One common question that has remained in the mind of market participant’s irrespective of their time and investment habits at its core is:

Where will the markets go from here?

We don’t know.

You don’t know.

Nobody knows.

Those who say they know, definitely do not know.

Ideally, the longer the time spent in the markets, the harder it becomes to answer this question. Hence, knowing that this question has no right answer is the real and rewarding answer.

So, if markets have made new all-time highs every financial year, one can expect that why will not they make another high in next financial year.

Statistically speaking, it is more probable for market to breach new highs next year than not!

So, Which Is the easiest strategy to adopt in times like these?

Systematic Investment Plan (SIP). Yes, SIP can work in today’s markets. Rather, it is an effective tool of investing when markets are near their apparent peaks.

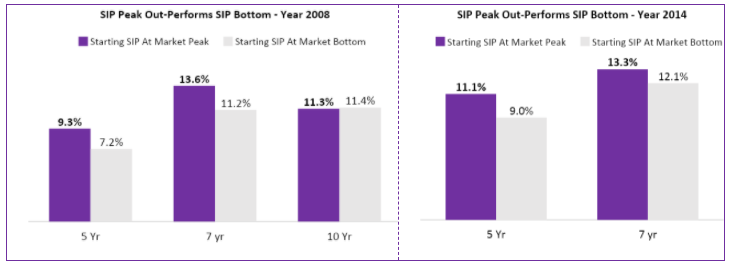

The graph below shows how SIPs performed in the past if initiated at peaks vs bottoms:

As is seen above, SIPs started at a yearly high, out-performed investors who are trying to “time” the market, and marking their entry at bottom level. The time-lines shown above were wrought with frenzy, carrying similar uncertainties regarding market’s near-&-long term growth.

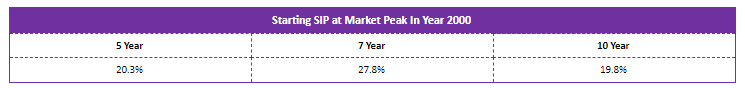

In fact, the same was seen in Year 2000, where SIPs started at peaks delivered lucrative returns to investors. The table below highlights the same:

Another key observation that we can draw from the numbers above is the impact of early investing. Earlier you start, higher is the benefit accrued from the magic of compounding.

Investor Takeaway:

As is widely acknowledged, no one can accurately predict what the next market high or bottom will be. However, empirical testing suggests that SIP can help investors recognize market’s potential via active participation even when participants are left blindfolded by their own admissions. So, don’t worry about where the markets are headed, as long-term investors are the only real winners in the Indian markets.

We actively suggest you to start your SIP today in funds which suit your risk-return profile and help you maintain your required asset allocation.

As always, we excitedly await to hear from you.

Till next time, wish you a happy weekend.