2020 has been the year of the coronavirus, bringing to a standstill, the socio-economic landscape of India and the world.

Central banks unleashed unprecedented relief packages to clot the economies from bleeding further. The relief, however, deemed not enough, saw global markets riddled with all-time high volatilities, as indices wiped out trillions in a matter of 2 months.

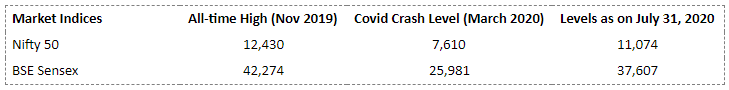

The virus followed suit for domestic investors, as markets went from touching all-time high levels to their biggest drop (-~40%) in 10 years to in a matter of 4 months.

In hindsight, the India VIX at 80+ levels reflected the retail investor dilemma, as they rushed to exit portfolios, with a sudden shift to wealth preservation to generation.

This is where Mutual funds got to revel in their livery as a simple and intelligent investment product

Mutual funds, beneficiaries of diversification, undertook multiple actions to tackle various market mood. The key initiatives taken are described below:

Seasoned Professionals & Active Management

2020 markets presented a multitude of opportunities, testing investors at every turn. Most squandered their chances, falling victim to emotional biases. However, for Mutual Funds, it was just another event-filled year. The vintage of mutual funds, and, old-as-time, management experience at the helm were the industry’s greatest asset.

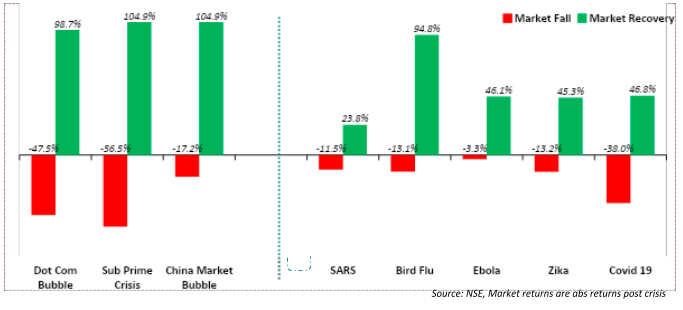

Having been subject to multiple crises over years-&-decades, fund managers’ have witnessed big falls, and bigger euphorias, to stand firmly by investment processes and not given in to temptations.

As can be seen, MF Fund managers have navigated through financial and health crisis, multiple times before, fully aware of the potential of markets and even more so, of sound investment principles!

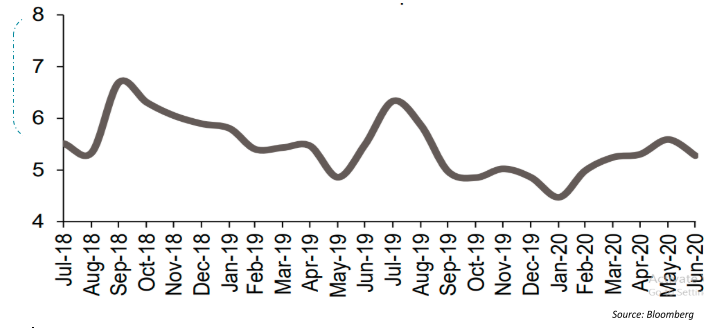

The calloused fund manager hands were on display as they smartly held onto/deployed cash balances to maximize returns, while minimizing risk. The chart below highlights the same:

MF Industry Level: Cash % of total assets

Hence, acute, and active management style has helped MFs in the past and will continue to do so in the future!

Hungry Hunting by a Bargain Hunter

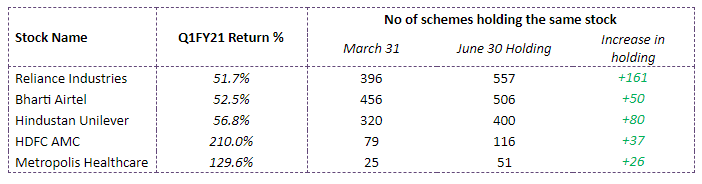

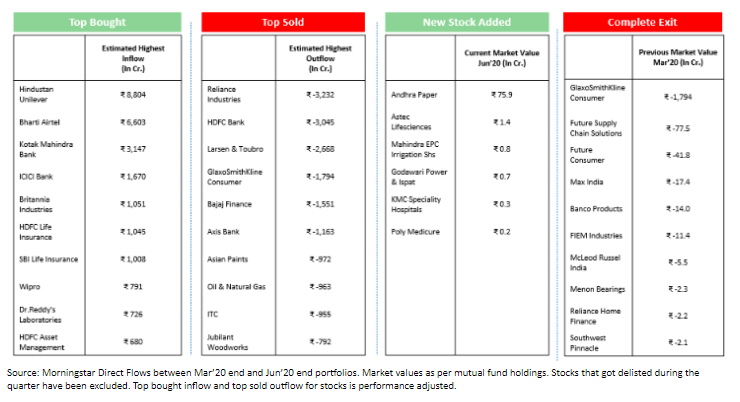

Coronavirus fears shrouded the market in dirt-cheap valuations, as investors deserted equities, and eyed comfort in Gold. Remembering, Warren Buffet’s quote: “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”, MF industry tightened their grip on the markets by purchasing stocks and sectors, showcasing near and long-term potential, at once-in-a-lifetime prices!

When retail investors abandoned equities, MFs stepped in, turning net buyers in equities in March at ~Rs. 29,000 Crores!

Do not be smart; a smart fund management team is working for you.

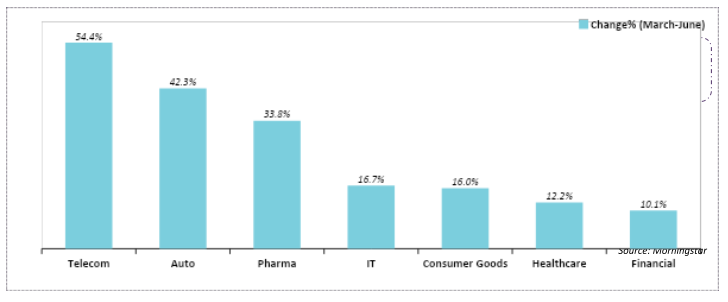

The same story stands true for Sectors too, as can be seen below:

While it may not be correct to construe the above information as an insight to support direct equity investing or any equity calls, it allows an insight into understanding that fund managers have been taking aggressive calls

Investor Takeaways:

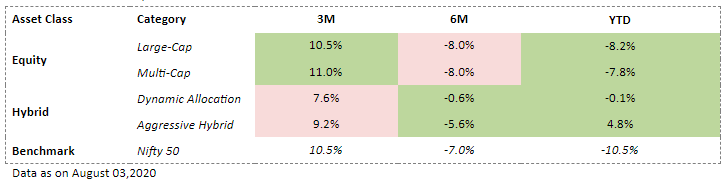

“Improvise. Adapt. Overcome.” With these words emblazoned at the heart of every Mutual Fund, the industry successfully differentiated noise over news, and grappled the covid climate with reason and ration. Where investors feared wealth erosion, MF results have shown otherwise.

MFs outperformed the country’s primary index in the short-term and long-term! There is a reason investor say, “Mutual Funds Sahi Hai!”.

While it may not be correct to construe the above information as an insight to support direct equity investing or any equity calls, it definitely allows an insight into understanding that fund managers have been taking aggressive calls and this, in light of recent developing situations. In any case, unless there’s a change in your financial goal or asset allocation, there should be no reason for you to take any action on your portfolio – rest assured, the fund manager is doing the job pretty well.

If you feel so otherwise, please do tell!