2021 is here, and markets have welcomed it with bang by closing on all-time highs!

After a curfew-induced new year, India looks to new unlockings to hold the “Fastest Growing Economy’ title. As market’s dichotomy vis-à-vis underlying fundamentals wears a wider spread, all investors wear 1 question – “What’s In Store For 2021?”

While no one can give an 100% accurate answer, we can help you reap, not repeal, market potential that lies in front of us.

In setting the tone of the note, let’s have refresh market’s behavior to the doings in the year:

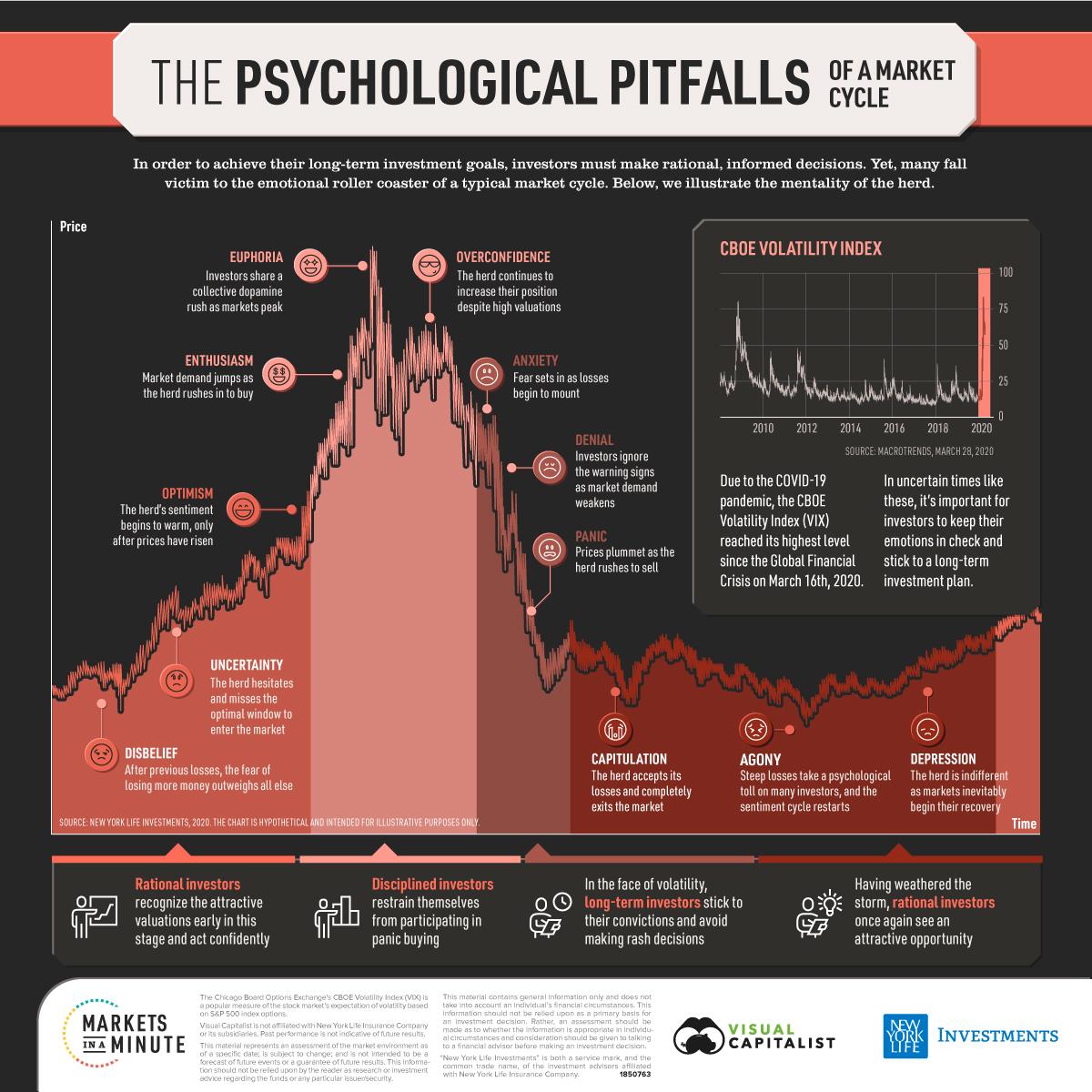

The markets have danced to its tunes as its wavelength jumped between pitches (High = Good, Low = Bad). From being shell-shocked in Mar’20 to excited elevations as of date, the markets tested investors across behavioral and buying patterns.

A vintage lesson found new voice as we observed how buying behaviors were a result of emotional biases rather than a self-actionable.

