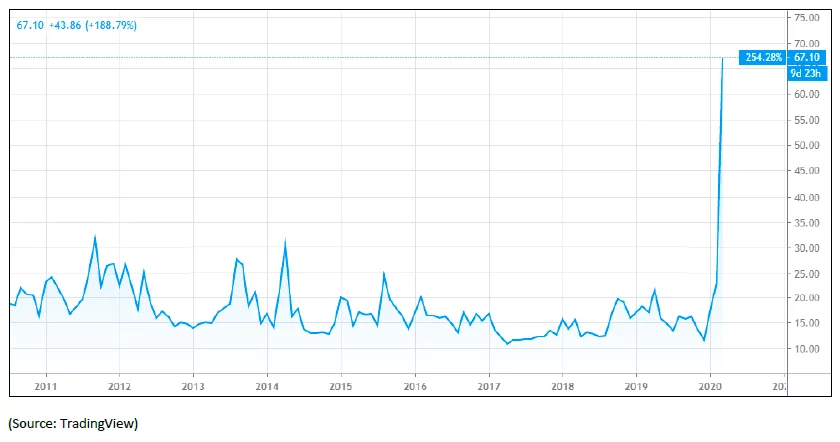

In a response to contain panic-driven volatility & short-selling, SEBI has reduced the limit of positions that can be taken in the futures & option markets along with increasing margin requirements and capping derivative exposures and bringing down the market-wide position limit.

This move by SEBI is expected to help achieve the immediate goal of arresting the free-fall in stock markets till rational senses & sentimental stability prevails.

This is a strategy used by traders who believe that a stock price will decline. A short sell implies that a trader (implicitly) borrows a certain number of shares of a company (typically from the broker) and sells it at the current price with a hope that he will be able to buy it back later at a lower price point and return the shares to the lender.

A trader can put up some of his own money and borrow a larger sum from his broker to execute trades otherwise unaffordable to the trader. The money put up by the trader is called margin. With an increase in margin requirements, traders will have to put in more amount of own capital to execute the same trade.

Open interest is the number of contracts (future & options; read as derivatives) open on any particular stock. These must be squared off either before or on the monthly expiry date.

MWPL is the maximum number of open positions allowed across all future & option contracts in a particular stock.

Measures & expected impacts (Savvy investors read on beyond the summary for details):

While mutual fund investors only stand to benefit from these initiatives, investors into the arbitrage segment (or categories like dynamic asset allocation which includes arbitrage positions) may see returns temporarily & negligibly deteriorate as an effect of the surprise regulation & increased volatility. This applies majorly to investors who have invested in these segments as recently as within the past one or two weeks. Investors in these segments with a horizon of three to six months are well-placed though.

Market-wide position limits

MWPL will be reduced to 50% from 95% of the defined limit for the ban to kick in if:

MWPL, expressed in number of shares, is the lower of:

Higher margin requirements

Ceiling on index derivative exposures

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2WHxIPu||target:%20_blank|” button_position=”button-center”]

Ready to take your portfolio to the next level? Explore our carefully curated New Year 2025…

This Diwali, we present a portfolio that reflect both sector-specific and stock-specific opportunities. With 2…

Thank you for showing interest in taking a BTST position using our Delivery Plus product.…

Thank you for showing interest in the consultation on trading strategies! Our expert will reach…

Even if you are a new participant in the stock market, the process of buying…