2020 is nearing an end, and in ways completely unexpected after the happenings of the recent past. Market moods have been at their volatile best as participants shifted attitudes and aptitudes like that of a chameleon adapting to new-found territory.

Today, when markets are trading near their all-time high levels (after breaking it multiple times In CY2020), investors are finding new ways to entertain their worries.

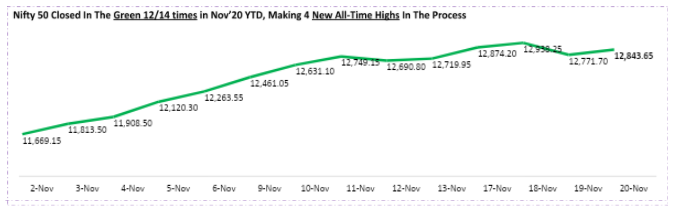

Before we address the woes via words, let us take a quick look at the trajectory of benchmark index in Nifty 50, month to date.

Delivering +5.4% CY20YTD returns, the markets are clearly leaning towards the Go-vid future. On the other hand, investors continue to carry Co-vid fears, resulting in a mix between fervors and fevers.

This juxtaposition in emotions can be realized via interpreting the market’s inherent behavior to factor in the economy of the future, vs the investor’s hesitancy to do so. Even more so in times like this, when not only the country but also the world is battling with a viral virus.

Since it is widely accepted that no one can print market’s future value, let us also refrain from doing so.

What we will do instead is address key events which is helping markets stay hoisted at current “elevated” levels.

- Reason 1: Shifting Away From Covid-19 Conundrum

The land-locking disease, touted as the greatest healthcare crisis of this generation, is finally seeing redundancy in spread across socio-economic factions of Indian society.

India, the world’s vaccine maker, is today in a very healthy-is-wealthy position as compared to its peers. While India is gearing up for Unlock 5.0, its peers across the pond are entering into lockdowns in their fight to curb Covid’s 2nd wave

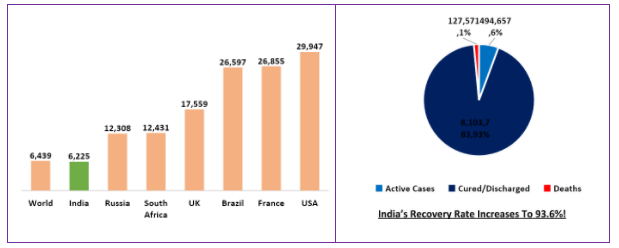

The distribution of Covid cases across the world and it’s pattern in India is shown in the graph below:

The chart above shows how astute India is in dealing with the virus.

The points mentioned below highlight the crisis craze across the pond:

- Europe is as of date registering 1 Covid fatality every 17 seconds with countries across issuing new travel bans and stricter lockdowns

- Australia & New Zealand are resorting to hotspot lockdowns by shutting down cities in certain cases. The former’s newly announced lockdown is being tagged as one of the harshest lockdowns in place

- The US Coronavirus death toll has crossed the quarter-million mark, with 80,000+ cases being recorded on the daily. US is the most infected country across the world with fatality rates following suit

As can be seen, India is well ahead than its in peers in medicating itself against the virus. The county is finally geared up to march away from ‘March 2020 Pain’ to ‘March 2021 Gain’.

- Reason 2: Sanctimonious Sync B/w Govt. and its Banker = Foreign Flow Favoritism

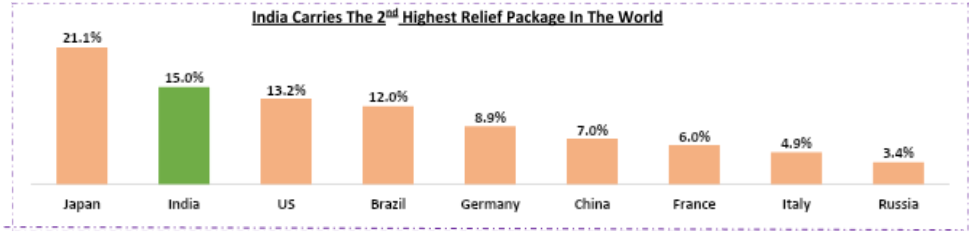

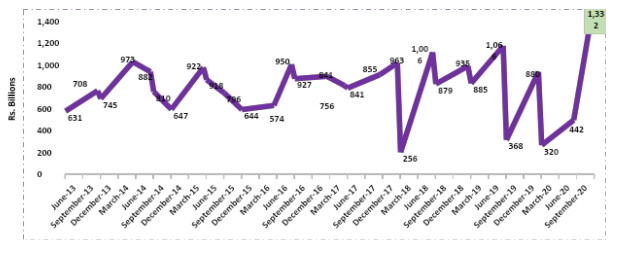

As pictures convey 1000 words, we present 2 graphs above showing actions of, and reactions to, India’s pursuit of expediting the New Normal.

1. In realizing the scope of the damage, India was quick to re-scale its relief package from 10% to 15% of GDP, thus jumping from 5th to 2nd highest relief packages in terms of value across the world!