Enjoying a direct co-relation, impromptu investing was a common theme seen across markets in CY2020. In attempt to categorize client behavior, we present the graph below to help you understand how emotions play out under different market scenarios:

The volatility seen in Markets (VIX all-time high, wealth phoenix) brought forth a host of emotions, which are all encapsulated in the above graph. While many hold conflicting thoughts about where stand today, all market participants agree to erring on the emotion tagged to particular phases of the market cycle.

Legendary investor Charlie Munger has said the one persistent challenge investing will face for perpetuity is natural feeling-laced perception-based money actionable. Calling for “Delayed Gratification”, he spearheaded the development of sans-emotion investing.

In fact, the seriousness about being “emo-&-ego”- deaf when investing is heralded by institutions and individuals alike.

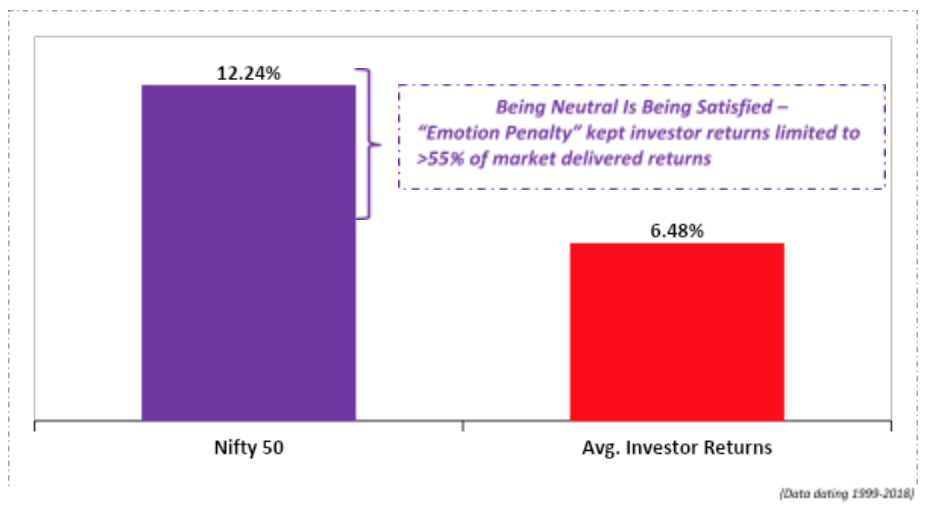

India’s National Stock Exchange (NSE) had conducted a survey named, “The Emotions Erosion Principle” wherein they touted reduced realized investing returns for participants, courtesy of spillover emotions.

The graph below highlights the concept of “Investing Gap” which is in essence a penalty levied for bubbling behavioral patterns:

Today, most investors are guilty of ‘unclean’ investing by wrapping their portfolios with hinges of pulses. The 1st and biggest lesson we can learn from 2020 is to master the skillset of avoiding faux-pas’ arising from frantic feelings.

Investing is a long-term activity, and hence should be practiced in a similar manner. The only time a portfolio requires manual intervention is in 1 of the following situations:

- Change In Investment Objectives

- Change In Risk-Return Profile

- Re-set Asset Allocation

Amongst the aforementioned points, Asset Allocation is a charter investing principle with disciples in the greatest investors of all-time.

2020, from an investor’s perspective, has not been shy of volatility, drawing parallels to that of a roller coaster ride. These temporary (read as: contingent) and temperament-testing swings on the downside across global and domestic markets, has witnessed wealth preservation become the flavor of investments, over wealth creation

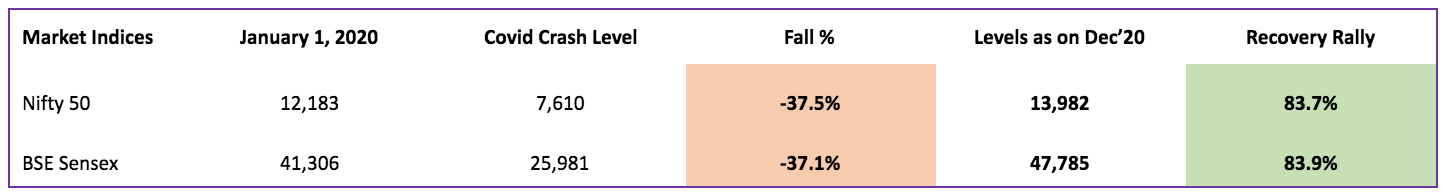

The case study for asset allocation is evidently clear from the journey of the 3 broad asset classes in calendar year 2020. The same is shown below:

Equity

- With VIX levels touching all-time highs in 2020 and no respite in sight, investor wealth saw massive erosion in the first 6 months of 2020

- However, external weaknesses with internal strengths have pumped euphoria onto markets elevating levels to trading at ~14,000 levels today!

