1. We Went Local, Its Now Time To Go Global

The government’s focus on Atmanirbhar Bharat for manufacturing, is an import substitution policy which will allow Indian manufacturing to acquire its rightful place. Rapid economic growth needs an export strategy that goes beyond mere incentive schemes.

It is necessary to identify sectors which has a comparative advantage or can acquire one. Non-financial and financial measures may help the identified sectors to get geared up for export. Also, identification within global market where the countries are net importers for particular product, commodity or services needs to be done. As it is an objective of India to be net exporter.

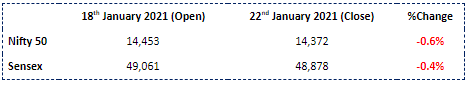

2. The Fear Of Flying At Mountain 50K

Flush with liquidity, the stock markets are at a dreamlike high. But the worries are also mounting. Many feel the gains have come too fast. With scores of new investors entering the bull market late, and with the cream of the rally behind, further gains are not going to be easy.

The cost for the dollar is low and, the liquidity is anticipated to flow into emerging markets. In such times, asset allocation plays a vital role as it seems valuations are high and a worrying scenario.

3. Indians Bargain With Selves As Businesses Bid Adieu

The slowdown in spending by Indian households (HH) through the lockdowns has resulted in US$200bn ‘extra’ net savings in financial assets-and as a percentage of GDP closet of the peak seen post-GFC.

Household savings kept in hand or in saving schemes will be like lazy money getting accumulated in accounts. The same savings should be moved to appropriate product by considering asset allocation and risk appetite. After all, It’s not how much money you make, but how much money you keep and how hard it works for you

4. RBI Polices Policy Rates

Liquidity operations to be restored to normalcy in a phased manner as RBI takes ₹2 trillion from banks at the first variable reverse repo auction. It is expected to result in short-term money market rates rising by 15-20 bps.

Short term G-sec yields have softened considerably since the lockdown due to huge liquidity infusion by the Reserve Bank of India. But G-sec yields at the long end have been quite stubborn due to record high borrowings programme by the government. This stance may help to soften G-sec yield in the long-end of the curve.

5. World’s Biggest Vaccine Manufacturer Initiates Its Export Drive

The shots developed by UK-based drugmaker AstraZeneca and Oxford University are being manufactured at the Serum Institute of India, the world’s biggest producer of vaccines, which has received orders from countries across the world.

Post vaccine roll-out within the nation, India is set to respond the supply request from other countries. Supply of commercially contracted quantities will result in revenue generation for healthcare sector.