Gold’ shine has allured attention since the beginning of time, meriting psychological comfort in times good and bad. The belief in Gold segued into it defining the monetary landscape during the gold standard era

In “The Great Partition: The Making of India and Pakistan”, a Sikh woman, Taran, relates how her mother took all the gold and tied it in handkerchiefs and distributed it among different family members for safekeeping. We did not know where each of us would end up – this gold was our security.

The visible blind-belief in Gold as safe-keeper has been preached as much as practiced in times of stress. The notion paints Gold as the de-facto investment of choice in times of economic or health turmoil due to its resilience and relevance vis-à-vis peer asset classes.

The graph below highlights Gold’s out-performance vs broader asset classes across times of pain:

Covid-19 marred the markets with pessimism even as equities blazed past the 15,000-mark mile-stone. Community conservatism increased investor appetite for arresting downside risks, with subsequent preference for asset classes with similar qualities.

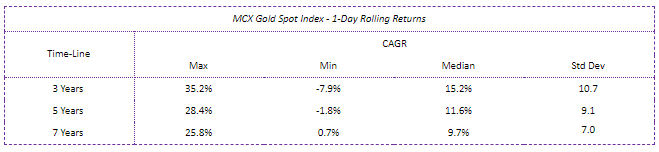

In an almost rehearsed maneuver, Gold took to the limelight once again. The table below highlights why:

Gold’s ability to navigate volatility increases sharply with longer tenures as is visible from the table. The metal sees a ~53% reduction in its standard deviation when held between three and seven years!

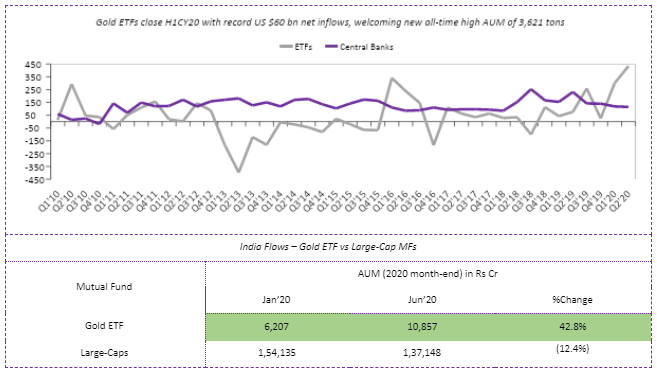

“In market’s, anything can go wrong, and usually it almost always does” is one mantra which explains the affinity for ‘yearn-for-yellow’. Gold draws commendable demand merit in participants choosing to be safer than sorry. The same was during the inception of the epidemic as in spite of overall dropping decadal demand, 60%+ of the world rushed to accumulate the safe-haven asset with Indian diaspora following suit.

The graph below highlights the same:

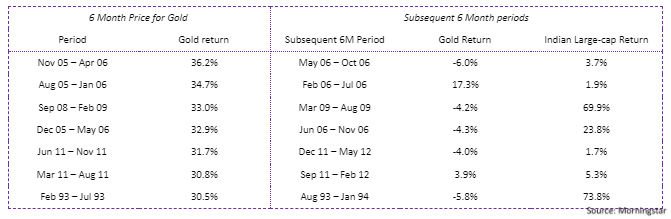

A key reason for latching onto gold in times of comforted equities, is the observation of the latter’s rally in the months to follow. On a portfolio level, the investor not only bottlenecks his fall but also is poised to maximize the upside when the opportunity strikes. In fact, research shows Gold and equities enjoy low correlation (-0.5 <-> 0.5%) when studied over the 30 years on a 3-year rolling basis.

The table below shows how normalization in economy can benefit those who diversify across asset classes:

The severity of the fall often makes for very lucrative points for Indian equities. As an example, there have been 2 instances in the past when the Index corrected by >50% only to deliver ~2x gain in the subsequent years.

In so far, it is abundantly evident that Gold should hold allocation in your portfolio per your risk-return profile. As you look to sourcing some the metal’s shine for your portfolio, you will be inclined to ask yourself If the now is the right time. (Side-note, all time’s the right time. It is the time in market that’s worth counting)

Well, the note has you covered on this front as well.

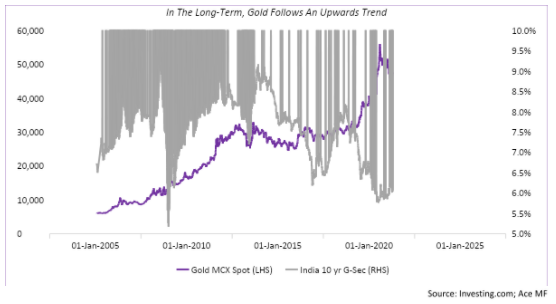

A key factor in determining Gold’s demand is the prevailing interest rates (it prints the cost of holding the shiny asset) and the economic situation (harsher climates call for higher demand)

Let’s see where we stand today on both fronts:

- India’s central bank is framing policies on the back of a sleuth of rate-cuts in the year past, squeezing inflation and fiscal discipline to oil country’s growth gears

- India’s economic situation is very tender as rising Covid cases, vaccination diplomacy and oxygen supply abruptions dampen hopes of quicker recoveries. The instability in the core sectors, and manufacturing and industrial indices reflect the same.

In accordance with the aforementioned, the chart below shows how Gold has performed across the variety of interest rates the country has seen over the last 15 years:

With conformity on why you should include gold and if now is the right time, the next and decisive step raises question regarding the buying approach. It is almost always advisable to enter the markets in a calibrated manner. But with Gold, a lumpsum approach is touted for by the majority. All we echo in the market’s chambers if for participants to accumulate more quantities of an asset class in times of dips.

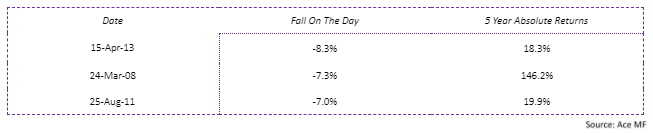

The table below shows buying gold in times of dips has worked well for them over the longer time frame:

In addressing actionable, it must be noted that a sole-Gold portfolio can have investors questioning their risk-return metrics across bull-&-bear markets. Quoting Warren Buffet’s thoughts on Gold, he says,

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head”.

As we are limited by our capacities in copying the investing legend’s techniques, it is advisable for you to have up to 15% allocation of the precious metal in your portfolio.

Remember, uncertainty and speculation go hand-in-hand. And hey, there’s a reason we say “Old Is Gold”! Hopefully with this note, we now know why.