What is Consumer Price Index (CPI) Inflation?

The CPI Inflation is a macroeconomic indicator of inflation, tracking the change in retail prices of goods and services which households purchase for their daily consumption.

Helping ascertain the country’s economic health, central banks actively design monetary policies to keep inflation under control.

India’s target inflation range is 4 (+/-2)%.

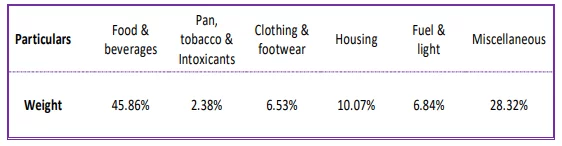

Its weighted components are as follows:

How to Calculate & read the CPI inflation data?

CPI Inflation is calculated as a weighted average of the prices of commodities.

Mathematically, it can be written as: (Price of basket in current period / Price of basket in base period) x 100

Currently, 2012 is used as base year for inflation calculation and reading purposes.

What does CPI Inflation data mean for Financial Markets?

It serves as an indicator of purchasing power of a nation’s currency, and shines light on the broader demand-supply situation in said country. It is also a good parameter to evaluate the investment potential of a country by foreign and domestic investors alike.

What is the latest reading?

India’s retail inflation touched its highest figures in last 6 years, coming in at 7.61%.

Inflation continues to stay above RBI tolerance level for 7th consecutive month. Inflation was 7.61% in September 2020 and 3.5% in October 2019.

Investor Takeaway

At over 6%, inflation remains just above the MPC’s tolerance band of 4 (+/-2)%, creating a stagflation-like scenario where inflation is high despite a collapse in growth (Sharpest contraction of GDP on record at -23.9%)

Element Inflations

It may not be appropriate to compare the CPI inflation in the post pandemic months with the CPI for months preceding the COVID 19 pandemic. Hence not comparing with prepandemic numbers.

Rise in CPI is mainly credited to rise in vegetable prices.

In coming times, we may see prices starting to moderate, courtesy of Govt.’s farmeroriented incentives and healthy monsoon.

Inching of core inflation from 5.7% to 5.8% can be credited to continued elevated levels of transportation prices and high cost of personal care services.

The former due to major supply side disruption, and latter owing to strict social distancing requirements and high sanitization cost.

As virus continues building blocks of uncertainty, we expect supply challenges to sustain over the short-term.

Central bank is likely to vouch for liquidity-infusible methods via outside-the-box policy actions to curb prevalent systemic challenges.

Hence, it is likely to remain on pause in December meet and consider rate-cuts near future efficacy in transmission of prior rate-cuts.

Click here If you want to read the complete CPI Inflation press release

Ready to take your portfolio to the next level? Explore our carefully curated New Year 2025…

This Diwali, we present a portfolio that reflect both sector-specific and stock-specific opportunities. With 2…

Thank you for showing interest in taking a BTST position using our Delivery Plus product.…

Thank you for showing interest in the consultation on trading strategies! Our expert will reach…

Even if you are a new participant in the stock market, the process of buying…