2. A few key Goct. Initiatives taken to help explain the exuberance in current markets are:

-

- Govt. announced key policies in Atamnirbhar Bharat to give home to companies looking for a new manufacturer for a new world. In adorning the “Make Local – Sell Global” approach, it announced the lucrative Product-Linked Incentive (PLI) schemes to incentivise companies in shifting bases from China to here.

-

- The Govt. is actively focused on scaling up the “Ease of Doing Business Ranks” with pitches, policies and placards reading the same sentiments.

-

- Spurring capex by public bodies by exercising its ownership rights to soften blow of conservative private capex and drive and deliver on much needed infrastructure boost.

3. The Govt.’s Banker has been at its most accommodative, with announcements focused on driving Growth and curbing conservative credit climates. A few actions of RBI are as follows:

-

- Maintaining market liquidity expectations by increasing infusion monies via special open market operations (OMOs) and outright bond purchases

-

- Announcing Rs.1tn of on-tap TLTROs

-

- Keeping borrowing costs at their lowest levels on record to spur spending and constantly analyse and act on Demand-&-Supply Channel Checks

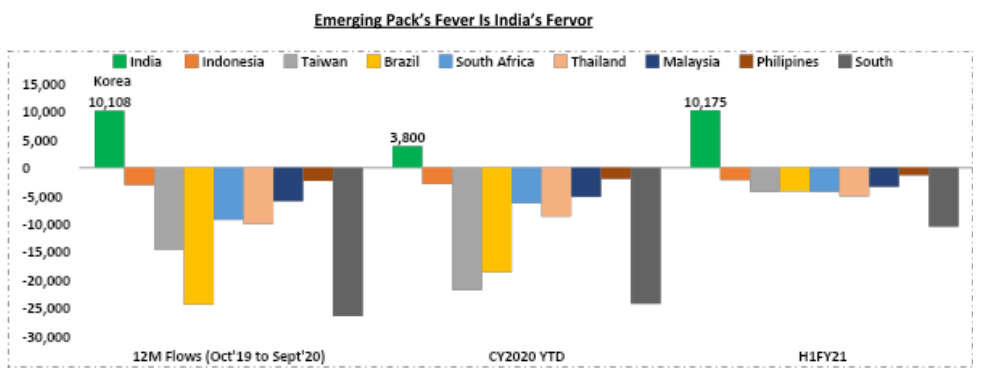

The harmony between the 2 bodies has resulted in FIIs shipping flows to India Inc. finding immediate and rekindled favouritism.

In knowledge of the impact of FII’s trading activity on domestic bourses, them being net buyers in Only India across time horizons vouches for overhang of markets at current trading bands.

In fact India is on track to see highest ever FII inflows if the momentum were to as reverberant in the coming times.

- Reason 3: India’s Magnetic Macros + Cropping Up Of India Inc Is A Winning Combination

India’s Macros are carrying strong indicators on the upside, registering growth figures only seen in years past. The resilience seen in key economic drivers today act as if Covid event was almost a blessing in disguise!

The table below shines light on few key growth vertices of the economy:

India Inc has followed suit in reporting stellar profits at 260%+ for latest quarter, the highest ever on record.

The graph below highlights the incredible journey of India Inc.

India Inc.’s profit growth for Q2FY21 was higher than the top quartile profit growth records over the past 60 quarters!

As India rides on the mark-ups in macros and micros, the markets continue to draw from such developments, thus holding their current levels.

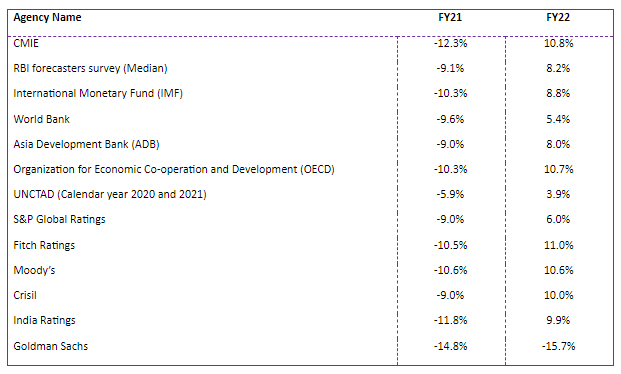

- Reason 4: Improved Estimates By Agencies In-&-Out House

The tenacity observed in India’s growth across multiple dimensions has agencies across revising their estimates with a shinier positive undertone.

The estimates shown are as below:

Investor Takeaway

Markets, like history, does not repeat itself, but finds a way to repair itself. It is in the process of re-balancing the scales, that the sound and standing investing principles shine.

Remember: Playing with emotions is Paying with emotions.

While you your judgment of the market prices tomorrow holds as much weight as the prediction of a Magic-8 Ball, you can sure take steps to reduce the extent and effect of uncertainty.

Adopt a Buddhist approach to investing when you don’t know so you don’t give in to temptations. To delay Gratification is to fast-track it.

Today, like every other day, we find ourselves not knowing of whats to come tomorrow. It is In these moments, we advocate to stay put and maintain your risk-based asset allocation.

If you harbor insights you wish to share with us, then do write we away. We excitedly await to hear from you.

Happy Weekend!