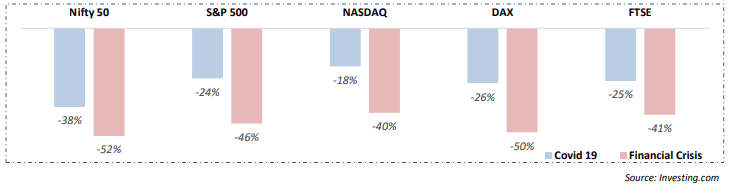

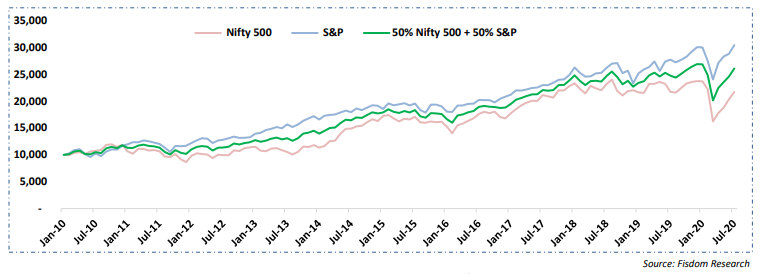

2020 has been widespread, halting activities across all longitudes and latitudes. However, the degree of impact is different between India and other countries. The relatively shallow impact across ponds highlights the potential global markets have to offer. The graph below shows how global markets stood firm across times of crisis.

As can be seen, International monies have been cushioning impacts across decades vis-à-vis Indian markets.

As India embarks on it is $5 Tn dream, it does so by drawing merits from its peers in parallel hemispheres. No Good is limited to only 1 country but is spread across boundaries. As we grow into donning a vaster vest from being an Indian to a global citizen, why not streamline your monies that way too?!

Now, with Fisdom, your trusted financial advisor, get the know-how and executional capabilities to give your portfolio a global shade, all while getting to exposure to the leaders of tomorrow!

Money Goes International

From Education to lifestyle, much is spoken of the International way of being. If you cannot go to Switzerland, bring Switzerland to your home! How so? You ask. Oh, simply by having your monies flow that way.

Adopting a wider financial flavor palette has always been a strong proponent of savvy, and efficient investing. While no can guarantee better performance, diversification can certainly act as a catalyst for the same.

Let us look at 3 key ways to help you understand the underlying benefits of your money flying international!

1. Diversified Grooming of Risk-Adjusted Potential

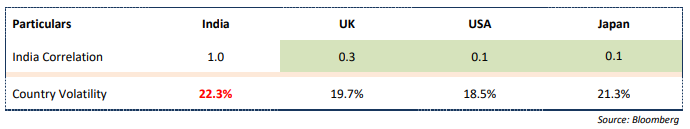

Being borderless with your investment’s aids in smarter money management as all monies is not tied to only 1 basket. The broader universe of portfolio helps in tactical asset allocation by investing in low correlated markets. Creating an intrinsic hedge, the portfolio is more suitable to arrest downside risks and maximize upside potential. The correlation matrix shown below highlights untapped diversification benefits other countries have to offer.

As can be seen, spreading investments over a broader geographical area can help reduce portfolio risks, and get added comfort of enhanced stability!

2. Bet Big – Win Bigger: Going Global Welcomes Growth Opportunities

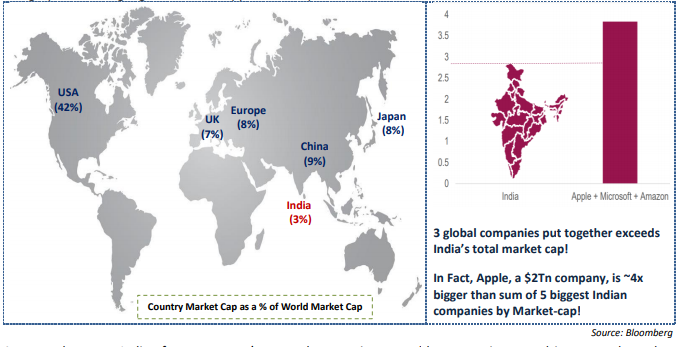

India, the promise land of tomorrow, has ~5,000 companies listed on the exchange but accounts for ~3% of world’s

market Cap! So where is the other 97% equity upside rested? In land, foreign to Indians, but not to money!