Debt

- The IL&FS crisis in late 2017, spelt doom for our shadow-banking industry, a key proponent for helping India achieve the $5 tn economy mark by 2025.

- The DHFL fraud, further augured feelings of discomfort in the debt industry with MFs not willing to roll debt or issue fresh CDs without adjusted risk premiums.

- This lead to a chain of by companies, casing one global fund house to close 6 of their prime debt funds, in recent times.

This clearly shows why risk-averse investors should not compromise on credit quality to realize growth, but stick to AAA/AA rated papers, or look into the likes of “risk-free” Govt. papers

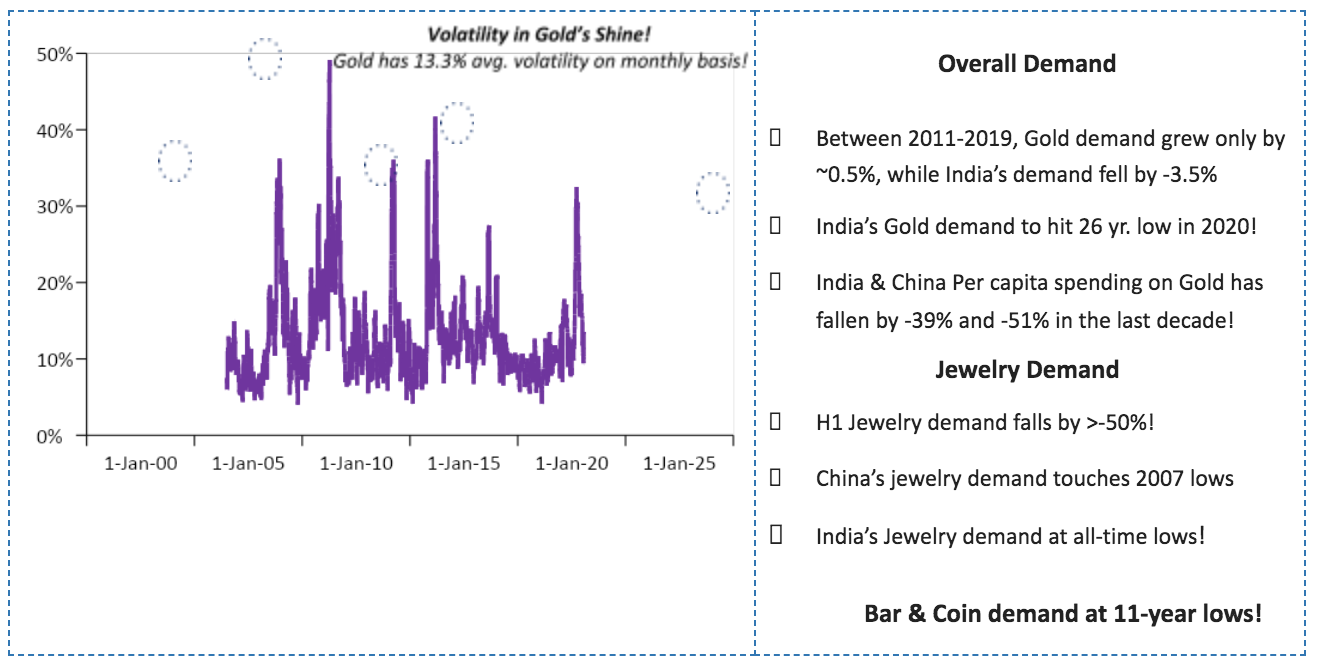

Gold

Gold lived up to its merit of being a safe-haven asset touching all-time levels. Converting ‘Cry’-sis into Currency, metal saw highest ever inflows on record. However, It too has its rusty elements. The same are shown below:

Gold’s attractiveness as an investment case tends to be weaker during healthy economic periods, in comparison to other asset classes

As can be seen above, all asset-classes are riddled with risks. Investors overweight on either asset class can misalign their risk-return metrics. The calendar-year returns for the same shown below:

2020 markets saw mini bouts for particular asset classes contingent on developments and un-developments. The call for asset allocation stood ground when extremes in allocations became widely visible.

Tailored, actively managed, rightly allocated portfolios made the best of markets in up and down trends by systematically managing portfolio exposures.

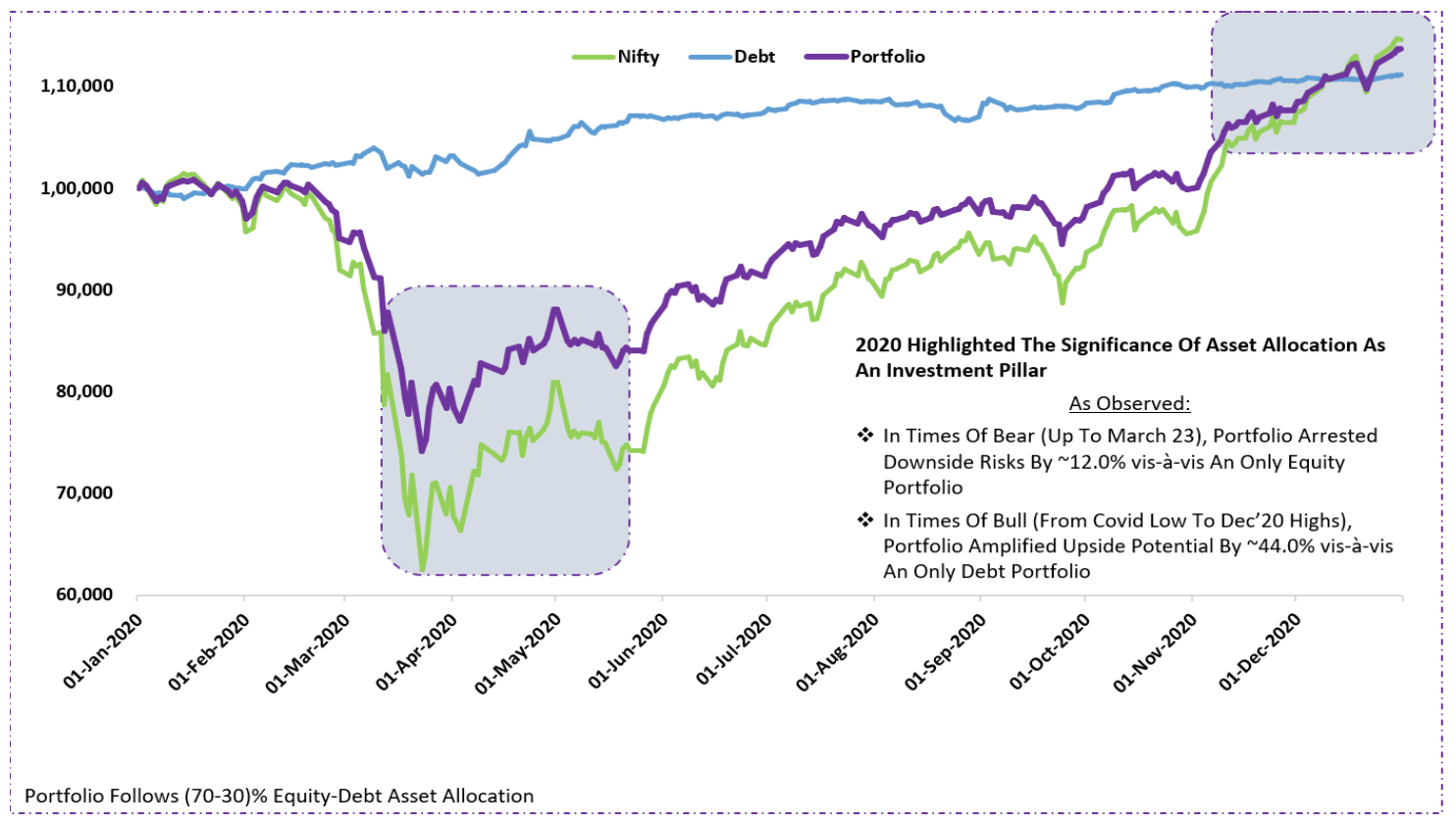

Below graph highlights how moderated and modulated custom portfolios fared vs 100% asset exposed funds:

Shuffling between conservatism and optimism, revived interest in Gold as an investment avenue, pushing it to deliver 2x returns vs equity stocks!

As observed:

- Gold Out-performed Equity by ~43% when covid malaise the markets with its viral virus

- Gold Out-performed Debt by ~13% in the recent run-up of markets, courtesy favorable SWOT analysis

Kick this year off by being more prudent and emotion-savy so you let your portfolio reflect your true objectives.

And next time there is a fire sale, remember Warren Buffett’s words, “Be fearful when others are greedy and greedy when others are fearful”

Investor Takeaway

Psychologically the human mind is designed to be risk averse. The pinch of losing almost always trumps the ecstasy of winning.

Asset Allocation is an umbrella risk investment, for it acts as limiter in practice and as Balm to anguish!

You can’t control market volatility, but you can limit its effects on your portfolio. Think of Multi-asset as antibody for inflated risks. The note has brought forward the inherent risks every asset class carries… Individually. Clubbed together paints a different picture, one which is risk-efficient from the get-go.

Be it books or speeches, sound asset allocation merits a special mention when talking of investing!

Wishing you a Happy New Year, lets get our money working for us this year.

Do write to us if you wish to share your thoughts.