Markets have welcomed 2021 with post-covid euphorias as is reflected in it crossing the 14,000 mark for the 1st time since inception. Looking at markets today humbles the realization that we are less than 2 months away from India’s Covid-lockdown anniversary. As the markets look ahead to 2021, it is sound for investors to realize where and how we stand today.

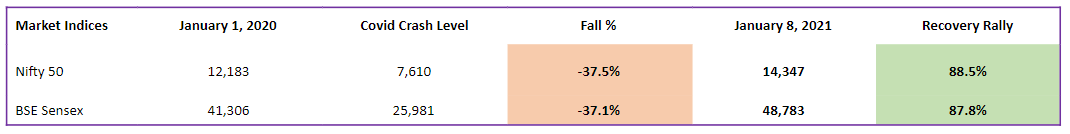

To put market returns in context, read the table below to visualize the bounce-back in Indian markets amidst the world’s biggest health crisis:

The bumper returns are a culmination of many direct and indirect events within and outside country borders.

The fast-paced bullish sentiments which have carried markets so far are now on the brink of welcoming yesteryear-like conservatism. The intensity in rebuttal of markets has taken participants by shock, with many questioning further buying or booking profits.

To investors who fall in this basket, we say to act not out of inferences but out of information.

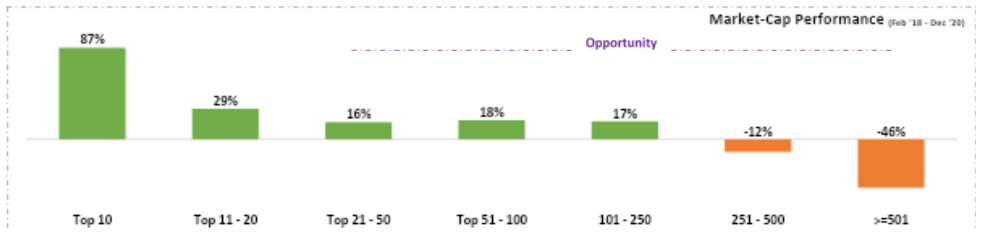

In addressing the biggest current concern of market sustainability, look at the chart below to scratch your market performance itch:

As is observed above, post 2018 market fall, market rally has been concentrated and led majorly by growth stocks. Going forward, the market rally is expected to be more broad based, courtesy of expansionary policy measures by global central banks, and other covid solution practices.

To put it simply, most of the market growth that we see today has come from a handful of stocks in adhering to the “big gets bigger” principle. As we near the exhaustion of the too-big-to-fail syndicates, Indian markets will expectedly fall on the performances of the mid, small and micro institutions. Wider inclusion across market-caps will not only reduce dichotomy between markets and economy fundamentals but also reflect true health & wealth of the sync between them.

The fact in growth being pegged to sans-large indices is clearly reflected in figures of the remaining muted market-caps, in their evolution of garnering relevant investor attention.

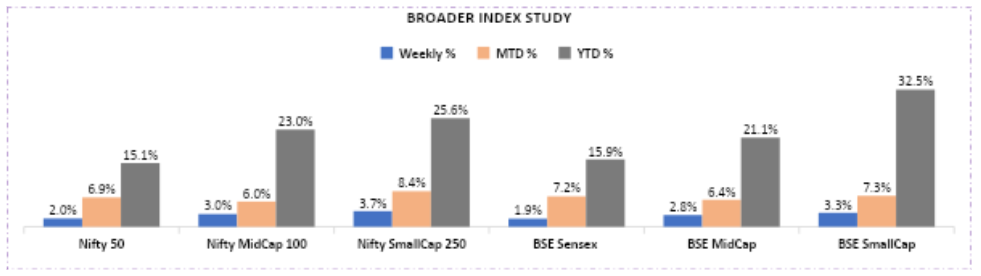

The graph below shows the calendar year return of major indices across Nifty & Sensex benchmark in calendar-year 2020:

As can be seen above, the Mid-&-Small cap indices have outperformed their large-oriented counterparts.

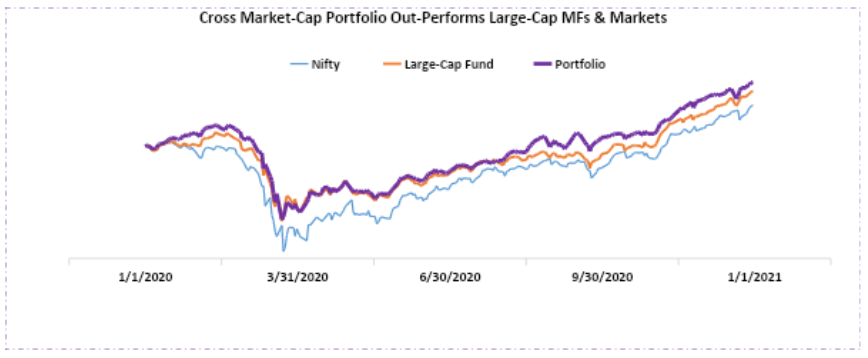

In fact, investors who were diversified across market-caps in their portfolios saw stronger performance vis-à-vis Large-cap MFs and broader markets.

The graph below highlights the same:

The funds taken into considerations were uniform across 1 AMC, with portfolio equally diversified across all market-caps. In numbers, following were the calendar-year results

- Portfolio delivered absolute return of 23.0%

- Portfolio delivered alpha of 3.2% vs Large-Cap fund

- Portfolio delivered alpha of 8.2% vs broader market index

Investor Takeaway

Markets are a tool for investors to learn-&-earn. It has and always will be the case. The 1 commonality it has enjoyed across the many crisis it has faced in years past is its long-term outcome, which is an upward sloping curve.

However, returns have rarely been this visible as the markets have rarely been this polarized. In capturing the growth that lies ahead, it is advisable for investors to diversify their equity portfolios across market-caps and not arrest upside potential by favoriting 1 segment of the market.

The degree of exposure of to mid-&-small segments should be done via your risk-return appetite. Those wearing a higher risk profile should look to aggressively expand flavor profile across sans-large indices and vice-versa.

For those thinking, mid-&-small cap indices are risky, let us remind you of how your portfolio is probably exposed to only 1 market segment, thus making your portfolio riskier than you would like it to be. Especially when that segment has delivered to the fullest and more.

Remember, Diversification is important not only across asset classes but within them too.

If you wish to share your opinions, do write to us. As always, we excitedly await them.

Wish you a happy weekend