Markets today are viewed as dichotomous vis-à-vis, the underlying economy. The statement rings loud as the former hovers near All-time Highs, while the economy is in the process of growing fresh legs.

The uncertainty in economy is not fully reflected in current muted market volatility (75% down from march highs), which is part-&-parcel of cyclicality observed in both counterparts.

It is this cyclicality which presents lucrative investment avenues from a top-down approach based on healthier and wealthier macro inputs.

Direct beneficiaries of broad-based growth are set to be domestic micros, i.e, equities. Hence, as India looks to become global engine of growth with supportive external & internal environments, the ICICI Business Cycle NFO launches at an opportune moment with intent of maximizing upside potential.

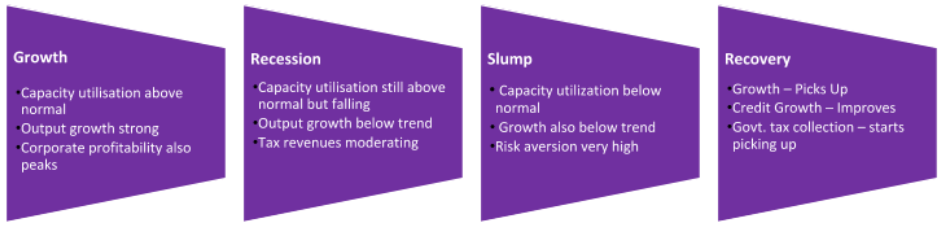

Before we jump into the state of economy and its underlying, lets refresh our understanding of economy cycles:

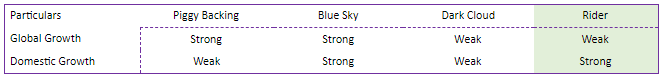

As India shifts gears between Recovery and Growth, business cycles and sectors re-affirm their growth trajectory by monitoring of data on frequent basis.

A few key features seen in Indian economy today to characterize its position as a rejuvenating economy are as follows:

- Spikes In Business & Consumer Confidence

- Pick-up in Factory Capacity Utilization

- Business Plan Expansion

- Employment Count Sees Fresh Strength

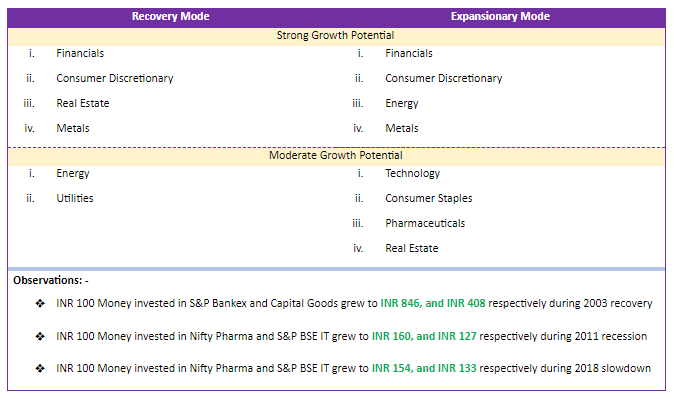

As economy has completed multiple cycles over time, observations show how select sectors enjoyed positive correspondence with the latter across its different moods.

Th table below highlights which sectors can reverberate well with current state of Indian economy:

Knowing which sectors can do well across different phases holds value only when the current state of economy is read in right manner.

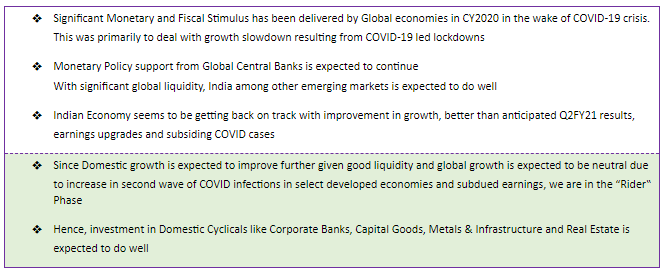

The table below highlights the state of current market scenario:

India’s ability to grow is shared by foreign institutions and individuals alike in facts and figures.

- In figures, Agencies post their growth expectations for India to be one of the quickest in immediate future, if not the quickest.

- In facts, FIIs have pumped in record monies in the FY21YTD.

-

- When looking the inflow/outflow ratio circa FY2020, India leads the pack at 72% FII flows, thus outperforming the 2nd by ~2.5x multiple!

-

- When charting the H1FY21/H1FY20 FII flows, India again tops the ranks by registering a ~650% growth, thus outperforming the 2nd by ~5.5x multiple!

Few other factors in harmony between Govt. & Central Bank, Very Low Interest rates (150 bps+ rate-cut in FY21YTD), & Declining Covid count makes for a strong case for macro-oriented business cycle–centric investment approach.

The versatility in capturing growth via aforementioned approach is broad as it helps shuffle sector allocation based on forward-looking data rather than historical data.

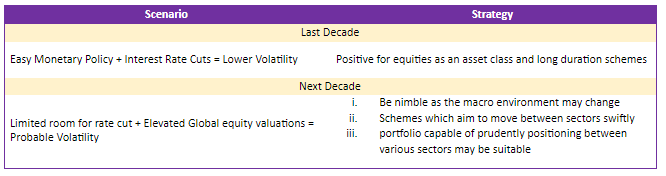

From a decadal POV, the strategy can help generate alpha courtesy of the expected global and domestic investment climate. Table below highlights economical summary:

Knowing of the potential ahead must have excited the investor in you. Well, ICICI Prudential MF brings a fund to align your portfolio’s growth with that of the newest fastest growing economy in India.

ICICI Prudential Business Cycle Fund

ICICI Prudential Business Cycle Fund aims to identify and invest in opportunities across sectors/themes/market-caps, based on prevailing business cycles.

- Investment Approach is construed of pure top-down approach based on macro indicators – inflation, growth, deficit, etc

- Security Selection is undertaken post identifying sectors based on the Business Cycle from the Nifty 500 TRI index.

The investment strategy will follow 4 broad themes to amplify upside and arrest downside across investment tenure. The strategies are shown as below:

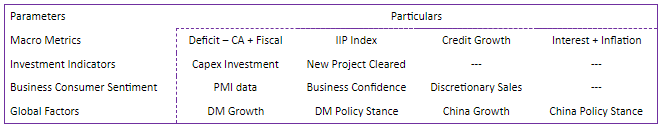

A few key parameters the fund will monitor to keep track of business cycle is as follows:

To Summarize, key takeaways about the scheme are as follows:

- Follow A Pure Top-Down Approach

- Macro-Based Fund

- Not A Value/Contra/Special Situation, etc

- Opportunistic and Nimble in terms of sector allocation

- No cap on market cap/sector/themes

- Hassle free approach – No stress of changing themes

- Long-Term Approach

The fund is suitable for investors with a high-risk appetite and minimum investment tenure of 5+ years.

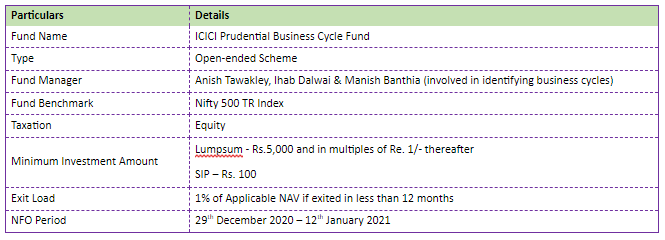

Key Features about the fund are as follows: