A Boutique Of Learnings & Earnings

Today’s blog makes for a special moment, for it is the last piece we write in CY2020 under the trademark “Signal” Brand.

We thought of structuring today’s note as an ode to the cherished communications we have enjoyed with you over this year. We do this by spotlighting the most favorited editorials in facts and figures by you, while maintaining symmetry to cover the landscape of events during the entirety of 2020.

2020 kicked off like 2021 is about to – Rallying on new-found optimism with markets hovering near All-time highs. What followed after has been an once-in-a-century event as the world dissolved into a socio-economic lockdown, courtesy of the biggest health crisis of the century.

Nearly 100 years later from the plague of this stature, Covid-19 has eaten up all of 2020. Hosting its virality, its vitality can see subsumption in the year to come as world’s vaccine centers rush in doling out doses in the fastest record on date.

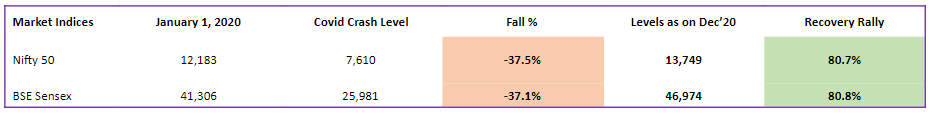

The markets have danced to its tunes as voice modalities jumped between pitches (High = Good, Low = Bad). From being shell-shocked in Mar’20 to excited elevations as of date, the table below shows market movement in CY2020:

In riding through the Covid Crisis, markets have come out super strong breaking All-time highs on an almost daily basis in Dec’20.

In fact, markets closed 16/18 times in the Green, making new All-Time Highs on 12 out of those occasions!

As we revel in hindsight, let us see how investors using the fisdom app navigated through the year’s troubles and made most of opportune markets.

Markets In Boon

The global breakout of the covid vaccine called for immediate shift in market mood to conservatism, as DIIs forecasted a selling spree in the midst of all-time high volatilities.

We at fisdom were pro-active in quashing investors’ emotional adrenaline by stringing out notes on actionables and in-actionables at the time. A few of them are mentioned below:

-

Mutual Fund – Your Wealth Caretaker

This piece showed how “mutual funds got to revel in their livery as a simple and intelligent investment product”. Coming at time when markets were peaked with fear and investors resorting to the yellow metal, many asked what to do.

Through this note we highlighted the financial nuances that MFs wore which allowed them to arrest downside volatiles and maximize returns on the upside.

In respecting key principles of investing, MFs continue to be the go-to evergreen investment product with variety wide to prescribe to your risk-objective profile

-

Who Said Opportunity Does Not Strike Twice

Markets have always bet best on those who meditate. It’s in the erroneous nature of human behaviour to react more than act, with unsilenced and unprofound degree of intensities.

Rudyard Kipling, in his poem “IF” taught us about how to treat losses and wins in the same manner.

Building on fresh lenses, this article voiced reason over treason as investors resorted to discovering new health-&-wealth of the markets.

Being overwhelmed with bad news in Crying Covid, Bad Banks, FII Fever, and Valuation Voes, we continued recommending investors to staying invested and follow “Time In Market” over “Timing The Market”.

Those who did had Christmas come early. Those who didn’t showed active response in getting interested and invested.

Markets In Bane

The lift-off post covid has helped India become the global engine of growth coming times. From relief package to harmony between Govt and central bank, the world’s biggest vaccine manufacturer is set to become to the world’s biggest manufacturer.

FIIs have poured in record monies in CY20 with DIIs jumping in late on the trend.

Market’s complete 180 turn has seen euphoria to extent where markets are portrayed as overly-optimistic. However, is that the case?

We at fisdom focused on the new market moods and doled out to pictographic notes to investors to help them make sense of market happenings at the time and draw the next best plan of action. A few pieces are below:

-

Markets Are Shining Bright! – Or Are They?

In comfort or confusion, the Market’s Shine in 2020 recorded complaints from investors and traders. 50% recovery or room is the half-glass perspective tailored to deliver half the results. The noted went ahead of questioning the strategy by challenging the perception at the time.

Striking balance between fact and fiction, the note caressed the apparent dichotomy between markets and its fundamentals.

-

The Best Way To Buy Into Great Stocks Today And More

This note tried to address the golden question which lies at the heart of sound investing. Highlighting myths and more myths, the note is a blueprint in tailoring your investment-making approach irrespective of market moods.

It also answered a key question in investors “Selling Mutual Funds To Invest In Stocks For Superior Returns”

-

What Price Is The Right Price

“What Is The Right Price?” is an all-time favorite question for all-time high markets. You ask, “What Is The Right Answer?” We say, “Is That The Right Question?”

Let us share a lesson with you which comes with market vintage, “There Is No Best Price”.

Investing is about staying wallet-vested (investment tenure) and emotion-divested (guess-timating market prices). You can only know of the right price when you have exhausted all the wrong options. To know this, you have to stay invested.

-

Breaking The Market’s Code. You Asked – We Answered

You Asked – We Answered. fisdom’s FAQs answer the markets hottest questions in the 4 Ws – What, Why, Where & Which!

To be aware of the 4 Ws is to be abreast with key market happenings.

Break The Market’s Code by burying uncertainties and welcoming probabilities. In knowledge lies power. In markets lie money….if you have the knowledge

Personal Finance – Education Series

Of all the interactions we had with you, this segment was an investor favorite. This segment was focused towards educating investors about most talked-about principles which find ardent fans in legendary investors like Buffett and Bogle.

Presented in interactive and colorful fashion, the blogs showcased the strength of investment basics across times and tides. Facts and figures encouraged a momentum of positive investor actions. A few of them are mentioned below:

-

SIP – The Common Investment Denominator Between New & Old Market Participants

Investors are paraded with SIP notifications by all investing bodies at all given times. In researching their claims, we found a host of merits across a seemingly simple investment strategy. In fact, the idea accoladed a string of notes on SIPs. A few are:

- Your Weekend’s Finance 101 Lesson – “Smartness Of Salary SIP”

- SIP – Investing In The Gandhian Way

- Systematic Investing – The PPE For Your Portfolio

-

Statue & Stealth – The 2 Perceptive Pillars Of Passive Investing

For as long as there has been investing, there has been an active debate about “Active vs Passive” philosophy. Each style has found its suitors, often citing, and sitting on opposite ends of the same reasoning spectrums. But what if there is no difference?

Being the same side of the same coin, Passive is more definitive and derivative of Active, than distinctive.

“Doing Nothing is still doing something” – is an apt way to describe the thesis within this note

-

Intelligence In Investing Approach

A key sub-category that was born out of reader interest were categorical takes on diversification, international investing, and entry-&-exit strategies amongst others. A few of our takes on the same are presented below:

- The Global Voice Of Domestic MFs

- Multi-Asset MF – The “One Size Fits All” Fund

- Entry & Re-Entry – The Movement Within Market Movements

- NFO Investing – All You Need To Know

- This Is How The Rich Invest

Investor Takeaway

As can be seen, the year’s noise and news overwhelmed markets with flurry of flavors. Pronounced actions deserved as much attention as staying put, as opportunities disguised themselves as cheap thrills and the other way round.

The year called for financial jurisprudence like none seen in years past, and we at fisdom actively stood up to the plate in hand-holding our investors through the Good, Bad and Ugly.

We have had a joyous time with each one of you, and look to have more of you in the times to come. As we say goodbye to 2020, let us take this year’s learnings and shape into next year’s earnings.

See you in 2021, sounder and wiser than the 3 Magi!

Wish You Happy Holidays