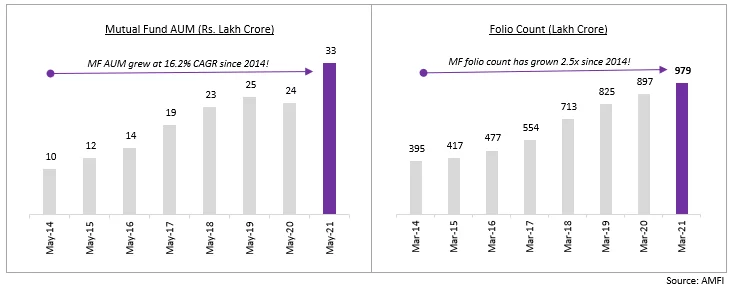

India’s most desired and versatile investment product ‘Mutual Funds’ is set to make headlines globally for crossing ₹ 33 Trillion in assets under management.

The making of this is a direct result of increased financial literacy in the country purported by ‘Sahi Hai’ campaign, wealth managers, distributors and independent advisors. However, the biggest credit goes to you (the reader) for signing up to learn and earn. While we talked the talk, you’ve walked the walk.

Starting in 1964, mutual funds have walked over millenniums, centuries and decades to be cherished as an “evergreen and everyday” investment avenue. Hence, we thought of dedicating this piece as an ode to the journey of mutual funds in India.

The ability of mutual funds to be investment-ready at all times, irrespective of market conditions has pushed mutual funds to the hierarchical top of investment product universe in the country.

It is visible in mutual funds out-performing the markets, even as the latter adorns the crown of the eighth largest index globally and trades at its highest ever levels. The graph below highlights the returns generated by newest MF category on the block vs the markets:

A key and underrated reason for mutual funds beating market returns is their ability of the professional managers at picking the right stocks at the right time. Over the last 5 years, ~45% of Indian equities have eroded investor wealth vs 100% of equity mutual funds having generated wealth! The table below shows the numbers behind these facts:

Today, mutual funds are recognized for more than amplifying return and arresting risk potential. Its incessant following of key investment principles in diversification, asset allocation, and time in the market, coupled with extra benefits such as tax-friendly norms in ELSS exemption and debt fund indexation benefits, has made mutual funds the go-to product for investors across the spectrum.

Apart from the signature features mentioned above, a key reason for mass adaptability of mutual funds has been due to systematic investment plans (SIPs). This metric has been so monumental in the laying the path of mutual funds for India, that today it is viewed as a sister metric to judge the appetite for mutual funds across state borders.

Think of SIPs as a reverse EMI as you invest at select intervals and amounts thus putting your portfolio on autopilot. Serving multiple benefits, SIPs help in averaging when accumulating units, rejigging allocations at regular intervals and ensuring tenure longevity. Hence, SIPs by structure, serve as an anecdote to anxiety.

SIP’s time and market-agnostic calibrated approach helps investors realize the maximum via participation potential over investors waiting for the “right time”. As the saying goes, “Those waiting for the right time, end up waiting forever.” Rather, start SIPs today and make the time right

Writing about mutual funds is like filling a bottomless bucket, one can go on and on.

The piece has so far has highlighted on how we reached today. We now shift focus on where we can reach tomorrow.

India has traditionally been a high savings economy (average 30% of GDP), but a large part has been allocated to physical savings. This has resulted in India’s MF AUM as a GDP % be among the lowest and a fraction of global average of 63%. Smaller emerging market peers, such as Brazil and South Africa, boast of better penetration. Even share of equities in household balance sheet is a minuscule 4.3%, implying credible structural opportunities.

The betterment of the long-term macro story favors India’s fund managers can see industry AUM grow at 13% CAGR till FY24 per industry experts. Equity AUM is to post 15% CAGR, with its share in the overall assets mix rising to 46% by FY24, from about 42% currently. So get in early while you still can!

The top ten states currently contribute ~90% of the entire industry AUM. Do your part in helping your city get in the top 10 list when we next pen a note to bow down to the many achievements the industry is on track on make!

Till next time, Happy Weekend!

Ready to take your portfolio to the next level? Explore our carefully curated New Year 2025…

This Diwali, we present a portfolio that reflect both sector-specific and stock-specific opportunities. With 2…

Thank you for showing interest in taking a BTST position using our Delivery Plus product.…

Thank you for showing interest in the consultation on trading strategies! Our expert will reach…

Even if you are a new participant in the stock market, the process of buying…