No task is impossible; no path is difficult; if our resolution is strong. We have to be

dedicated to make ourselves self-reliant.This magnificent building of self-reliant India will stand on five pillars namely

economy, infrastructure, technology, demography and demand.– PM Narendra Modi

India Lockdown has been an extremely sensationalised topic for long.

Armchair analysts & social media enthusiasts have taken to sharing their not-as-much-as-two-cents on how the lockdown is going to spell doomsday for the Indian economy and wealth erosion. However, does not seem like many are taking efforts to observe beyond the chaos.

The pandemic, not just the lockdown, will obviously impact world economies. “World” being the keyword – India is not an isolated case. But what really matters is how are economies dealing with the current situation and what is it that is going to help push towards a faster economic recovery.

There is no argument against the fact that the pandemic (including the lockdown) has impacted businesses. Many misconstrue the lockdown as a reason for the economic slump but fail to realise that the lockdown, in fact, has acted as a gunshot wound to an otherwise death-pill in the waiting. The lockdown should be viewed as an act of socially responsible & proactive measure more than an economically painful decision.

As we enter Lockdown 5.0, here is a brief account of how the Indian economy is utilising the time to nurse past wounds and focusing on the nutrition required along with how investors are viewing the progress amidst lockdown.

Lockdown 1.0

Key Measures:

1. Stimulus Package: India announced Rs 1.7-lakh-crore ($22.5 Billion) relief package to take care of poor, workers and those who need immediate help amid the lockdown to combat the coronavirus pandemic.

2. MPC Actions: Reduced the policy rate by 75 basis points to 4.4% and reverse repo rate by 90bps to 4%. CRR reduced by 100 BPS to 3% for all banks

3. LTRO 1.0: Auctions of targeted term repos of up to three years tenor for a total amount of up to Rs 1 trillion (0.7%of GDP)

4. MSF: Under MSF banks can now borrow an additional 3% of NDTL (vs 2% earlier). This will potentially infuse Rs 1.37tn (0.6%of GDP)

5. Moratorium: Moratorium of 3 months on payment of instalments in respect of all term loans outstanding as on March 1, 2020 permitted.

Lockdown 2.0

Key Measures

1. RBI Lower rates: RBI lowered the reverse repo rate by 35 bps to 3.75%.

2. Targeted LTRO 2.0: RBI announced a second targeted LTRO of Rs 50 thousand crore on April 17, with a focus on NBFCs and MFI’s.

3. Refinance facilities: Provide special refinance facilities for a total amount of Rs 50 thousand crore to NABARD, SIDBI and NHB to enable them to meet sectoral credit needs.

4. State Finances: Increasing the state’s ways and means to combat the virus threat by availing advance limit to 60% until end September – providing a temporary help to states

5. Liquidity for Mutual Funds: RBI decided to open a special liquidity facility for mutual funds of Rs 50 thousand crore. Funds availed under the SLF-MF shall be used by banks exclusively for meeting the liquidity requirements of MFs

Lockdown 3.0

Key Measures

1. The Asian Infrastructure Investment bank has approved a loan of $500 million to support India’s effort to fight covid-19.

2. 20 Lakh Crore Stimulus Package for Self-Reliant India.

3. Government plans to privatise PSUs in non-strategic sectors and suspend loan defaulttriggered bankruptcy filings for one year and increased minimum threshold to initiate

4. Insolvency threshold upped to 1 Cr from 1 Lakh. Also raised borrowing limits for states for the current fiscal to 5% of GSDP from 3%, given headroom of Rs.4.28 trillion.

Lockdown 4.0

Key Measures

1. RBI cut the repo rate by 40 bps to 4%. Reverse Repo reduced to 3.35% from 3.75%. This rate cut is expected to bring down the lending and deposit rates.

2. Loan moratorium: RBI extended loan moratorium by another three months until August 31. Relief to borrowers and companies those have had dues on working capital.

3. Increase in export credit period to 15 months from 1 year and buttressing EXIM Bank through INR. 15,000 Crore line of credit.

Other Notable Developments During the Lockdown:

1. In the last few weeks, Jio Platforms, which includes RIL’s internet services, has attracted $10.5 billion in investments from top-tier global VCs and PEs, valuing the entity at over $65 billion. This is higher than the valuations of internet economy giants like Zoom ($42 billion), Uber ($35 billion), Twitter ($34 billion), and Airbnb ($26 billion).

2. Indian Pharmaceutical companies was faster clearance for some of the manufacturing units of the Indian Pharmaceutical companies (Lupin, Dr Reddy’s Lab, Strides Pharma, Biocon, Aurobindo Pharma and Natco) by the United States Food and Drugs Administration (USFDA) in the month of April 2020, especially when supply-chain disruptions due to the Covid-19 pandemic were causing drug shortages across the world

3. For the first time in 2020, net inflow form Foreign Portfolio Investors turned positive (INR 11,718 Cr.) in May 2020

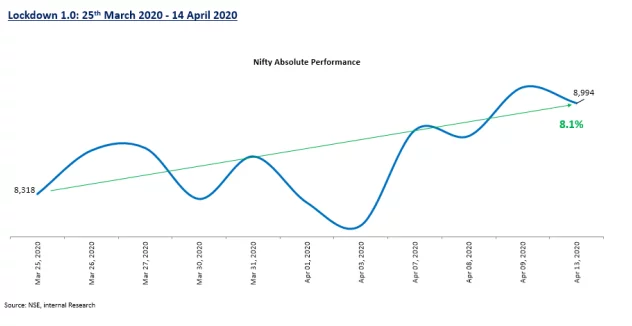

At A Glance: India in Lockdown; Investors Reinstate Faith as India Prepares For Recovery

Smart investors, globally, are playing the Great Indian Recovery Story with a solid investment plan. Others are choosing to be fence-sitters with no real plan. You know who will win at the end.

You have a choice. What is it going to be?

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2XPWxYL||target:%20_blank|” button_position=”button-center”]

Ready to take your portfolio to the next level? Explore our carefully curated New Year 2025…

This Diwali, we present a portfolio that reflect both sector-specific and stock-specific opportunities. With 2…

Thank you for showing interest in taking a BTST position using our Delivery Plus product.…

Thank you for showing interest in the consultation on trading strategies! Our expert will reach…

Even if you are a new participant in the stock market, the process of buying…