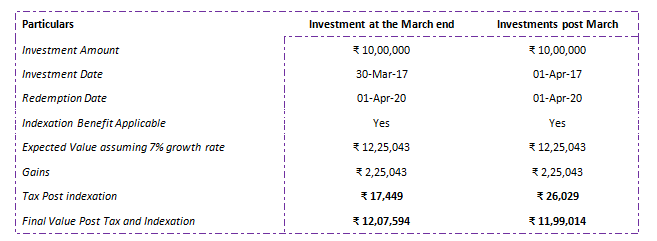

Debt investments are recognized for their tax efficiency vis-à-vis traditional investment instruments. Qualifying as a tax-savvy structure on passing of financial year, you can get 4 Indexation benefits by 1 timely debt fund investment. Here’s all you need to know & do for the same:

- Long term capital gains (holding period of over 3 years) from debt mutual fund schemes are taxed at 20% plus applicable surcharge and cess with the benefit of indexation.

- Government notifies Cost Inflation Index (CII) for each financial year taking into consideration the prevailing inflation levels

- The cost of purchase for computation for tax is adjusted for inflation using CII, thereby reducing the capital gains from tax perspective.

- A debt mutual fund investment near the end of financial year (March 2021) with holding period of >3 years (April 2024) makes you eligible for CII application for >5 financial years, resulting in 4 indexation benefit.

You can avail 4-indexation benefit, if you invest in the required manner on or before March 31,2021 and redeem during FY25

Note: Above table is an illustration. Investors to be aware that fiscal rules/tax laws may change and there’s no guarantee that current tax positions may continue indefinitely.

You May Consider Opting For Debt Mutual Fund Schemes Right About Now.