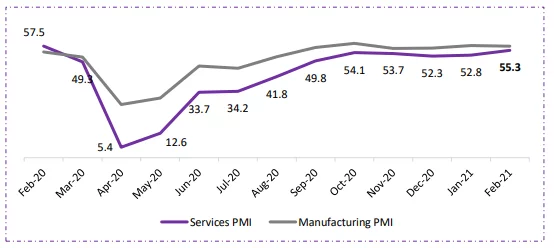

What is the latest Services PMI reading?

India Services PMI increased to 55.3 in February from 52.8 in January, growing at its fastest pace in over a year. Growing for 5 months in a row, survey credited the uptick to improved demand and more favorable market conditions.

A reading above 50 denotes expansion and below 50 denotes contraction.

The growing services PMI adds to expectations of strengthening of current economic recovery, with other high-frequency indicators such as IIP, auto sales, railway freight, power demand, and exports(declining at weakest rate in last 12 months) also exhibiting similar traits.

The active manufacturing and distribution of covid vaccine is expected to welcome expedited recovery and help with uncertainty regarding pandemic and input inflationary pressures (strongest inflation rate since February 2013). The same is reflected in increase in new orders and improving business confidence (at 1-year high).

Marketing efforts and increase in new client count welcomed increase in new orders for 5th straight month.

Worryingly, however, employment declined for the 3rd month in a row with companies recording the sharpest rise in overall expenses for 8 years

Covid-19 pandemic regulations and higher input costs in freight, and fuel put cost pressure on companies. However, competitive pressures prevented companies from lifting their own fees. February highlighted a broad stabilization of selling prices, following marginal declines in each of the prior 2 months.

In a sign of capacity pressure, services companies signaled a further increase in outstanding business halfway through Q4FY21. The pace of backlog accumulation was solid and quickened from January.

Sub-sector data highlighted Transport & Storage as the brightest spots recording the strongest increases in new business and output. Information & Communication was the only sub-sector to post contractions in sales and business activity. Companies in this category bucked the general trend of positive growth projections, signaling neutral output outlooks.

In the private sector, aggregate business activity hit a 4-month high, with their confidence for future growth at its highest since November 2019.

As is seen globally, manufacturing PMI continues to out-perform its services counterpart, courtesy of the latter being hit harder by Covid-19.

Coming out of technical recession in Q3FY21, and growth in key economic drivers can see sectors continue growth momentum in times to come. The same is reflected in agencies revising their growth estimates for India on the upside.

The key risks will continue to be unforeseen events resulting from the virus, and inflationary upticks (private sector inflation rose to its highest in over 7 years). Passing cost burdens to client via price hikes can see demand strength come under pressure.

Click here If you want to read the complete Services PMI HIS Markit press release

Ready to take your portfolio to the next level? Explore our carefully curated New Year 2025…

This Diwali, we present a portfolio that reflect both sector-specific and stock-specific opportunities. With 2…

Thank you for showing interest in taking a BTST position using our Delivery Plus product.…

Thank you for showing interest in the consultation on trading strategies! Our expert will reach…

Even if you are a new participant in the stock market, the process of buying…