What is Consumer Price Index (CPI) Inflation?

The CPI Inflation is a macroeconomic indicator of inflation, tracking the change in retail prices of goods and services which households purchase for their daily consumption.

Helping ascertain the country’s economic health, central banks actively design monetary policies to keep inflation under control.

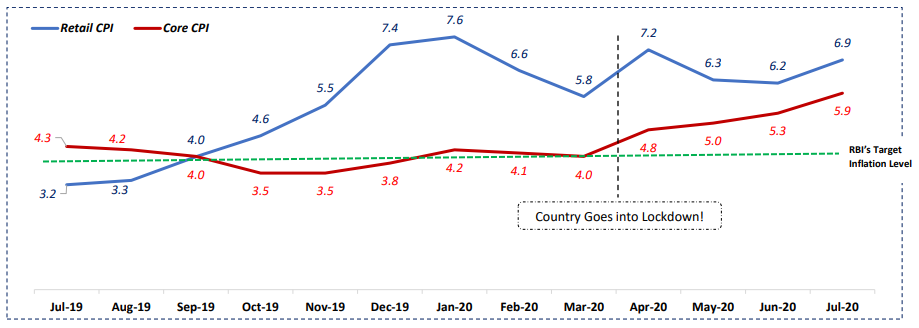

India’s target inflation range is 4 (+/-2) %.

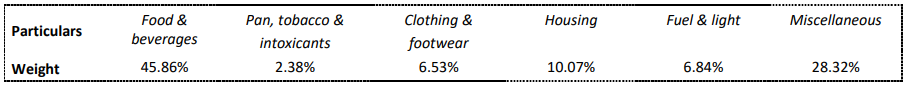

Its weighted components are as follows:

How to Calculate & read the CPI inflation data?

CPI Inflation is calculated as a weighted average of the prices of commodities.

Mathematically, it can be written as: (Price of basket in current period / Price of basket in base period) x 100

Currently, 2012 is used as base year for inflation calculation and reading purposes.

What does CPI Inflation data mean for Financial Markets?

It serves as an indicator of purchasing power of a nation’s currency, and shines light on the broader demand-supply situation in said country. It is also a good parameter to evaluate the invest potential of a country by foreign and domestic investors alike.

CPI Inflation Reading – July 2020

What is the latest reading?

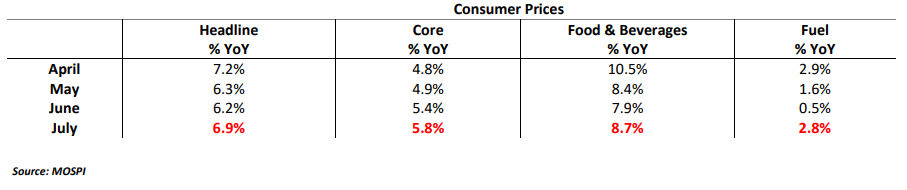

India’s retail inflation exceeds MPC Target For 4th month in a row, rising to 6.93% in July from 6.23% in June.

It may not be appropriate to compare the CPI inflation in the post pandemic months with the CPI for months preceding the COVID 19 pandemic. Hence not comparing with pre-pandemic numbers.

Investor Takeaway

At over 6%, inflation remains just above the MPC’s tolerance band of 4 (+/-2) %, creating a stagflation-like scenario where inflation is high despite a collapse in growth (GDP estimates point towards contraction).

The CPI print is along expected lines and justifies in retrospect the RBI’s decision to take a pause in the rate reduction cycle. Clearly, supply chain issues have been feeding through the food prices, especially vegetables and partly from higher fuel prices. Supporting the system with tools like liquidity measures and restructuring facility, will propel economic drive in coming times.

As virus cases continue rising impeding opening of economies, we expect supply challenges to sustain over the short-term, with central bank vouching for rate-cuts only after effective transmission of previous cuts and outcome of other liquidity and other similar measures. Hence, it is likely to remain on pause on the October meet and consider rate-cuts in the December meeting.

Click here If you want to read the complete CPI Inflation press release.