General Commentary

While acknowledging the looming risks posed by the omicron variant of the virus, the Central Bank

has decided to wait and assess the situation before jumping into policy normalisation actions.

The Governor asserted that the data reflects a promising pickup in aggregate consumption demand

led by rural India owing to a stronger comeback of the agriculture sector. Reduction in excise and VAT

on fuel prices is expected to support demand. While prospects of economic activity are steadily

improving, private consumption is still below pre-pandemic levels. The sluggish present state of the

economy and private consumption warrants continued support for durable recovery.

The Central Bank has stated that it holds strong buffer to manage global spill overs and inflation is

broadly aligned with targets. The Governor asserted confidence while stating that the Central Bank is

better prepared to deal with the economic ramifications of the pandemic.

The RBI will release a discussion paper on charges on digital payments. It is to also launch Unified

Payments Interface (UPI)-based Feature Phone Products. Further, UPI caps for gilts, retail and IPOs are

to be enhanced to Rs 5 lakh

Stance & Rates

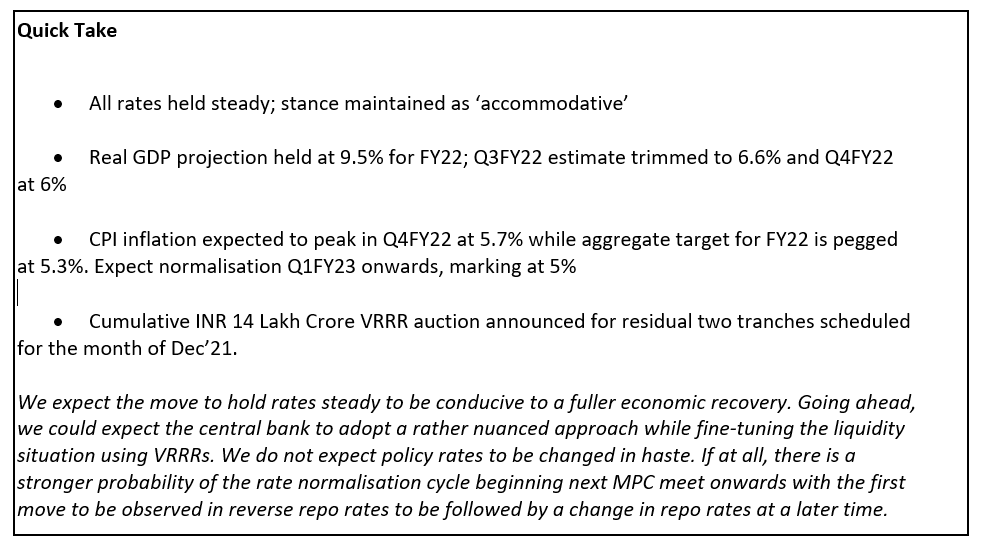

The committee has voted 5:1 in favour of a ‘accommodative’ stance to revive and sustain economic

growth on a durable basis.

Policy rates are held steady for the ninth consecutive time. Repo pegged at 4% and Reverse Repo at

3.35%. Marginal Standing Facility and Bank Rate also held steady at 4.25%.

Projections

RBI’s projection for real GDP growth remains at 9.5% while projection for Q3FY22 trimmed to 6.6%

from 6.8% and Q4FY22 trimmed to 6% from 6.1%.

Headline inflation expected to peak in Q4FY22 before normalising thereafter. Target CPI inflation for

FY22 pegged at 5.3%. CPI inflation expected to be around 5.1% in Q3FY22 and 5.7% in Q4FY22 before

settling around 5% through Q1FY23.

CPI inflation excluding food & fuel since Jun’20 remains to be a policy concern with the increasing

probability of input cost pressures to be transmitted rapidly into retail inflation.

Actions & Exercises

RBI remains committed to maintaining an accommodative stance for as long as the economy needs it.

At the same time, it will be open to proactively utilising Open Market Operations tools and operation

twist as and deemed necessary.

RBI will re-establish 14-day VRRR auction as the go-to liquidity management exercise. VRRR target was

pre-announced to be pegged at INR 6 Lakh Crore by 3rd Dec’21. The Central Bank has also been

conducting 28-day VRRR auctions and has expressed that going ahead, 14-day VRRR operations will

be complemented by longer duration auction programs with size and maturity being decided basis

continuous assessment of evolving liquidity situation.

TLTRO (targeted long-term repo operations) will continue till the terminal date. It is proposed to return

to normal dispensation under the MSF window. Banks can dip into two percent of NDTL with effect

from January 1, 2022, as against three percent now. Banks will be allowed to make a one time

prepayment.

The Governor shared targeted 14-day VRRR auction sizes as INR 6.5 Lakh Crore on 17th Dec’21 and INR

7.5 Lakh Crore on 31st Dec’21. He also stated that going ahead, Jan’22 onwards, liquidity absorption

exercises will be primarily through the auction route.

Our Take

Though largely anticipated, the decision to hold rates steady reflects the Central Bank’s commitment

to economic growth. The announcement is expected to accentuate confidence among economic

participants and trigger a stronger spirit tuned for recovery.

We expect the Central Bank to face pressures for policy normalisation sooner than later if risks such

as global policy normalisation, beyond expected fuel-led inflationary pressure, accelerated demand led

inflation materialises. The Central Bank has asserted that liquidity management would be done

primarily through use of auctions. However, if a risk-induced situation materialises and warrants a

policy rate action by the next MPC meet scheduled February 2022, we can expect the Central Bank to

first modify the reverse repo rate and wait before it amends the repo rate.