Indian markets and mutual fund industry have grown parallelly over the last 40+ years. Today, Nifty and Sensex are trading near their All-time highs, with MF industry crossing INR 30 Trillion for the 1st time ever in November 2020.

Today, there are ~1,200 open-ended funds spread across multiple categories with further hierarchical structures in broad and sub-categories.

After the qualitative and quantitative growth witnessed over the rich vintage, markets continue to be a place of opportunities.

It’s ~78% rally from march lows across Nifty and Sensex merit the claims made above.

Banking on these opportunities, the Mutual Fund industry has launched a flurry of New Fund Offers (NFOs) in recent past with 9 NFOs live for subscription.

We have many investors reaching out to us asking about which NFO to invest in and what factors to consider when choosing a particular NFO?

In addressing the investor’s FOMO (Fear Of Missing Out), we present below few points you should consider when putting money into a fund with no track-record.

Before you get to making notes, do note that the suitability of a NFO for a particular investor is determined primarily by their risk-return profile and investment objectives.

A few parameters an investor should weigh before picking a NFO are as follows:

- There’s Money In Being Unique

The ability to make money in markets is limited by the thinking capacity of the investor. What this translates to is, If there is unlimited money to be made, then there must be unlimited ways to make it.

This school of thought has given birth to many unique strategies/ themes deployed by product manufacturers to capitalize on untapped potential.

It is viable to opt-in for NFOs offering new-to-market strategy which can help investors in maximizing market-cum-fund potential and while also achieving portfolio diversification

If the strategy is not unique, it requires a look at fund philosophy, asset allocation, and market-cap preference amongst other key fund-specific metrics.

If the NFO sees significant overlap in strategy with existing funds, it is better to side by the latter, courtesy of readily available fund data.

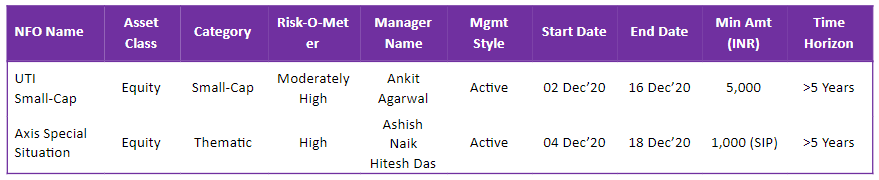

A live NFO currently meeting this criterion is the Axis Special Situations NFO (4th December – 18th December, 2020)

The fund seeks opportunities in the most uncertain period since WWII, capitalizing on current crunched climate & emerging new trends. The fund also offers international exposure of up to 30% via JV Partner Schroders, making it stand out from peers.

In capturing the disruptive value, the fund embodies Albert Einstein’s famous words, “In The Middle Of Difficulty Lies Opportunity”. Well, Today is difficult. Today is Opportunity

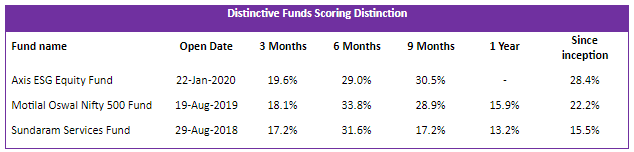

Markets have often rewarded those who captured the spirit of “Staying Different = Staying Ahead”. The in table below highlights the performance of NFOs which offered for out-of-the-box propositions during launch:

- Time Is Money – Sometimes More Times Than Others

George Orwell once said, “All animals are equal, some are more equal than others”. The adage perfectly encapsulates the philosophy are trying to prescribe to through this thought.

While we continue to be strong advocates of timing in the market over timing the market, NFOs get to side-line this thought, courtesy of opportunity-oriented, goal-focused inception dates.

Markets have shot off in post-covid economy as conservative fevers have transitioned to aggressive fervours. The magnetic combo of macro + micro boom has helped markets formulate a pseudo-vaccine to balm the banes away

Multiple actions have spawned off avenues for growth in today’s subdued times such as:

- The unprecedented support from the govt. and its banker via their policies and packages continue to augur supportive pillars for growth and instil confidence in near-term sustainability

- The heavily polarised markets present opportunities across different sectors and market-caps, as select components have been key contributors to today’s market health & wealth.

As an example: The value of benchmark index in Nifty 50 will be slashed by ~50% if the gains made by Top 5 stocks were to be weeded out

A live NFO currently meeting this criterion is the UTI Small-Cap NFO (2nd December – 16th December, 2020)

Today small-cap NFOs find themselves in a valuation tussle as they seem to catch the uptrend after period of lacklustre movement.

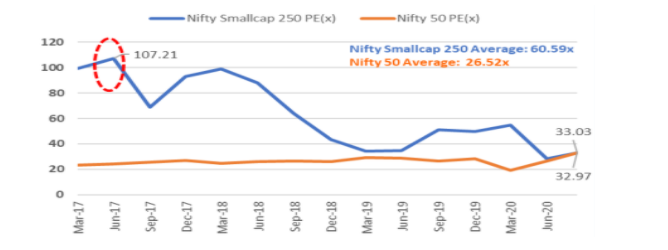

As of September 2020, the small-cap division has seen sharp fall at ~70% from June 2017 peaks. The fall has been a result of consecutive event spills and investor behavior to forage for “safer” asset classes in time of tries

On a valuation front, the index has seen sharp contraction of 46% from peaks in 2017

The chart below highlights the PE valuation gap between the Nifty50 vs Nifty Small cap

In studying rolling returns, it is observed that the current gap between the small-caps and large-caps is currently at favourable level. The graph below highlights the same

In lieu of the above, small-caps can enjoy run-up in the coming times. Those with respective risk appetite can look at adding this fund to their kitty.

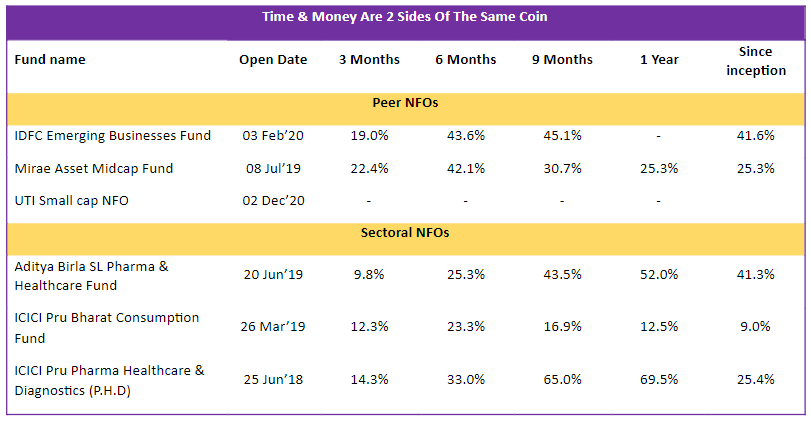

The theory of launching the right funds at the right time has rewarded investors multi-fold as can be seen blow:

Investor Takeaway

Markets will continue to be flooded with new opportunities in times to come. It will be Imperative then to apply the learnings through this note to maximize earnings from the subscribed NFOs.

If you wish to participate in the NFO trend, you can look at the list mentioned below and pick one that fits your risk profile.

As always, feel free to write to us to share your thoughts/observations on market’s makings-&-takings.

Till next time, wish you a Happy Weekend