The calendar Year 2022

India’s asset management industry overview

Industry Level Trends

India’s asset management industry overview

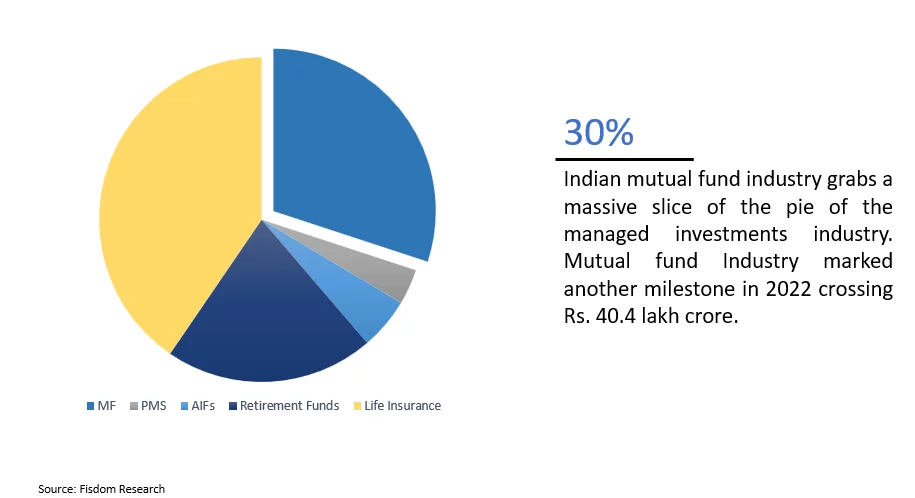

How significant is the mutual fund industry?

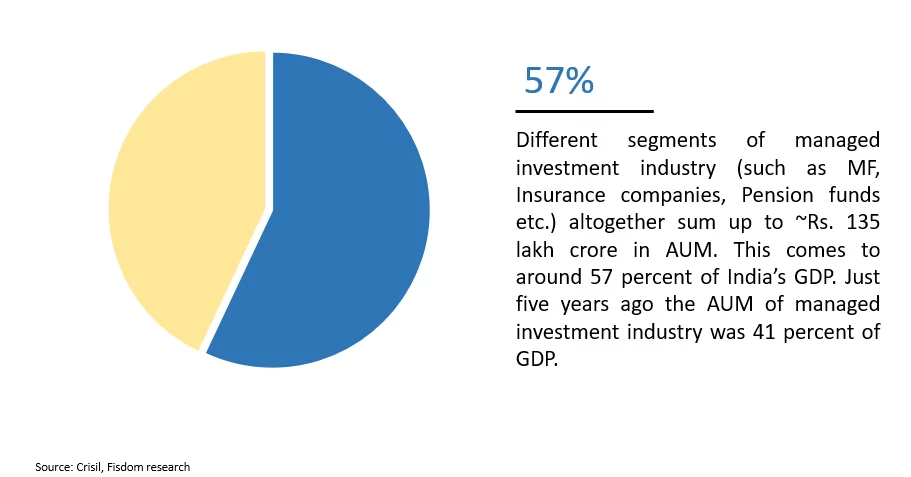

Penetration of Mutual Fund Industry

India’s MF to GDP ratio stands at 16.2 percent compared to 11.9 percent in 2017 indicating a robust growth in the industry assets. When compared to the world average of 75% India’s mutual fund penetration is significantly lower.

The Mutual Fund industry’s AUM hit a lifetime high at INR 40.4 Tn in CY’22. This amounts to a >5x growth in just a decade. Such AUM growth is accompanied by robust growth in number of folios, the bifurcation of which, reflects increasing retail participation. Total number of folios stood at 13.98 Crore for the period ended Nov’22.

Mutual funds remained major deployers in CY 2022

SIP contribution remained at all time high despite market volatility

Market continued to react to global factors and domestic rate hikes. However, mutual fund investors showed resilience and continued to invest in SIPs with consistent contribution month on month. SIP inflows trajectory remained upwards; during the year. SIP contributions clocked a lifetime high in Nov’22 with inflows of over INR 13,300 Cr. after increasing for five straight months. Total no. of SIP accounts stood at 6.04 Crore in Nov’22 with 1.6 crore fresh registered SIPs.

While additional SIP inflows during bullish market conditions is typical of retail investors, the persistent SIP flows reflect enhanced investor maturity and ability to stay committed through cycles.

Flexi cap and Sectoral funds preferred by investors

Flexi cap category received highest inflows in CY22 so far. However, sectoral funds remain second preference by investors as they bet on broader market recovery. The rise in inflows in these categories can also be attributed to new funds launched in the segment.

Debt category witness outflow across the board

Debt category witnesses outflows across the board. Investors have been pulling out money from debt categories since interest rate hike cycle began due to persistent high inflation. Rising interest rate cycle resulted to lower bonds price and debt mutual funds saw mark-to-market impact on their NAVs spooking investors.

Target maturity funds gaining traction despite outflows in debt MF universe

Target Maturity Funds have grown significantly over the last few years after the government launched Bharat Bond ETF (managed by Edelweiss Mutual Fund) back in December 2019. In 2022, Target Maturity crossed Rs. 1.3 lakh crore AUM to become the largest debt mutual fund category, barring liquid and overnight funds. TMFs come with vide range of maturity which makes it easy for investors to invest in one that suits their investment horizon.

Funds mobilized through equity NFOs remain buoyant

Highest AUM mobilized by SBI AMC through NFOs

Sectoral/Thematic funds gained popularity

Passive funds gains market share

The current year saw 37 equity passive fund launches, In terms of AUM share of passive funds increased from 2.5% in Jan’22 to 5.4% of total AUM in Nov’22. The total AUM in the index funds is recorded at INR. 1.23 Lakh crore in the month of Nov’22.

Source: AMC investor notice, ACE MF, Fisdom Research

Ready to take your portfolio to the next level? Explore our carefully curated New Year 2025…

This Diwali, we present a portfolio that reflect both sector-specific and stock-specific opportunities. With 2…

Thank you for showing interest in taking a BTST position using our Delivery Plus product.…

Thank you for showing interest in the consultation on trading strategies! Our expert will reach…

Even if you are a new participant in the stock market, the process of buying…