The title of this piece is what defines the entire market mechanism. To know the answer to this question is to find the hen laying the golden egg.

Different investor behaviors give birth to different answers to this 1 question. The beauty lies in distinguishing the right from the wrong when the definition of the 2 words is undefined.

Funnily enough, the longer the time spent in the markets, the harder it becomes to answer this question. Hence, knowing this question has no right answer is the real and rewarding answer.

Building on this insight, we then question the question itself. Within fisdom’s walls, we ask, “Is There Even A Right Price?”

After countless hours of number crunching and probability testing, the answer is as flawed as the question.

A big two-lettered “No”

Let us share stand-out observations which will help you realize that investing is never about the price but about the time (read as: investment tenure)

Dilemma: should I Enter The Markets Today At Their All-Time High Levels Or Wait For Right Price (Read As: Correction)?

Simply put, All-time highs are when markets beat their previous recorded highest levels.

The question is inherently faulty for it assumes market’s inability to breach highs in short successions, if at all.

However, this question is debunked as markets today have not only covered all their covid-induced losses, but also beached levels last seen In January earlier this year.

If the markets can pierce previous price highs during a pandemic, imagine what they can do when India completely transitions to the new normal!

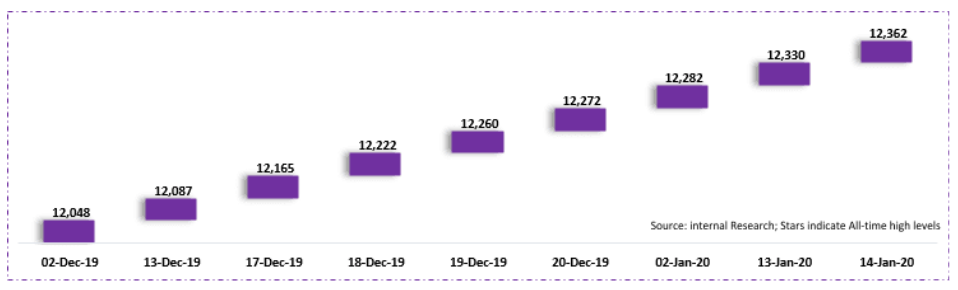

Charting the thought below, the graph shows how markets jumped from 1 high to another between December’19 and January’20 when thoughts of socio-economic covid lockdowns was being scoffed at:

The observations made from above show how figuring out the right price is like finding 1 black ball in red-ball bucket only.

Ideally, the All-time high price is the best price in the market for all market participants. But even all-time high prices themselves are not consistent as we learned recently. This brings us back to square 1, leaving us as confused as confident in our attempt to determine what price is right.

We ran a 2nd test considering only the best prices on a calendar-year basis to understand if it was then possible to draw up an equation to figure out the best price. The Answer? As was subconsciously expected, None.

The table below compares todays All-time highs vis-à-vis yesteryear’s:

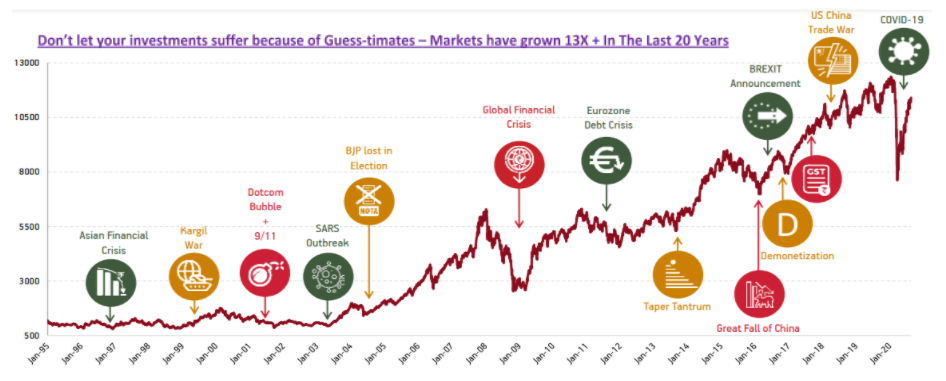

As can be seen, longer the timeframe from the high at the time, higher the opportunity cost.

Hence, it is in your monies best interest to stay invested or have the misfortune of missing out on ~40% returns like investors in 2015 who acted on their knowledge of ‘right price’ information.

Investor Takeaway

The chart above shows more predictions of wrong prices, than evidence of right prices.

In crisis or in championship, markets will change but the question will stay the same. And after this note, so will your answer.

So, if no price is the right price, how do investors planning to enter markets during Diwali festival approach this dilemma?

Simple, by respecting time-tested principles of asset allocation. Remember, Fisdom help is only a call/click away.

To conclude, pick the Magic 8 ball and ask it for the right price. Its answer will be as sound as a market veteran or a market novice.

And that should tell you more than any other fact or figure can.

If you wish to share your thoughts with us, do know we eagerly await to hear from you.

Wish you a Happy Diwali and A Happier New Year!