span of control of individual agents to

continuously engage and retain customers. These challenges and consequent

operating inefficiencies are also captured in the high-cost ratio. In line, LIC has been

observed as conceding market share consistently to private peers. From a bottomline

perspective, the large profit pool can be attributed to size and not as much to margins.

There is scope to improve margins with a change in product mix strategy.

On a relative basis, versus global counterparts as well as private listed peers, the

valuation may seem attractive. However, it would be far from appropriate to state that

the insurer is offering stakes at a discount. Considering the state of business, financial

affairs, prospective growth and softer context, the valuation is suggested to be close

to reasonable and fair.

If the insurer strengthens its non-individual agent distribution channels and enhances

focus on high-margin products, the macro context and brand value can propel the

company’s versus where it stands.

Investors, especially policyholders and employees benefitting from the discount on

offer, can stand to benefit from longer term value creation by the insurer.