Global markets host the biggest companies in the world, which are shaping today’s youth and defining tomorrow’s leaders.

While India aspires to be $5 Tn economy, it has peers boasting GDP figures 4 times its size!

The graph below highlights room for opportunities present in other economies.

As you bet on India for tomorrow’s growth, tap into world economies to drive growth today.

We at Fisdom make this as simple as clicking a button! Get in touch right away.

3. Depreciating Rupee Can Appreciate Your Returns

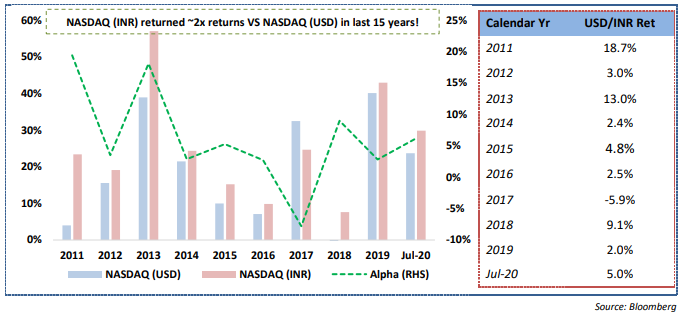

Today, the value of INR is lower than USD, at values lesser vs in 2010’s, and even lesser than in 2000’s. The graph below highlights how an index return can increase multifold if the currency play is done right!

As can be seen, money is always to be made! A falling rupee bodes well for Indian investors as it welcomes ground for amplified returns. Where else can you invest monies and expect it to grow when your asset class falls in value!

Portfolio Difference – Local vs Global

Sitting In your home, you can now invest across the world in a time and process friendly manner! We have so far seen the qualitative side of investing into international funds. Now, let’s see the quantitative side – where the real Masala lies!

Markets have been riddled with vicious volatility all this year, seeing trillions of investor wealth being wiped out in a matter of months! As a result, investors dumped equity and rushed for safe-haven assets in search of portfolio equilibrium. The graph above highlights how a portfolio having a borderless structure is best poised to deliver sound risk-adjusted returns. It can help you curb volatility while not having you compromise for returns!

So, what are you waiting for? Let us buy your portfolio a flight to the rest of the world.

Investor Takeaway

As an institution and individual, we often resort to overseas to fulfil multi-purpose necessities. Then why do we invest any differently? Think of cross-seas investing as your 1st step in broadening your domestic mind and money.

Be it books or speeches, sound asset allocation merits a special mention when talking of investing. International investing is an outcome of this principle, for it maximizes upside potential on a global level, while arresting downside risks on a domestic level. One should take into consideration the risk appetite before adding the international funds in the portfolio.

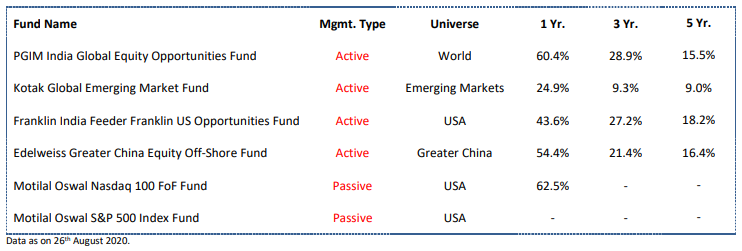

Already excited to go hunting for your favorite global fund? While Yes is the only right answer, Fisdom has got you covered here too! Mentioned below are a few different types of Global funds, to cater to multiple types of investors:

Carrying the versatility of Mutual funds, International funds capture the equity potential in market leaders across

continents!

We are as excited as you as are to help you re-design your portfolio as a mixing pot of culture. Why be bland when you can be blazing!