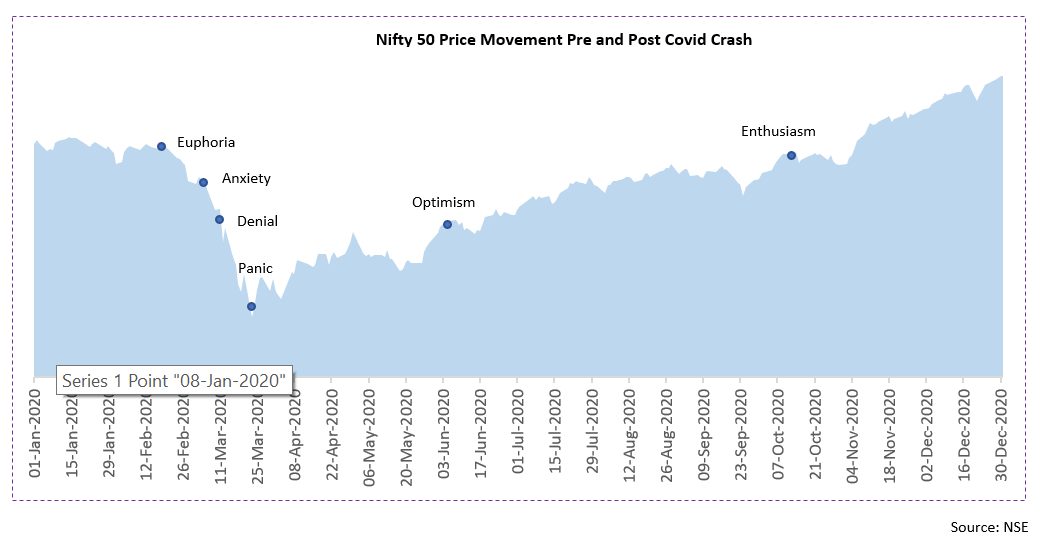

Regardless of how disciplined, people often make financial decisions that are influenced by behavioural biases that cause them to act on emotion or make mistakes processing information. This is the basis for behavioural finance, a field of study that combines psychological theory with conventional financial economics. Behavioural Finance argues that there is some financial phenomenon which can be better understood using biases where agents are not fully rational. The charts below indicate various emotions that comes to an investor’s mind during a volatile phase. Here there are different biases playing out we will try to have a look at some of them.

Over-Confidence Bias:

Overconfidence bias is a tendency to hold a false and misleading assessment of our skills, intellect, or talent. In short, it’s an egotistical belief that we’re better than we actually are. Over-confidence bias can arise from over-confidence of ranking, timing, control etc. Finally, it is of 2 kinds; Over-confidence in the decisions you make and over-confidence in the information you receive.

Impact: The impact of over-confidence bias in the decisions you make is to lose money by making more trades and being more confident of yourself. Over-confidence in the information you receive can lead you to blindly take positions which might be based on false facts, thus giving a rise to potential loss.

How to avoid this: You can avoid this bias by relying more on data and less on hear-say, by diversifying to minimise risk from one asset class, not be too emotionally involved in a particular stock and focusing on the changing fundamentals.

Loss-Aversion Bias:

The Loss-Aversion Bias means that people feel more pain from the same magnitude of loss when compared with the same magnitude of gain i.e., investors try more to avoid losses rather than making gains.

Impact: In a portfolio, loss aversion arises in a few ways, including large cash allocations (in the fear of making wrong bets), holding onto losing positions (in order to not realise losses) and lastly, panic selling. For example, a study found that in 2018, a year that saw two sizable market corrections in the global markets, the average investor lost twice as much as the S&P 500 Index. While many of us are long-run investors, it can be necessary to “cut our losses” with an investment that has had changes to its outlook. Unfortunately, even when fundamentals or new information suggest it’s time, loss aversion means it can be difficult for investors to sell and realize the loss.

How to avoid this: You can avoid this psychological trap by following a particular strategic asset allocation strategy. Losses and Gains should be looked at and weighed equally. Lastly, it is essential to always see the bigger picture and by that we mean you ultimate financial goal while investing and see how well the investment fits into that.

Hindsight Bias:

Hindsight bias is a psychological phenomenon that allows people to convince themselves after an event that they had accurately predicted it before it happened. This can lead people to conclude that they can accurately predict other events. The investor becomes convinced that they saw it coming. A very famous example of this bias is the 2008 financial crisis or the dotcom bubble of the late 1990s. If you talk to many people now, everyone knew it was coming due to the signs. However, if you examine the history, you learn that analysts or investment professionals who were screaming that there was a problem at the time weren’t listened to, in fact, they were laughed at and investors largely ignored their warnings. A very popular movie by the name of “The Big Short” has also highlighted this.

Impact: Financial Markets are very complex and a belief in having predictive powers can be very costly for the investor. You tend to evaluate the result more than the process and over-look a few other key important factors. An investor may also start taking risky positions because of this bias thus putting his corpus at a huge risk.

How to avoid this: An investment diary, comparing outcomes to the reasoning behind our investment decisions, is a good way to keep this hindsight bias in check.

Recency Bias:

Simply put, it means that humans favour current events over historic ones when thinking about what may lie ahead in the short run. This is one of the most important and popular bias that exists in the financial world. This bias is what creates trends and bubbles in the markets. For example, investors expect growth stocks to outperform and they keep the demand of such stocks high and thus prices rises creating a bubble. After the dramatic market declines in March, many investors expected markets would continue to fall.

Impact: The impact of this bias is that people tend to think in a very short term approach which might hurt their investments. One sector which has outperformed others in one year, may not do that again in the next year. Investors tend to forget and over-look other factors which might affect the investments. Short-term market moves caused by recency bias can sap long-term results, making it more difficult for you to reach your financial goals.

How to avoid this: To combat recency bias, investors can take a broader view of how markets tend to move over time and the larger trends that may have the biggest impact on their investment returns.

It is essential to understand the common biases that may affect your decisions and find the best way to combat them to minimise their effects. One should always focus on the process and their personal financial goals in the long run. Investing smartly doesn’t necessarily require a high IQ but it does require control over your emotions and patience.